Silent Crypto Exodus? or Just a Realm Rearrangement?

Key takeaways

Key takeaways

On the fateful day of January 21, 2026, news broke that the deal’s valuation is said to flutter around the grand sum of $1 billion-though the details remain as elusive as a cat in the shadows. Meanwhile, daily active users have plummeted by 40%, and revenue has, dare I say, cratered by 85%. It appears the dream is rather more like a nightmare!

With a flourish, Allaire waved away the banking sector’s concerns faster than you can say “deposit flight.” Apparently, they think that paying out interest on stablecoins is going to send all their money running for the hills. But Allaire, with the confidence of someone who just found $20 in their winter coat pocket, said this narrative is as ridiculous as a cat wearing a bow tie.

Binance, ever the patron of the digital proletariat, has launched this rewards program for users holding USD1. $40 million in WLFI tokens await distribution, a sum that, one imagines, could either solve a small nation’s debt or fund a particularly lavish dinner party in Moscow.

Yet, here lies the jest: 80% of this bustling activity was deemed “systematic noise,” akin to the meaningless chatter in a crowded market. Scaling efforts, allegedly aimed at progress, strangely left the network awash with lower-quality traffic-cheap, like a poorly spun yarn.

And just to spice things up, geopolitical tensions have returned like that annoying ex who just won’t go away. The U.S. and the EU are back at it, throwing trade-war threats like confetti at a New Year’s party. Meanwhile, Greenland is somehow caught in the middle. Because why not mix business with a little bit of ice and snow, right?

This listing, a gilded bridge between the old world of finance and the new, whispers promises of prosperity to the retail investor, yet the price of entry is the surrender of direct control, a surrender to the whims of a system as capricious as the markets themselves.

So, is TON dead, or is it just napping before its grand comeback? Spoiler alert: Anthony Scaramucci thinks it’s the latter. Because, of course, he does.

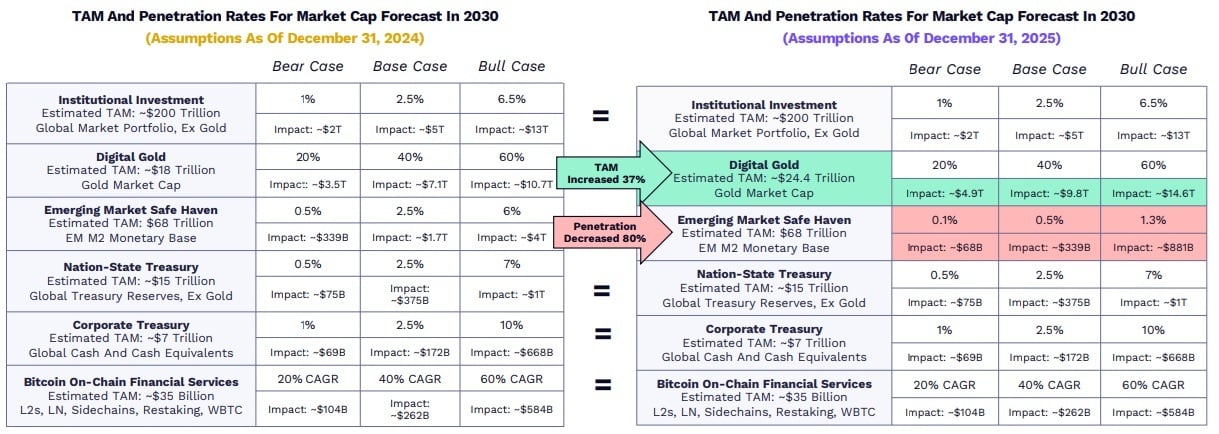

Ark Investment Management has released its Big Ideas 2026 report outlining long-term views on disruptive technologies and digital assets. The publication explains how bitcoin’s potential value is constructed through market sizing and adoption assumptions rather than a stated price target. The framework positions bitcoin valuation as a calculated outcome of demand scenarios and fixed supply.

Picture this: XRP is forming a double bottom around the $1.90-$2.00 mark, like a kid trying to find the perfect diving board. It’s one of the few good things XRP has done in months! But let’s be real-it’s less of a comeback and more like a cat learning not to fall off the couch.