Ah, the capricious dance of Bitcoin! It began February 2026 with a plunge so dramatic, one might think it had stumbled into a Gogol-esque farce, dropping 10.1% and settling at a mere $78,700-a far cry from its lofty cycle high of $124,400. Yet, like a nose that inexplicably detaches itself in one of my tales, this drop may be less calamitous than it appears. For lo, the soothsayers at CryptoRank whisper that February is no harbinger of doom but a month of mirthful gains!

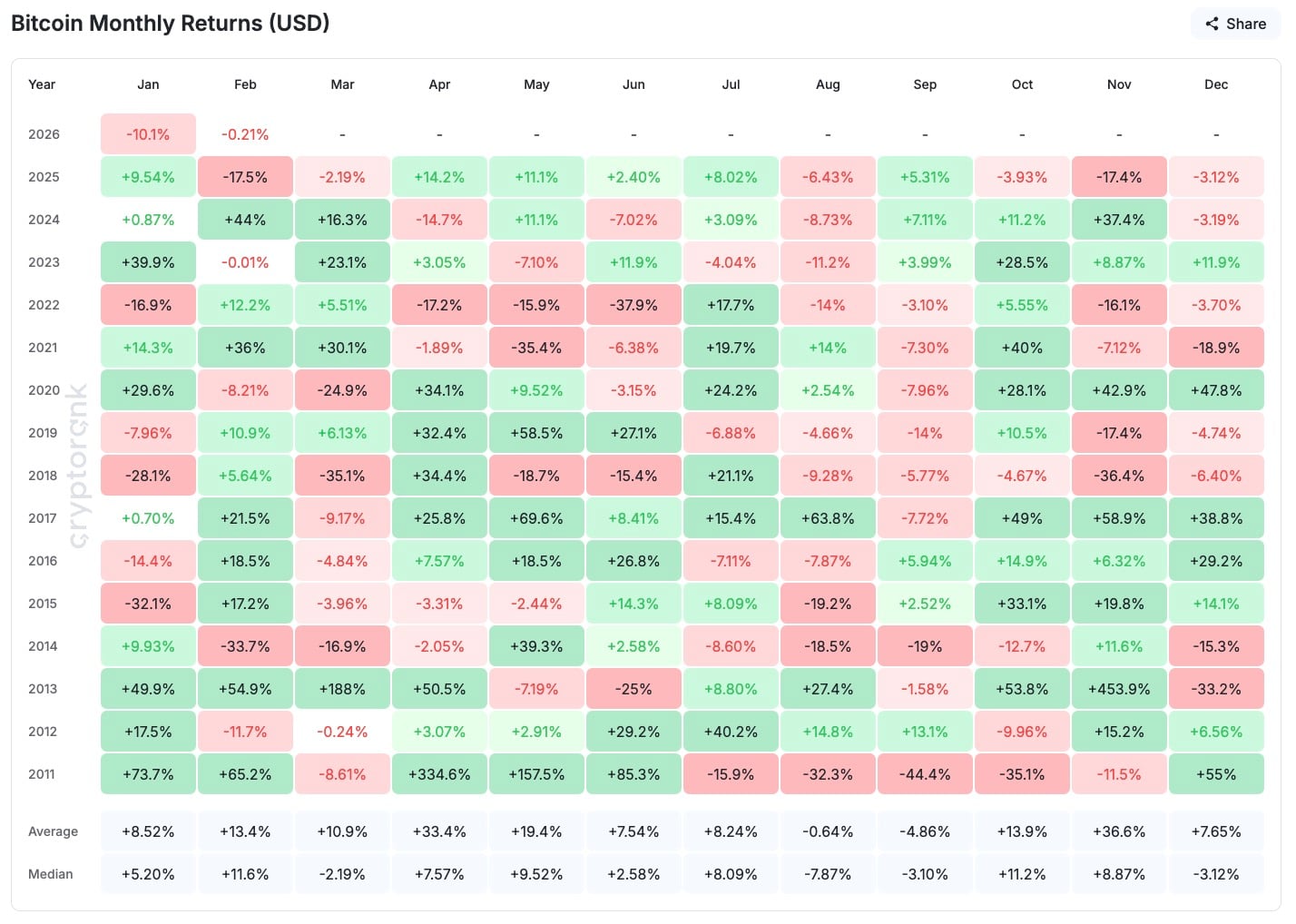

Indeed, February boasts some of the most ludicrous average and median gains in Bitcoin’s sordid history: +13.4% and +11.6%, respectively. Only April and October, those impudent rivals, dare to outshine it. Imagine, if you will, a bureaucrat’s nose growing longer with each lie-February’s gains are equally absurd and delightful.

For 12 long years, Bitcoin has waltzed through February with a gain 9 times out of 13. The exceptions-2020, 2014, 2012-are as rare as a rational character in one of my stories, often tied to economic calamities. Yet, even in these dire times, a crimson January is oft followed by a verdant February, like a dead soul rising from the bureaucratic ashes.

Consider 2018, when January’s feeble -0.28% gave way to February’s hearty +5.64%. Or 2023, when February barely stirred at -0.01%, only for March to leap by a preposterous +23.1%. It is as if the market, like a bewildered protagonist, cannot resist the pull of its own absurdity.

Saylor’s Specter and the Strategy of Shadows

Bitcoin’s weekly candle weeps a 9.18% decline, yet all eyes turn to the $73,000-$76,000 support zone-a spectral threshold where Michael Saylor’s Strategy lurks with its average purchase price on a staggering 712,647 BTC stack. To set traps here is only logical, for February’s seasonal whims seem to favor the bold, or perhaps the foolish.

Mark well the years 2013, 2014, 2015, and 2021, when February unleashed double-digit rallies despite January’s travails. In 2021, February surged by a ludicrous 36%, following January’s modest 14.3% uptick. This mirrors the 2025 trend, where the year began with a 9.54% gain, as if the market were a character in one of my tales, perpetually stumbling into fortune.

The breakdown on February 1st may be but a shakeout, a dramatic twist to reframe a textbook bullish setup. If history repeats itself-and in my stories, it often does-we may witness a return to $90,000-$98,000 before March. Even as the masses panic, February rarely collapses twice in a row, and when it does not, the snapbacks are as violent as a Gogol protagonist’s realization of their own absurdity.

So, dear reader, do not be fooled by the crimson hues of fear. February, like a mischievous character in one of my farces, may yet have the last laugh. Will Bitcoin’s ghostly gains haunt the bears? Only time-and perhaps a detached nose-will tell.

Read More

- GBP CAD PREDICTION

- EUR ARS PREDICTION

- EUR CLP PREDICTION

- PEPE PREDICTION. PEPE cryptocurrency

- STX PREDICTION. STX cryptocurrency

- GBP RUB PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- AVAX PREDICTION. AVAX cryptocurrency

- TON PREDICTION. TON cryptocurrency

- USD PHP PREDICTION

2026-02-01 20:00