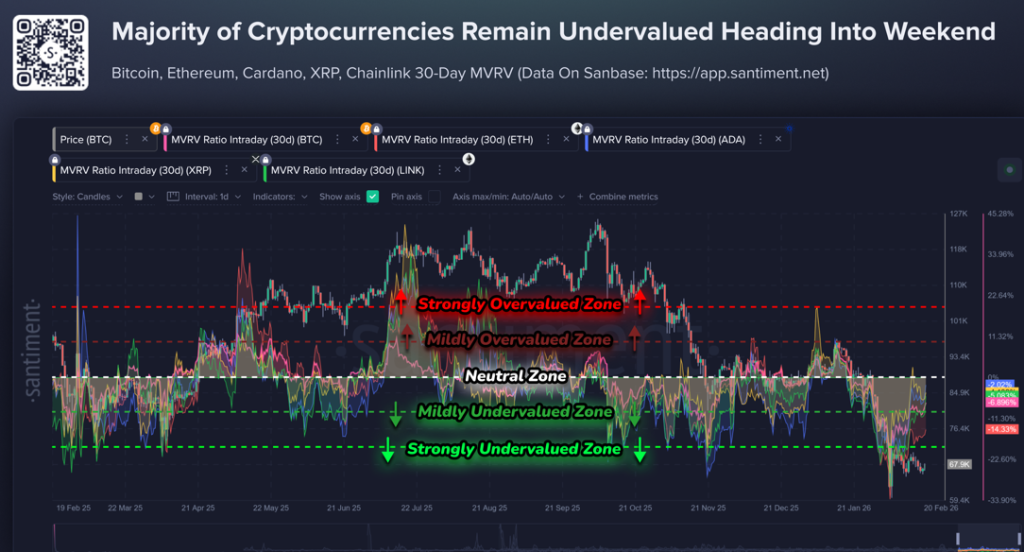

As the weekend approaches, the leading cryptocurrencies, those paragons of digital wealth, find themselves in a state of profound unease, their 30-day MVRV metrics casting a shadow over the horizon of traders’ hopes. Ethereum, that most pensive of digital titans, lingers at -14.3%, while Bitcoin, the venerable patriarch of the realm, trails at -6.9%. Chainlink, XRP, and Cardano, though less afflicted, still bear the marks of a world where even the most steadfast souls are tempted to despair.

What is this but a tale of averages? The traders, those weary souls, find their returns as barren as a winter field. Yet, does this barrenness guarantee a harvest? No, but it does alter the calculus of risk, as one might alter the course of a ship in a storm.

The MVRV: A Harbinger of Discount or Despair?

Santiment’s 30-day MVRV, that unyielding arbiter of value, does not dance to the whims of hype. It measures not the fevered dreams of traders, but the cold, hard arithmetic of returns over a month. And lo, the message is clear: the giants of the digital realm now dwell below their neutral zone, as if the very blockchain itself has grown weary of their hubris.

Ethereum, that most discounted of the bunch, stands as a testament to the depths of human folly. Its -14.3% figure whispers of short-term holders adrift in a sea of losses, their spirits as battered as the waves that once carried the first explorers to these shores. Yet, in this despair, there lies a glimmer of hope-a relief rally, perhaps, though one as elusive as a dream upon waking.

Bitcoin, ever the stoic, bears its -6.9% with the dignity of a nobleman. LINK, XRP, and ADA, though less afflicted, still tread the fine line between discount and delirium. They are not yet in the throes of excess, but neither are they free from the specter of ruin.

Undervalued, yes-but does this alone summon a rally? No, but it does shift the balance of fate, as a single grain of sand can alter the course of a river.

The Momentum: A Dance of Titans

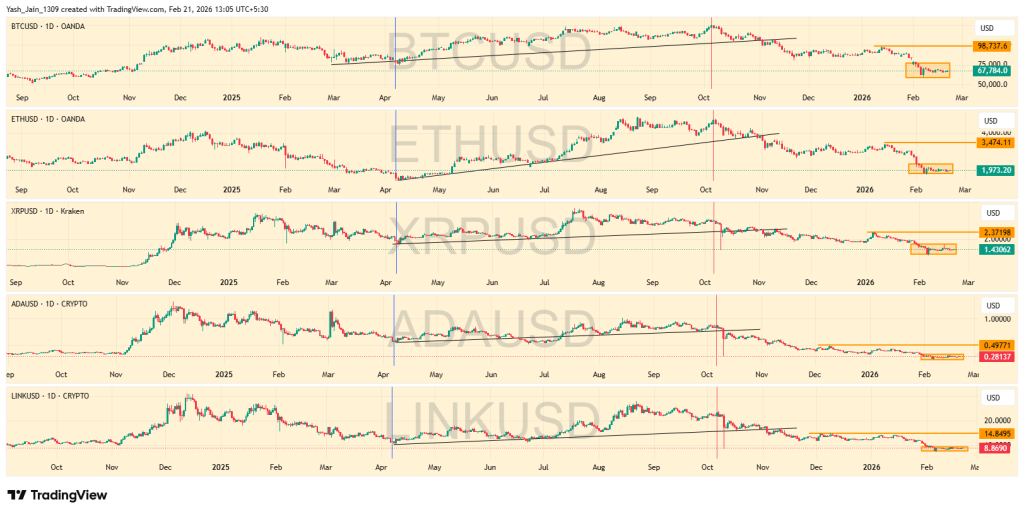

Technically, the correlation remains as unyielding as the laws of nature. The Bitcoin price, that ancient and enduring force, and Ethereum’s structure continue to dictate the rhythm of the broader digital realm, even in this age of supposed progress. And lo, the whispers of XRP, ADA, and LINK on platforms like X echo the same refrain, their price predictions as futile as a scribe’s attempt to capture the essence of a sunrise.

Though each asset possesses its own soul and purpose, they move as one, their momentum a symphony of collective will. When the first movers consolidate, the others pause, like dancers waiting for the lead to change. When they expand, liquidity flows outward, as if the very fabric of the market were a living, breathing entity.

Thus, while the absolute prices may diverge, the timing of their trends aligns with a precision that borders on the divine-or perhaps, the absurd.

The Relief Rally: A Mirage or a Miracle?

Short-term projections, those fickle prophets of the future, suggest potential relief levels as mere shadows on the wall: $98,737 for BTC, $3,474 for ETH, and so on. These are not the moonshots of yesteryear, but rather the faint outlines of resistance, as fragile as a promise made in the heat of passion.

If these levels are reclaimed, the sentiment may shift, though only slightly. But if they are rejected, the cycle of despair continues, and lower lows loom like the specter of a forgotten war.

And here lies the cruel irony: while the MVRV declares a discount, the price structure demands proof, as if the market itself were a capricious lover, refusing to be swayed by mere numbers.

Moreover, the accumulation-style consolidation of 2026 has been as visible as the sun in the sky. Yet, the top cryptocurrencies will not pivot unless their leaders break decisively. Until then, the undervalued readings remain a double-edged sword, offering both opportunity and the promise of ruin in equal measure.

Read More

- XDC PREDICTION. XDC cryptocurrency

- USD VND PREDICTION

- AAVE PREDICTION. AAVE cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- USD JPY PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- Bitcoin Ransom Scandal: NBC Anchor’s Mother Vanishes

- Paxful’s Peculiar Plight: $4 Million Penalty for Peddling Prostitution and Popping Pockets!

- Banks vs. Crypto: A Tale of Old Money and New Tricks

2026-02-21 15:08