Markets

What to know:

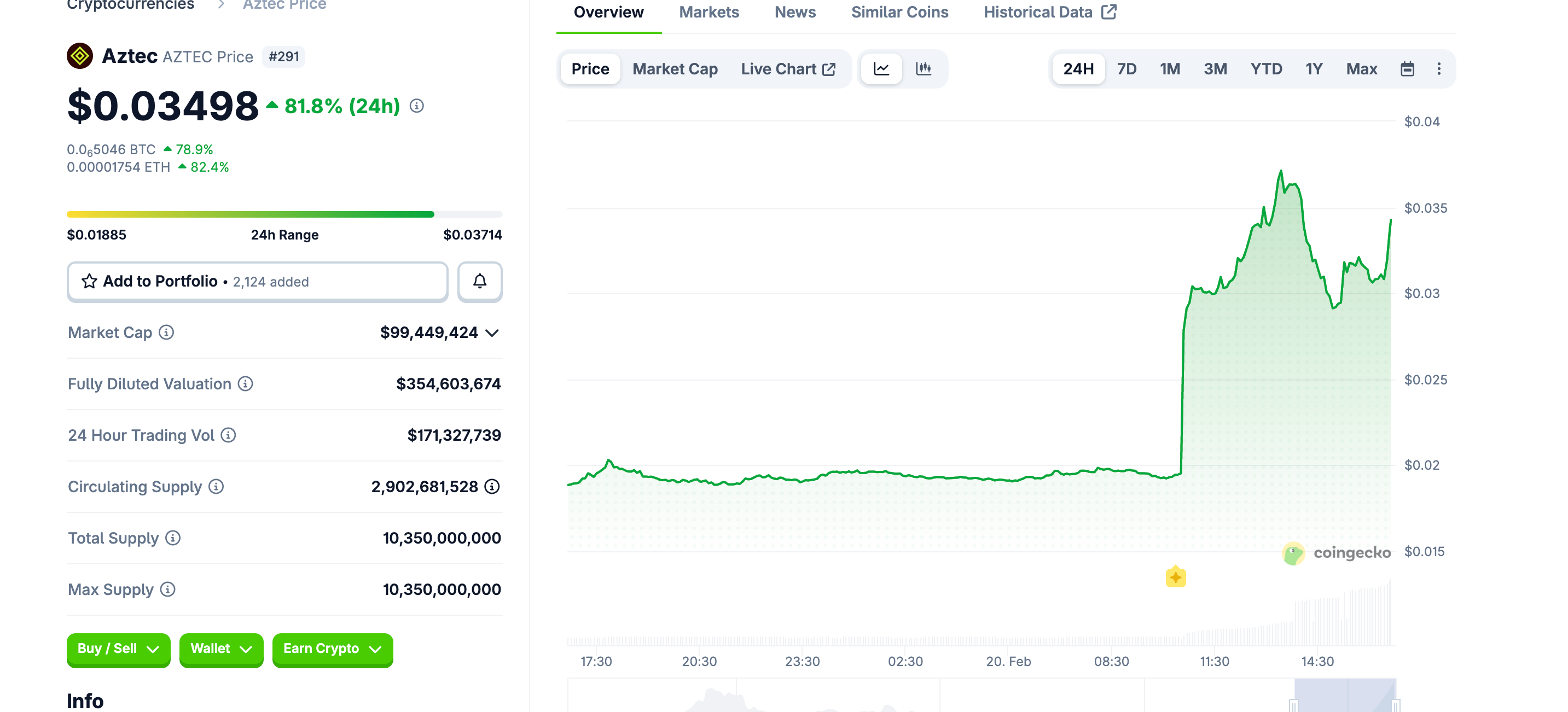

- Like a cat in a sunbeam, Aztec’s token catapulted 82 percent to about $0.035, all thanks to those lovely folks at Upbit and Bithumb deciding they wanted it on their shelves with some won trading pairs-suddenly, everyone wants a piece of the pie.

- When these KRW listings pop up on major Korean platforms, small tokens get a makeover-like Cinderella at the ball-thanks to a local retail base that’s as lively as a weekend karaoke session.

- In the grand spectacle of crypto, this AZTEC listing widened the infamous kimchi premium, but don’t worry, the clever arbitrageurs were ready with their calculators, narrowing that gap faster than you can say “let’s make some money!” As for Aztec, pitching itself as a privacy-focused Ethereum layer 2 gives it more depth than just a one-night stand.

Aztec (AZTEC) took a delightful leap of about 82% in just 24 hours, settling around $0.035, all due to those charming South Korean exchanges, Upbit and Bithumb, who decided to sprinkle some local currency magic into the mix.

Why do Korean listings still matter? Because they turn tokens from mere crypto curiosities into something the locals can scoop up with their own currency, making it feel as accessible as a bowl of bibimbap.

South Korea often ranks among the top three countries for crypto trading volume, and Upbit is no slouch, regularly matching or even outpacing Coinbase in daily spot turnover during active sessions-it’s like a crypto party, and everyone’s invited!

A KRW pair means no hopping through USDT; it plugs directly into Korea’s bustling spot trading culture, presenting tokens right on the screens where people are actually looking. This exposure can transform smaller-cap tokens like AZTEC into overnight sensations.

Traders often treat new Upbit and Bithumb listings like flash sales, diving in before the liquidity deepens and the initial excitement wears off. We’ve seen this movie before-tokens like VIRTUAL have danced their way into double-digit gains just because they got a mention in a Korean listing announcement, regardless of their actual worth.

In these thin markets, that creates the kind of vertical candle that AZTEC just printed. Once the local prices start climbing, the savvy arbitrageurs swoop in, buying on global platforms and selling into the Korean bids, dragging prices up like a lifeguard at a crowded beach. The so-called “kimchi premium”-the delightful spread between Korean and international prices-tends to balloon during these events before the arbiters catch up.

Aztec itself is touted as an Ethereum-based, privacy-focused layer 2 that uses zero-knowledge proofs to enable encrypted transactions on a public chain. So, while the listing drama unfolds, it also has a storyline deeper than just a soap opera episode.

By the time the Asian evening rolled around, the premium had slightly narrowed as the arbitrage flow caught the wave and the surge began to show signs of fatigue-because even the most vibrant party has to wind down sometime, right?

Read More

- XDC PREDICTION. XDC cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- USD JPY PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- USD MXN PREDICTION

- EUR PLN PREDICTION

- LINK PREDICTION. LINK cryptocurrency

- STX PREDICTION. STX cryptocurrency

- BCH Soars 61,561%: Bears Weep, Bulls Celebrate!

2026-02-20 14:45