January arrived like a blunt censor, and the ledger did not blink. Corporate appetite for bitcoin surged, yet the room’s momentum wore the unmistakable face of one heavyweight. Humor, they call it; sarcasm, perhaps; truth, certainly, dressed in numbers that refuse to lie.

4.08 Million BTC Held Across Entities, Says Bitcoin Treasuries Report

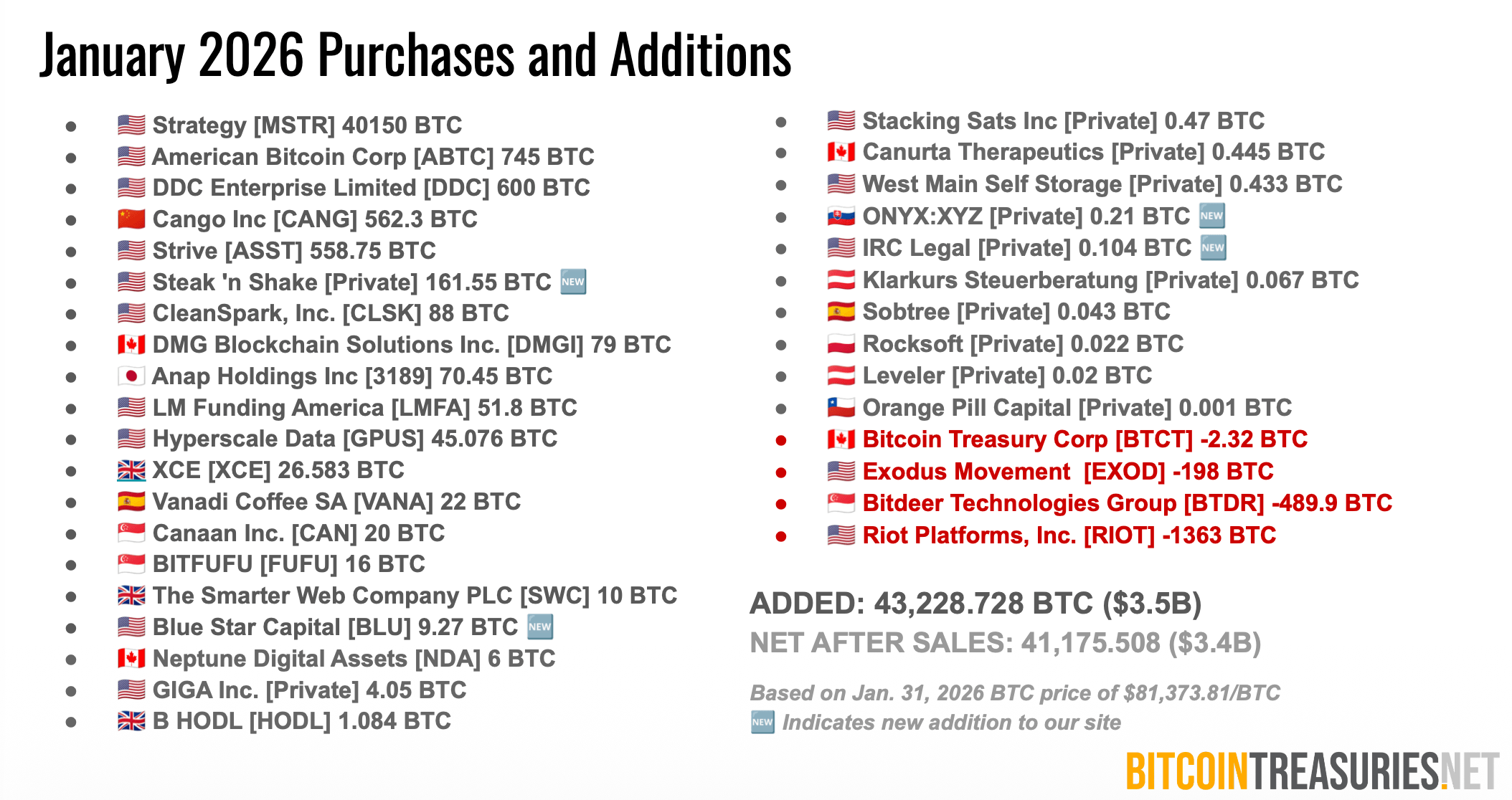

The January 2026 Corporate Adoption Report from bitcointreasuries.net records that public and private entities added 43,228 BTC during the month, valued at roughly $3.5 billion based on Jan. 31 pricing. After sales and reductions, net additions totaled 41,175 BTC.

The data point to one single conductor: Strategy bought 40,150 BTC in January and closed the month with 712,647 BTC in its ledger. That figure accounts for up to 97.5% of public-company buying after sales, marking the third consecutive month in which the firm set the tempo and the others marched to its metronome.

