Bitcoin Miners: Profits Plummet, But the Show Must Go On! 🎭💰

The Bitcoin network’s hashrate, that ever-reliable barometer of mining competition, declined for a second month in December. A tale as old as time: less strife, more despair. 🧨

The Bitcoin network’s hashrate, that ever-reliable barometer of mining competition, declined for a second month in December. A tale as old as time: less strife, more despair. 🧨

This comes after ADA decided to wake up from its 2026 nap and rally from its Jan. 1 low of $0.331. Because, you know, New Year’s resolutions aren’t just for humans. 📈🚀

What does it take to lead business development in an industry where most projects vanish faster than a Siberian snowdrift in May? To pretend we understand, we cornered Sarah Song, Head of Business Development at BNB Chain, during Binance Blockchain Week in Dubai-a city where blockchain dreams are as abundant as sand and just as stable. She spoke of ecosystem growth, developer support, RWAs (Real-World Assets, or “Things We Tokenized Because We Could”), stablecoin payments (because who needs banks?), and expansion into emerging markets (where regulations are as loose as a drunken Cossack). She also shared her thoughts on building credibility (hah!) and being a woman in web3 (because apparently, that’s still noteworthy in 2024).

The Americans, naturally, have decided to take charge of the Venezuelan oil industry. Because apparently, running a country wasn’t enough. Now they’re running the fuel supply too. This has, predictably, caused the price of oil to wobble like a jelly on a particularly bumpy cart. As for the crypto markets? Well, they’re holding their breath and trying very hard not to look directly at the chaos. So far, so good, though ‘resilient’ is probably just a polite word for ‘confused’.

HYPE, ever the drama queen, currently sits at $26.45-up 4% in the last day, as if to mock those who dared despair. Yet, over the past month, it remains down 15%, and a staggering 55% below its September peak of $59. Such is the fickle nature of crypto fortunes. 💸

Prices are doing the equivalent of a toddler’s nap-no movement, just waiting for someone to drop a snack. But hey, maybe regulation will finally make this thing less chaotic. 2026? Sounds about right. After all, why let crypto mature before 2030? 🚀

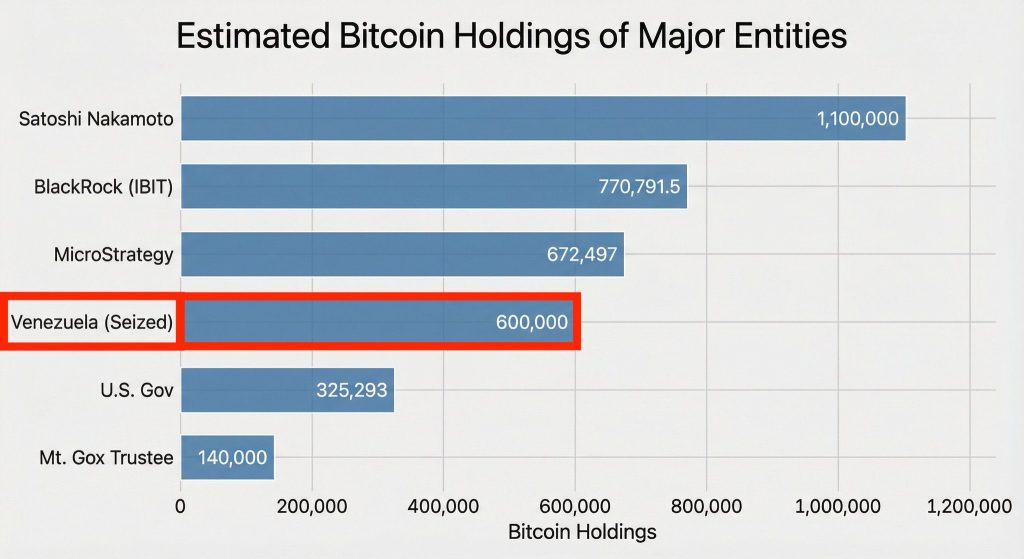

Whispers from the crypto crypt suggest Venezuela’s treasury now brims with Bitcoin, a shadow reserve so vast it could make even Satoshi Nakamoto blush. If true, this treasure trove might yet send shockwaves through the global crypto market by 2026-or perhaps just a few well-timed gasps from investors.

The remarks arrived fashionably late-about two weeks after the BOJ’s December rate hike to 0.75%, a figure so nostalgic it might as well have come with a dial-up modem. Ueda’s previous guidance had been about as clear as Tokyo smog, sending the yen into a downward spiral that would make even seasoned currency traders weep into their sake.

The XRP rally is hotter than my Aunt Ethel’s vindaloo, folks! At $2.12, with digital wallets near empty, the feeling’s mutual at U.S. ETFs.

Metaplanet, you see, is profiting handsomely from this weakness. A structural advantage, as they so blandly put it. Imagine! Financing the acquisition of this… digital illusion with a currency that is actively losing its value. It’s almost…diabolical in its simplicity. A philosophical query for the ages: is it brilliance or madness?