Trump’s Cyber Strategy: Crypto’s New Best Friend?

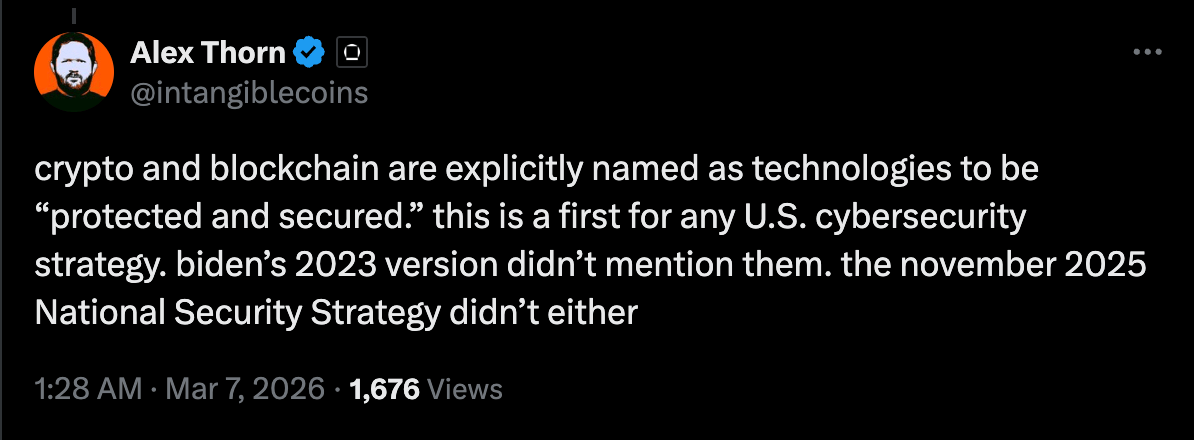

The entire crypto industry is closely keeping an eye on President Donald Trump’s newly released National Cyber Strategy, searching for clues about how the administration may approach digital assets and blockchain technology. One might say they’re as eager as a child at a candy store-except the candy is policy, and the wrapper is indecipherable.