In the ever-pulsating heart of the XRP ledger, a new leviathan has emerged, replete with an appetite for tokens that would make Moby Dick look like a sardine. With astonishing speed, this behemoth orchestrated a transfer of wealth amounting to a staggering $120 million in mere moments-an act that has left the trading world divided, scratching heads and pondering the great cosmic significance of such movements.

Through the murky waters of blockchain ledgers, it is revealed that our newly minted whale received two transfers, each equal to a whopping $60 million XRP, courtesy of a crafty intermediary wallet that seemed to play a game of digital hopscotch, shuffling these coins around faster than a magician at a child’s birthday party.

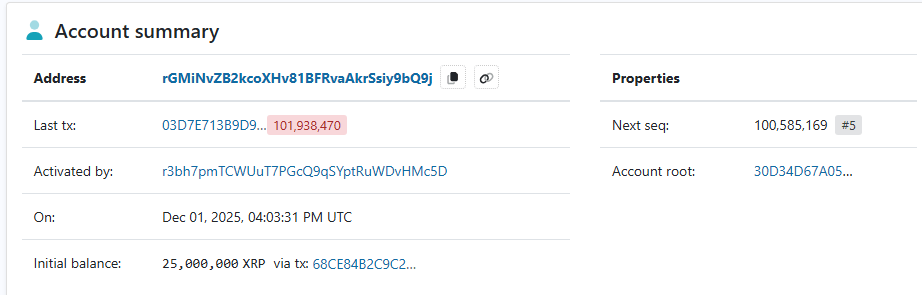

Behold the Activity of the Great Whale

The reports are as clear as mud: two hefty batches of XRP were deposited into the waiting maw of our whale, which now, after a swift flourish of transactions, boasts a balance of $185 million XRP, augmented by a modest $35 million already tucked away. Yet, in this tale of riches, the absence of exchange tags and custodial labels adds a delightful touch of mystery, making the trail as confusing as a cat chasing its own tail.

Ah, The Routine Moves of Titans

Now, one might wonder: why such frenetic activity? Large stakeholders often shuffle their treasures for reasons ranging from custodial tidying to exchanges consolidating their holdings-or perhaps simply to confuse the rest of us onlookers. As the price of XRP dipped into the low $1.70s, breaking the $1.80 support like a cheap watch, traders could be seen peering nervously at their screens, fingers crossed for a miracle.

If this were merely a case of buying the dip, we would expect to see some signs of life-a stabilization or a flicker of upward movement, perhaps a surge in spot volume or net outflows from exchange wallets. But alas, no such signals graced our screens. Instead, the funds lay dormant, hinting that this spectacle was perhaps an internal reshuffle rather than a bold accumulation of assets.

The routing through a central wallet is as common as rain in April-some teams prefer to corral their receipts into a single account for the sake of accounting clarity or security checks. The rapid pace of transactions can appear dramatic when viewed through the lens of a block explorer, but let us not conflate drama with genuine influx; for all we know, this could merely be a grand charade.

Without tangible evidence that these funds originated from the depths of outside exchanges or were purchased from the open market, one must treat this escapade with a healthy dose of skepticism. Similar on-chain machinations have been noted in recent months, often revealing themselves to be either coordinated buying efforts or the mundane housekeeping of the crypto elite.

Read More

- GBP CAD PREDICTION

- EUR ARS PREDICTION

- EUR CLP PREDICTION

- GBP RUB PREDICTION

- PEPE PREDICTION. PEPE cryptocurrency

- STX PREDICTION. STX cryptocurrency

- AVAX PREDICTION. AVAX cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- TON PREDICTION. TON cryptocurrency

- USD PHP PREDICTION

2026-02-01 16:45