Markets

What to know (or laugh at):

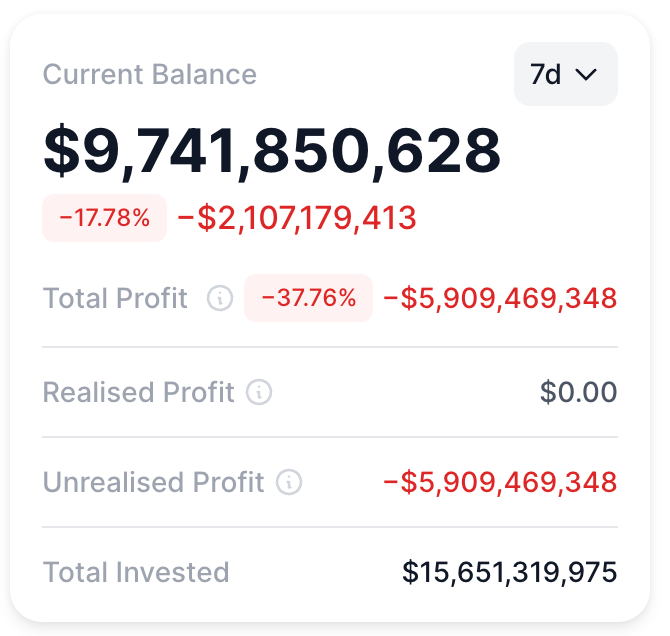

- BitMine Immersion is sitting on a hilarious $6 billion in paper losses after ether’s latest nosedive. Their 4.24 million ETH stash is now worth a mere $9.6 billion, down from a whopping $14 billion in October. Talk about a crypto comedy show!

- The company’s recent purchase of 40,000 ether has everyone scratching their heads-or laughing. Turns out, heavy corporate crypto treasuries are like juggling chainsaws: fun until someone loses a limb (or $6 billion).

- Chairman Tom Lee is now singing a more cautious tune, warning that the market is still deleveraging and 2026 might be rougher than a Mel Brooks movie marathon. Meanwhile, their $164 million in staking revenue is about as useful as a screen door on a submarine.

BitMine Immersion’s ether hoarding has backfired harder than a whoopee cushion at a board meeting. With over $6 billion in paper losses, they’re proving that crypto is the ultimate rollercoaster-minus the safety bar.

The publicly traded firm added 40,000 ether last week, bringing their total to 4.24 million ETH. But since then, prices have plummeted faster than a banana peel in a cartoon. Their stash is now worth $9.6 billion, down from $14 billion in October. Ouch.

Ether slid toward $2,300 on Saturday, proving that crypto markets are more unpredictable than a Mel Brooks plot twist. Selling accelerated across major tokens, leaving investors clutching their digital wallets in despair.

BitMine’s timing with their latest purchases has put their balance-sheet strategy under the microscope-or should we say, the comedy spotlight. Corporate crypto treasuries are all the rage, but heavy exposure turns them into sitting ducks when the market takes a nosedive.

Losses piled up faster than a Monty Python sketch, thanks to forced selling in derivatives markets. Liquidations picked up alongside ether’s drop, adding insult to injury and compounding pressure on spot prices.

Chairman Tom Lee has swapped his rose-colored glasses for a more cautious pair. While he’s still optimistic long-term, he admits the market is deleveraging and early 2026 might be rougher than a Blazing Saddles bar fight. In a recent interview, he pointed to October’s $19 billion sell-off as a “reset”-or as we like to call it, a crypto slapstick moment.

BitMine claims part of their ether is staked, raking in $164 million annually. But let’s be real: that’s like using a Band-Aid to fix a bullet wound. It does little to cushion the blow during sharp price drops.

Read More

- GBP CAD PREDICTION

- EUR ARS PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- EUR CLP PREDICTION

- AVAX PREDICTION. AVAX cryptocurrency

- GBP RUB PREDICTION

- LTC PREDICTION. LTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- STX PREDICTION. STX cryptocurrency

- EUR HUF PREDICTION

2026-02-01 10:00