Hyperliquid’s 4x Growth: A Tale of Tokens and Triumph! 🚀💸

Trading activity, akin to a well-rehearsed ballet, reached dizzying heights, with daily volumes soaring to $32 billion. A testament to the frenzied dance of digital assets! 💃🕺

Trading activity, akin to a well-rehearsed ballet, reached dizzying heights, with daily volumes soaring to $32 billion. A testament to the frenzied dance of digital assets! 💃🕺

PumpSwap, the trading MVP of the Pump ecosystem, is suddenly putting up numbers that could make a stockbroker weep with joy as Solana’s memecoin scene has a hot flash again.

It is said that these guardians of the financial realm seek to act with alacrity, lest ill-gotten gains vanish into the ether before regulators may intervene. A most vexing dilemma, indeed, for what is a court warrant but a bureaucratic yawn when time is of the essence? 💸

Avec un bitcoin qui tient bon au-dessus de 93 000 $, les capitaux fuient les blagues cryptomonnaire pour s’établir dans les coins utiles, comme les tokens liés à l’intelligence artificielle (IA) 🤖. C’est le grand nettoyage du portefeuille de tout ce qui sent la vanille !

Crypto.com has just achieved what many thought was impossible: securing a VASP license from the Cayman Islands Monetary Authority, a feat akin to convincing a librarian to let you borrow a book with a time machine. 🧠 The conditional license allows them to expand their services, but only if they promise to behave. 🤯

As the clock struck 2025, AMBCrypto whispered tales of a 1.15% monthly Sui unlock, a potential tsunami of selling pressure. Yet, the market, that fickle lover, has turned its back on despair. A miracle? Or just a temporary respite before the inevitable crash? 🌩️

Market caps? USDC’s shot up 73% to a hefty $75.12 billion, while USDT, still trying to stay relevant at $186.6 billion, only managed a modest 36% growth. Last year? USDC was even hotter, growing 77% versus USDT’s 50%. Looks like USDC is doing its homework. 📚

Behold, Apex Season 3-a gladiatorial arena of trading where $450k will be tossed to the wolves (and their portfolios) until February 1, 2026. Leaderboards bloom like crypto’s own Garden of Eden, ripe for daily, weekly, and monthly conquests. Meanwhile, the New Year Futures Boost offers a $200k “safety net” (if you believe in nets made of code). It’s a New Year’s resolution wrapped in a risk-mitigation fund, because who doesn’t want to lose money responsibly? 🚀

The 15th of January loomed like a specter, the anticipated launch date of the CLARITY Act, a legislative endeavor destined to end the era of “regulation by enforcement” that has plagued U.S. crypto firms for years. 🧠

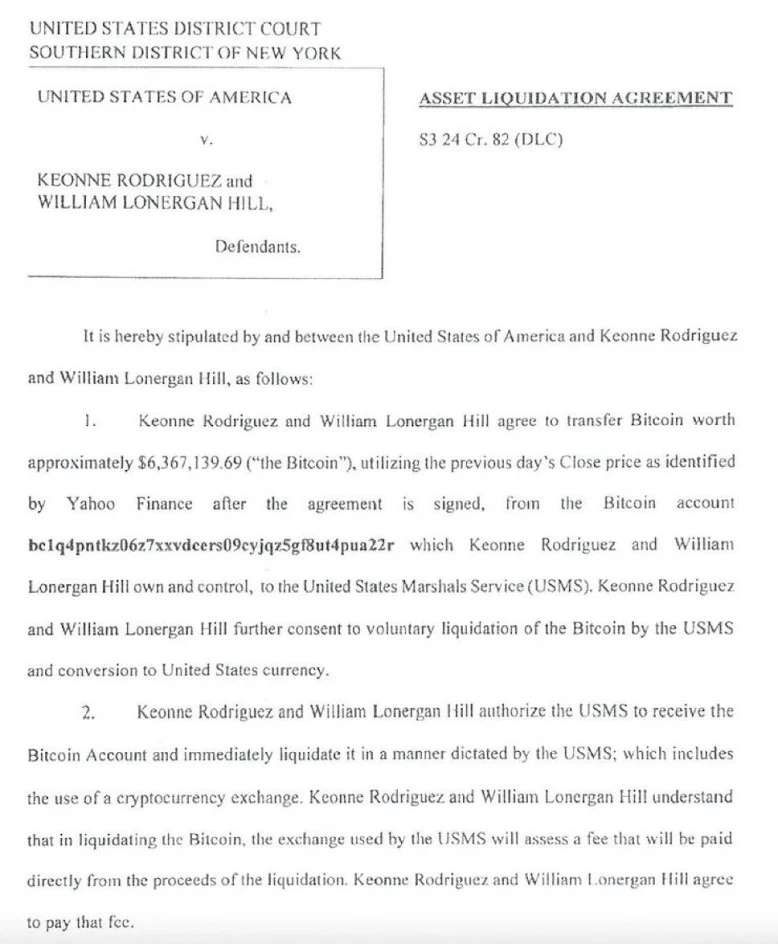

According to crypto Twitter and a few overly caffeinated experts, the DOJ’s U.S. Marshals Service (USMS) allegedly sold 57.55 BTC (aka $6M in digital gold) in November 2025 via Coinbase Prime. The Bitcoin? Seized from Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill. 🚨