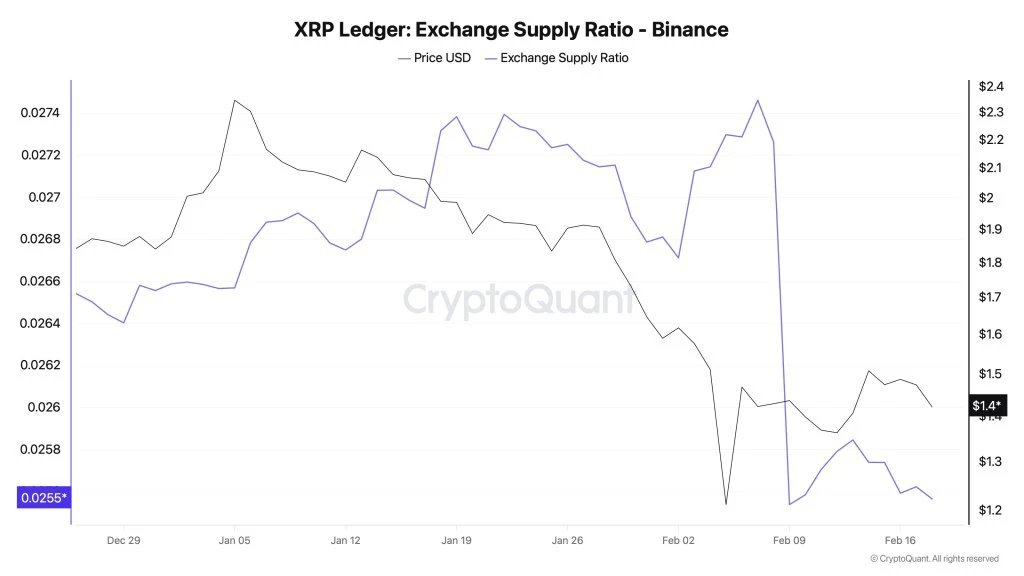

Pray, allow me to draw your attention to a most curious occurrence in the realm of XRP. Over the past ten days, a staggering 200 million tokens have taken their leave of Binance, as though the exchange were a ball grown suddenly tedious. Concurrently, the exchange supply ratio has diminished from 0.027 to 0.025, a detail not lost on the vigilant eyes of market observers. In essence, a smaller portion of XRP’s total supply now resides within Binance’s walls, a development as intriguing as an unexpected proposal at a country dance.

Such a movement, one must infer, portends but one thing: fewer tokens lie in wait to be sold, a circumstance that might well raise the spirits of the more sanguine investors.

The Chart’s Tale

Casting one’s gaze upon the chart, one notes the exchange supply ratio (denoted by a line of purple hue) descending with alacrity in early February. This precipitous drop follows hard upon XRP’s rather dramatic 40 percent correction, a turn of events that has left many a speculator in a state of considerable agitation.

Simultaneously, the price (represented by a line of sober black) has retreated from its recent heights, much like a debutante withdrawing from the dance floor after a particularly spirited reel. The confluence of dwindling exchange supply and a corrected price oft suggests that certain investors are relocating their coins to private wallets, a maneuver more aligned with accumulation than the fleeting whims of short-term trading. Though it offers no guarantee of a rally, history whispers that declining exchange balances may alleviate the immediate pressure to sell, a prospect as welcome as a favorable review in the morning papers.

Market Sentiment: A Study in Contrasts

The broader crypto market, alas, has found itself in a state of languor, struggling to reclaim its former vigor. Social data reveals that bullish sentiments regarding Bitcoin and Ethereum have waned since last week, much like the fading of a once-vibrant bloom.

XRP, however, stands apart, its sentiment ascending to a five-week pinnacle. This shift appears to be fueled by recent announcements of partnership expansions and a burgeoning optimism within the XRP community. While Bitcoin and Ethereum find themselves in a chill, XRP’s discussions grow ever more animated, a contrast as striking as a witty retort in a drawing room.

It is, indeed, a spectacle worthy of observation.

XRP Price Update: Levels of Import

From a technical perspective, XRP staged a spirited rebound from its February 6 nadir, ascending some 30 to 35 percent. Yet, this rally lacked the vigor of a true continuation, much like a suitor whose attentions prove fleeting.

The price failed to breach the resistance zone established earlier in February and now drifts toward its principal support area, nestled between $1.19 and $1.36. Herein lies the crux of the matter:

- XRP maintains its position above this support zone for the present, though one wonders how long such resolve may last.

- Should the price descend below $1.19 to $1.20, the risk of a deeper decline looms, potentially ushering in levels beneath $1, a prospect as unwelcome as a rain shower at a garden party.

- For the bulls to reclaim their dominion, XRP must mount a robust upward reaction from this support and ultimately surpass $1.67, the recent swing high, a feat as challenging as securing a favorable match in a season of scarce prospects.

The recent rallies, it must be noted, have assumed the form of three-wave structures, typically indicative of corrective rather than impulsive movements. A more robust five-wave breakout would be required to confirm a lasting shift in trend, a development as eagerly anticipated as the arrival of a long-awaited letter.

Read More

- XDC PREDICTION. XDC cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- USD VND PREDICTION

- AAVE PREDICTION. AAVE cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- USD JPY PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- USD THB PREDICTION

- EUR UAH PREDICTION

- XMR PREDICTION. XMR cryptocurrency

2026-02-21 08:06