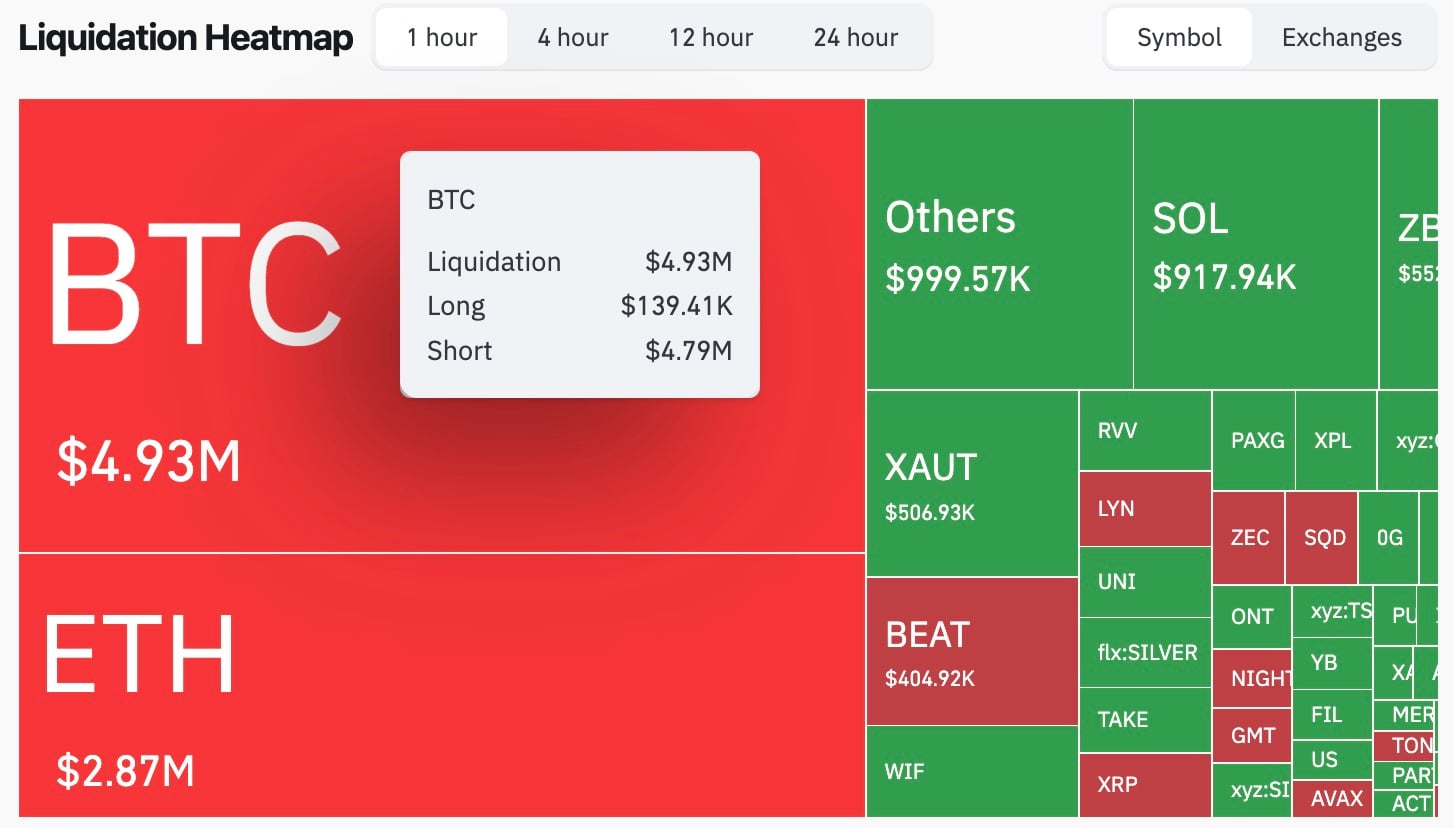

In the dim light of a market storm, Bitcoin’s liquidation data whispered a tale of woe. Shorts, poor souls, were herded like frightened sheep at a rate of $4.79 million, while longs clung to life with a paltry $139,410-a 3,436% imbalance that would make a poet weep. Total liquidations reached $4.93 million, as per CoinGlass, a ledger of despair.

The “safety trade” crumbled too. Gold, once a noble hero, now faltered by 3.1%, while silver, platinum, and palladium descended into a ballet of despair-8.37%, 12.67%, 16.07% down, each hitting lows that would make a gluttonous gull turn away. A symphony of losses, if you will.

Gold, still up 64.9% for the year, wears its triumph like a crown of thorns. Silver, at 132.5%, clings to pride. Bitcoin, the year’s tragic underdog, trails at -6.5%, a beggar at the feast. Will it rise to “catch up” as metals bleed? Only time will tell-or perhaps not.

Is this the flippening? A twist in fate where shorts are punished like misbehaving children, and longs barely sip from the trough? In one hour, $5.23 million vanished from Hyperliquid, a single trade that turned charts into headlines. A tragedy for some, a headline for others 🤡.

Over 24 hours, 95,012 traders met their doom for $293.55 million-a theater of liquidations where longs ($153.88M) and shorts ($139.67M) duetted in chaos. A grand finale, perhaps? Or merely intermission? 🎭💸

Read More

- OP PREDICTION. OP cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- ALGO PREDICTION. ALGO cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- GBP USD PREDICTION

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- EUR CHF PREDICTION

- GBP EUR PREDICTION

- CNY RUB PREDICTION

- LTC PREDICTION. LTC cryptocurrency

2025-12-29 20:54