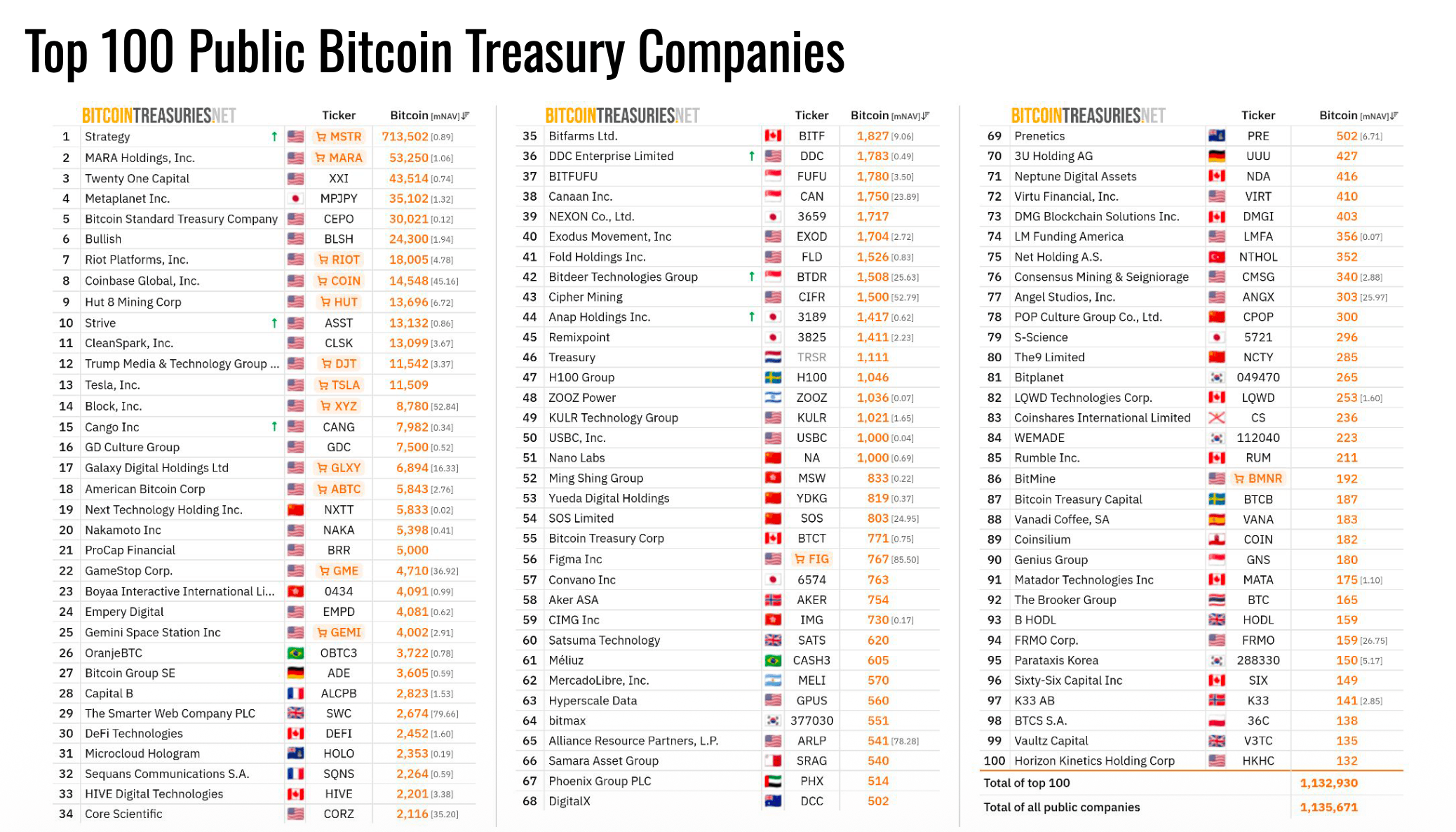

Yet the total monthly buying neared summer-like levels, and the researchers remind us that this revival is not a chorus of broad participation but a soloist’s encore. Public treasuries now hold approximately 1.13 million BTC, while all tracked entities – including ETFs and governments – hold about 4.08 million BTC.

The analysis casts Strategy’s long-range projections in a stern light. In its most aggressive model, the Q4 2025 report sketches the possibility of 2.5x growth in bitcoin per share by 2032, aiming for 492,000 BPS under a 14% assumed annual bitcoin yield. A prophecy, or a spreadsheet with bravado-take your pick.

Beyond spot purchases, bitcointreasuries.net’s new digital credit dashboard tracks $26.8 billion in cumulative trading volume tied to preferred-share products and related instruments. Strategy’s offerings account for nearly all of that activity, while yield dispersion and pricing differences shape investor appetite with the dry precision of a rusted caliper.

The research also highlights a stubborn cohort of repeat buyers. Of 194 public companies with bitcoin holdings, roughly one-third have added at least 1 BTC per day on average since treasury strategies launched, and 20 firms average at least 10 BTC per day. The drumbeat persists, and the room grows a little more crowded with every tick of the market clock.

Adoption continues to broaden. Since October, 21 new treasuries have joined the bitcointreasuries.net coverage universe, contributing about 3% of non-Strategy buying over the past four months. A small chorus, perhaps, but the cadence is unmistakable.

