Ah, dear reader, behold the unfortunate tale of Solana, whose price continues its tragic descent, plunging to depths not seen since the quaint days of January 2024. How delightful it is that amid such a dismal market crash, one can still find solace in the strong fundamentals that this digital darling supposedly possesses!

- Alas! Solana’s price has tumbled to the lowest level in years-what a spectacle!

- Fear not, for third-party data assures us of its robust fundamentals. Surely, that counts for something?

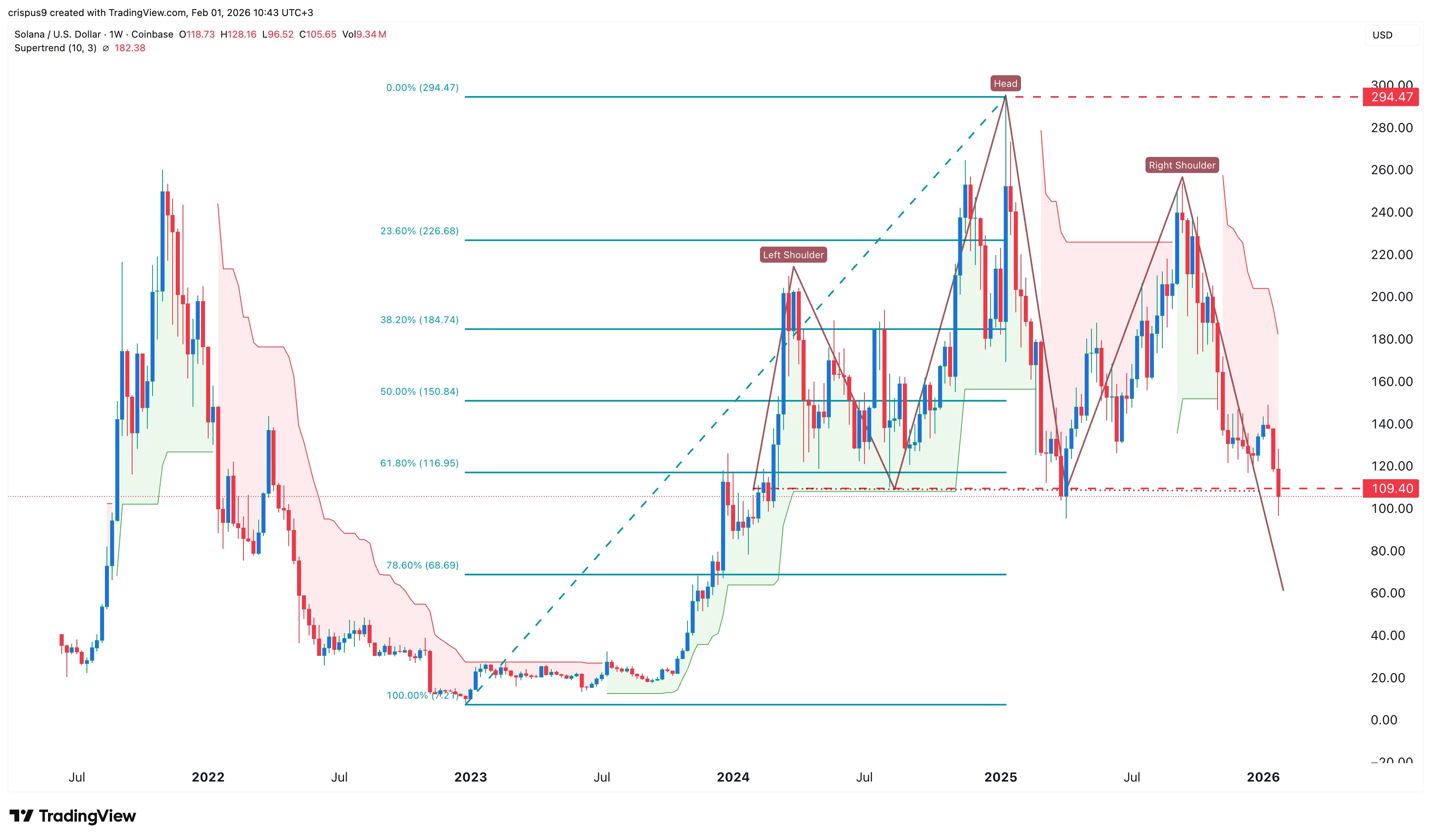

- It appears our friend has sculpted a magnificent multi-year head and shoulders pattern on the weekly chart. Truly an artistic endeavor!

With a mournful cry, Solana (SOL) has dropped to a paltry $104, a far cry from its former glory of nearly $300. One might say this crash has erased billions of dollars in value-how poetic!

Curiously, this decline occurs just as Solana’s fundamentals seem to blossom like flowers in spring. Forsooth! According to the esteemed Nansen, its network is apparently the most beloved by investors.

In a frenzy of activity, Solana managed to handle over 2.34 billion transactions in the last 30 days-a 33% increase. To think, its transaction count surpasses that of Ethereum, Base, and BNB Chain combined. A true overachiever!

Moreover, Solana’s active addresses have surged by a remarkable 67% in January, now exceeding 98 million. It is but a whisper away from crossing the illustrious 100 million milestone, a feat greater than all others combined. How charming!

In addition to its popularity, Solana is raking in the dough through transaction fees-over $26 million in the last month alone! Compare that to Ethereum’s modest $14 million and BNB Chain’s $19 million, and one cannot help but chuckle.

Most amusingly, Solana ETFs are witnessing a newfound demand from American investors this year. Spot SOL ETFs have welcomed $104 million in inflows as Bitcoin, Ethereum, and Solana themselves shed their assets like autumn leaves.

Thus, we must conclude that Solana’s price debacle is largely a reflection of the broader sector’s performance. Bitcoin and its altcoin companions have all plummeted in recent days, with the trend accelerating like a well-timed comedy routine over the weekend.

As market participants ponder the nomination of Kevin Warsh for the next Federal Reserve Chair and the rising geopolitical tensions between the United States and Iran, one must wonder: what will become of our dear Solana?

Solana Price Technical Analysis

Upon examining the weekly timeframe chart, it becomes painfully clear that Solana’s price has indeed crashed over the past few months. A closer inspection reveals that it is in the midst of forming the tragically bearish head-and-shoulders pattern, with its neckline resting at a rather disheartening $109. Alas, it has dipped below this neckline, sealing its fate.

Our dear Solana has also fallen beneath the 50-day and 100-day Exponential Moving Averages and the Supertrend indicator. It has even dropped below the sacred 61.8% Fibonacci Retracement level-oh, the horror!

Thus, the most likely scenario appears to be a continued descent as sellers target the next key destination at $70, which happens to align with the 78.6% Fibonacci Retracement level. How utterly predictable!

Read More

- GBP CAD PREDICTION

- GBP RUB PREDICTION

- PEPE PREDICTION. PEPE cryptocurrency

- STX PREDICTION. STX cryptocurrency

- AVAX PREDICTION. AVAX cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- TON PREDICTION. TON cryptocurrency

- EUR ARS PREDICTION

- EUR CLP PREDICTION

- GBP EUR PREDICTION

2026-02-01 16:34