Crypto’s New Phase: XRP & Cardano in the Hot Seat! 🔥

Key Takeaways (or should we say, the juicy bits? 🍊)

Key Takeaways (or should we say, the juicy bits? 🍊)

Before retracing in Q4, BNB’s market cap surged from $75 billion to $182 billion – A sign of steady capital flows. On the price charts, BNB has traded within a descending channel since, coinciding with the broader crypto market’s correction too. At press time, Binance Coin [BNB] was trading at $835. 📉📈

So, Bitcoin’s monthly Relative Strength Index (RSI) has decided to take a little vacation below the historically significant 58.7 level. 🌴 Currently chilling at 56.5, this move is basically the crypto equivalent of showing up to a party 10 minutes late – everyone’s like, “Oh, there you are!” But is this a sign of weakening momentum or just Bitcoin being fashionably tardy? 🤔

Brian Armstrong, with a flair for dramatic irony, found himself in the delightful position of congratulating the Indian police for their expedition into the shadows of crime, where a former employee had allegedly danced with hackers, leading to an astonishing breach that compromised the sensitive data of many patrons. It seems that the Hyderabad police have not only captured a fugitive of financial misdeeds but also restored a modicum of faith in the great cosmic balance of security.

CoinGlass data reveals that traders betting short on BCH have seen $169,260 wiped out, a sum that could buy a small island… if the island accepted Bitcoin Cash. 🏝️

No longer shall digital assets cower in the realm of “miscellaneous income”-that mystical tax purgatory where lost receipts and speculative fortunes go to be devoured alive. Nay! The imperial decree now heralds crypto as a “financial product for asset formation,” a phrase so noble it belongs on a scroll sealed by the Emperor himself, or printed on a pachinko parlor brochure, depending on your cynicism level. 🧧

The disparity between the fundamentals and the price is like a farmer looking at his barren field while dreaming of a bountiful harvest. Yet, analysts and industry sages peer into the depths and see a slow but steady tide of improvement swelling beneath the surface, like the earth preparing for spring rains.

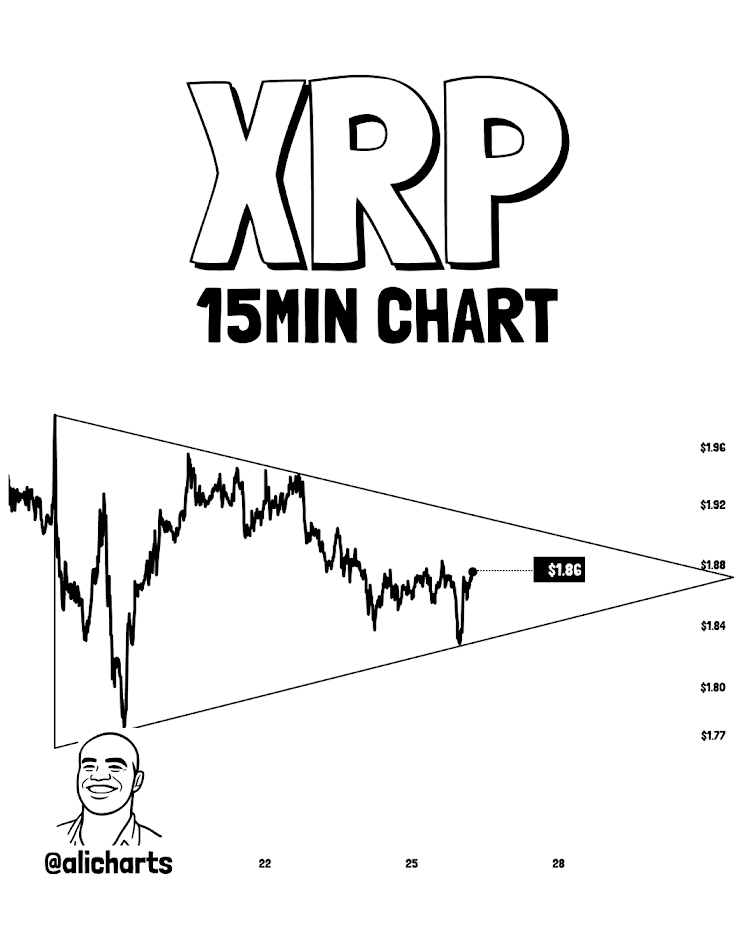

Despite the price’s deathly embrace, U.S. spot XRP ETFs are rolling in the dough-crossing a billion dollars in assets under management. English translation: Institutional investors are still playing hard to get, but they’re clearly interested. With a history as long as a Dickens novel and regulatory clarity that rivals a well-behaved puppy, XRP remains appealing enough for the traditional finance crowd to peek through their monocles. And, in the shadows, on-chain activity reveals a political coup-roughly 750 million XRP slipped off exchanges recently, leaving only about 1.5 billion to taunt us. If this trend keeps up, 2026 could see the market’s grandest supply squeeze-like a squeezed lemon, only with more zeros and less zest-especially if the big money keeps pouring in like a never-ending champagne fountain. 🍋🥂

The two startups, who were riding the Latin American digital payment wave – think: doing just fine until JPMorgan decided to throw a wrench – apparently saw a rise in chargebacks and weak identity checks that no amount of digital fortresses could fix. JPM’s official stance? “It’s just our compliance thing,” they say casually, “not a total crypto excommunication.” Because nothing says warm, fuzzy fintech hugs like freezing accounts in the middle of a booming market. 🤷♀️

Analysts, those ever-watchful sentinels of financial propriety, have observed an unusual alignment-like a well-matched set of gloves-between options positioning and shrinking volatility, hinting that technical exhaustion might be less a sign of surrender than of a poised, dramatic crescendo. One could almost imagine the curtains rising on a grand scene. 🎭