Bitcoin Price Bash: A Quiet Market Drama You Won’t Believe

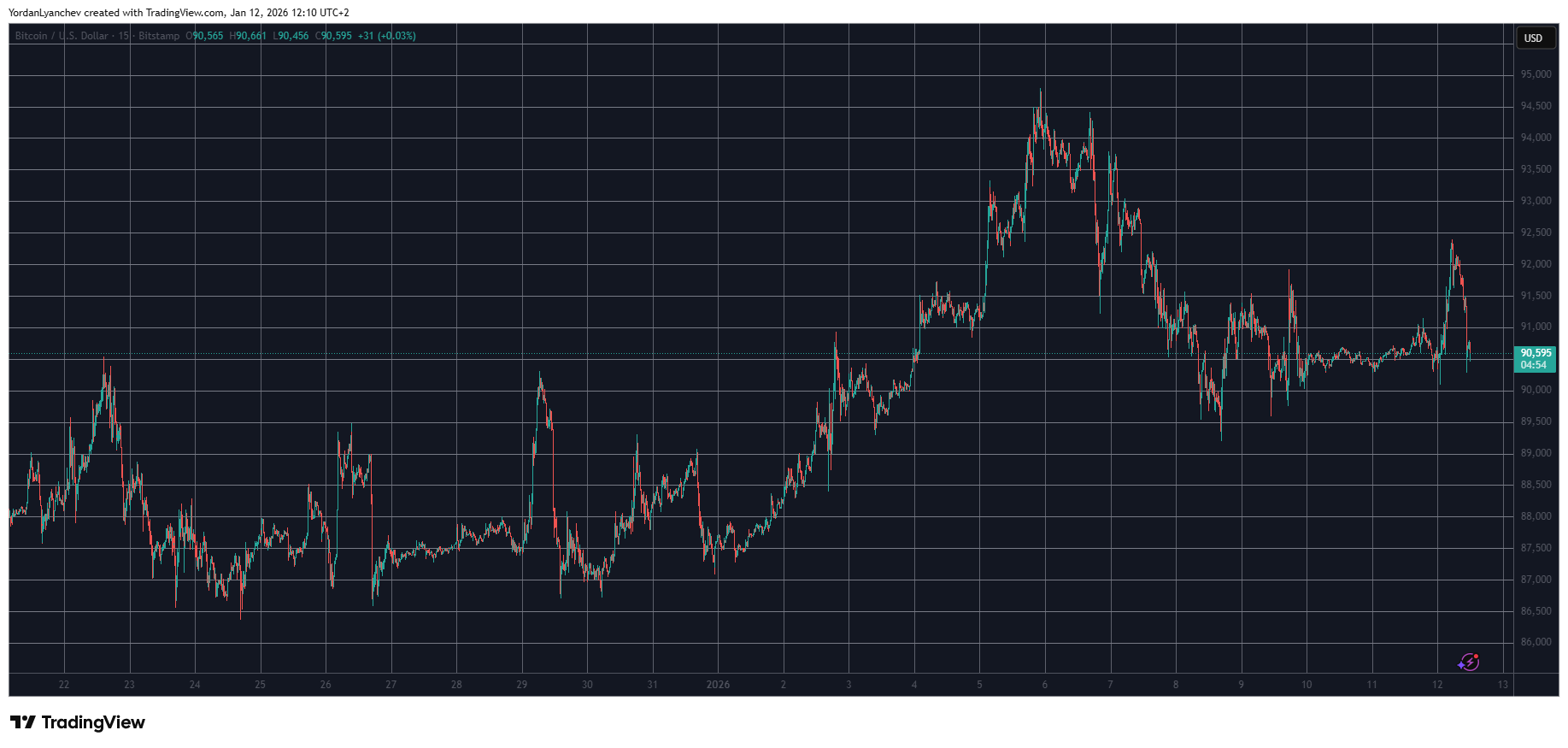

Bitcoin’s rate has slipped by 0.32 percent since yesterday-a tiny misstep that could hardly perturb a peasant, save that it carries the air of destiny. 😅

Bitcoin’s rate has slipped by 0.32 percent since yesterday-a tiny misstep that could hardly perturb a peasant, save that it carries the air of destiny. 😅

Over the weekend, the XRPL’s labor slowed to a whisper, activity sinking by about 99% within 48 hours. Closer inspection shows the falling rhythm comes more from the clock than from a broken engine; weekends have a way of thinning the crowd, and with it the liquidity. The ledger sighs, not with fear but with the fatigue of a city that has learned to endure these cycles.

This revelation marks a rather significant pivot; previously, our dear friends at JPMorgan had confidently proclaimed a cut of 25 basis points was likely in January 2026. Alas, those dreams have evaporated like morning mist. ☁️

In that moment, a transaction occurred that did not cry out but lingered, a small hole punched in the ice where people believed money must be supervised by a man with a badge. It was not a revolution announced from the rooftops, but a stubborn glimmer that money could walk by itself, from hand to hand, without a gatekeeper.

The altcoins, a troupe of disheveled actors, shuffled through the week in muted tones, save for Monero (XMR). This rogue, with the audacity of a street urchin, pirouetted upward by 17%, nearly brushing $600. One might say it danced on the graves of Zcash’s misfortunes, or perhaps it simply found a new hat to wear.

In what can only be described as a most dramatic turn of events, Coinbase, that titan of cryptocurrency exchanges in our fair United States, is exerting considerable pressure upon lawmakers residing in Washington. A crucial element of the proposed CLARITY Act threatens to curtail the manner in which stablecoin rewards are bestowed, thereby igniting a lively discourse between the crypto realm and the staid banking sector.

Breaking free from the shackles of the $1.40 mark, RENDER soared-yes, soared!-over 30% in a mere week. The $2 resistance, once a formidable foe, has been conquered and now serves as a cushion of support. The key EMAs, once gloomy, now gleam with bullish fervor. 📈

The week ahead promises a symphony of economic chaos: inflation reports, Fed whispers, and President Trump’s latest attempt to cap credit card rates. A veritable feast for the financially anxious. 🍽️

In a spirited discourse with the esteemed David Solomon of Goldman Sachs – a gathering of modern financial wizards, if you will – Master Armstrong, chief of the largest crypto emporium in these United States (by measure of trading, mind you!), did liken the prospective rise of these tokenized shares to that of those same stablecoins. A bold comparison, indeed!

‘Investigation’ into Powell’s ‘Misdeeds’ – Because Who Needs Evidence? 🕵️♂️