Still, the ledger refuses to pretend equality. Concentration is rising. The report cites data showing growing inequality in corporate bitcoin holdings over the past two to three months, even when the largest holder is excluded from the count. Mining firms remain influential, accounting for roughly 11% of public company balances, though January featured notable miner sales that weighed on net additions.

In short, the January report shows a sector expanding in headcount and product complexity – digital credit included – yet still decisively steered by one balance sheet that continues to set the tempo for all the rest.

FAQ ❓

- How much bitcoin did companies add in January 2026?

Bitcointreasuries.net reports 43,228 BTC added, with 41,175 BTC net after sales. - How much bitcoin does Strategy hold?

Strategy ended January with 712,647 BTC, according to bitcointreasuries.net. - What is the size of the digital credit market?

Bitcointreasuries.net estimates cumulative digital credit trading volume at $26.8 billion. - Is corporate bitcoin ownership becoming more concentrated?

Yes, bitcointreasuries.net data shows rising holdings concentration over recent months.

Read More

- EUR RUB PREDICTION

- 🐻 Mr. Cramer’s Bearish Blunder: Will Bitcoin Survive His Wrath? 🎭

- USD VND PREDICTION

- USD RUB PREDICTION

- USD GEL PREDICTION

- APT PREDICTION. APT cryptocurrency

- CRV PREDICTION. CRV cryptocurrency

- Bitcoin’s $70K-$80K Zone: A Desert in the Crypto Sahara 🌵💸

- Crypto’s in a Coma: Is It Time to Pull the Plug? 😱💰

- BTC Tumbles 🔻, Venezuela Flames Sky🔥 – Crypto’s Latest Heartbreak?

2026-02-13 00:07