Markets

What to know, dear reader:

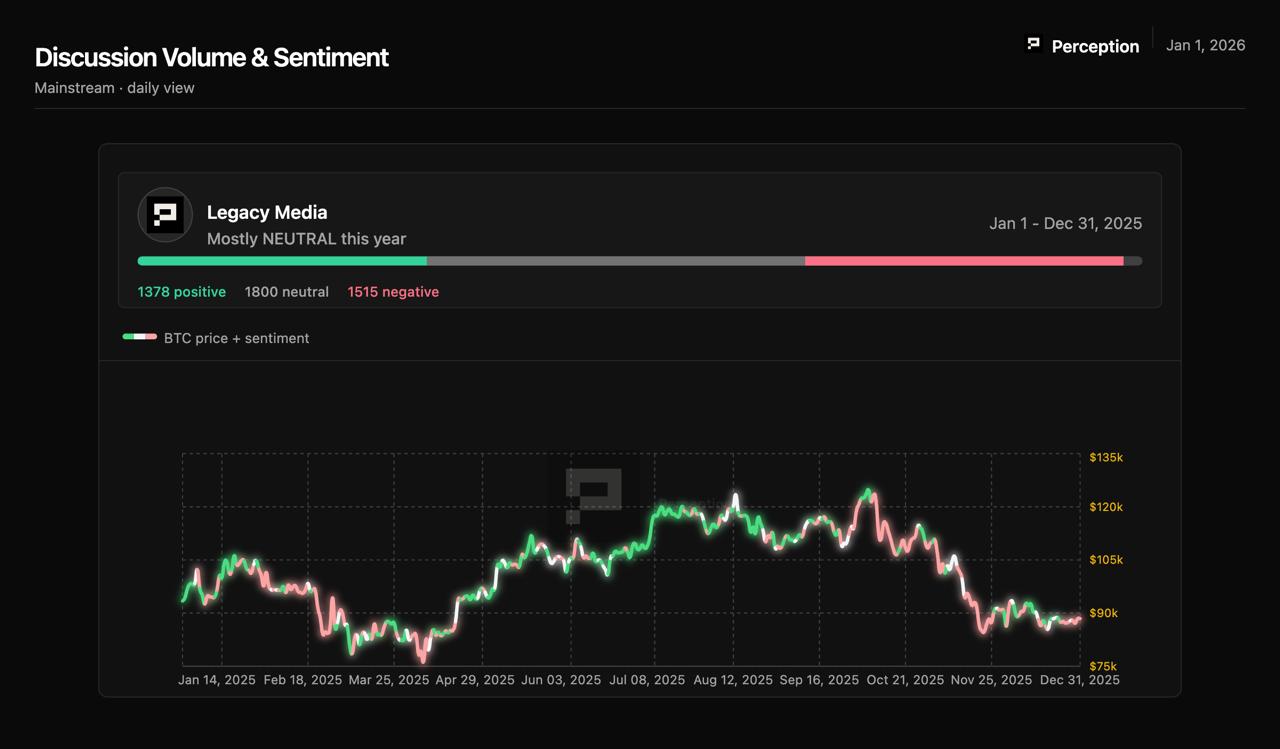

- In 2025, the media’s love-hate affair with Bitcoin took a breather-like a drunkard pausing to vomit. Neutral reporting, that rarest of beasts, now outshone its venomous cousin.

- The shift? Not due to Bitcoin’s sudden virtue, but the exhaustion of old tropes. The press, like a bureaucratic clerk, ran out of ink to write “disaster” and resorted to “meh.”

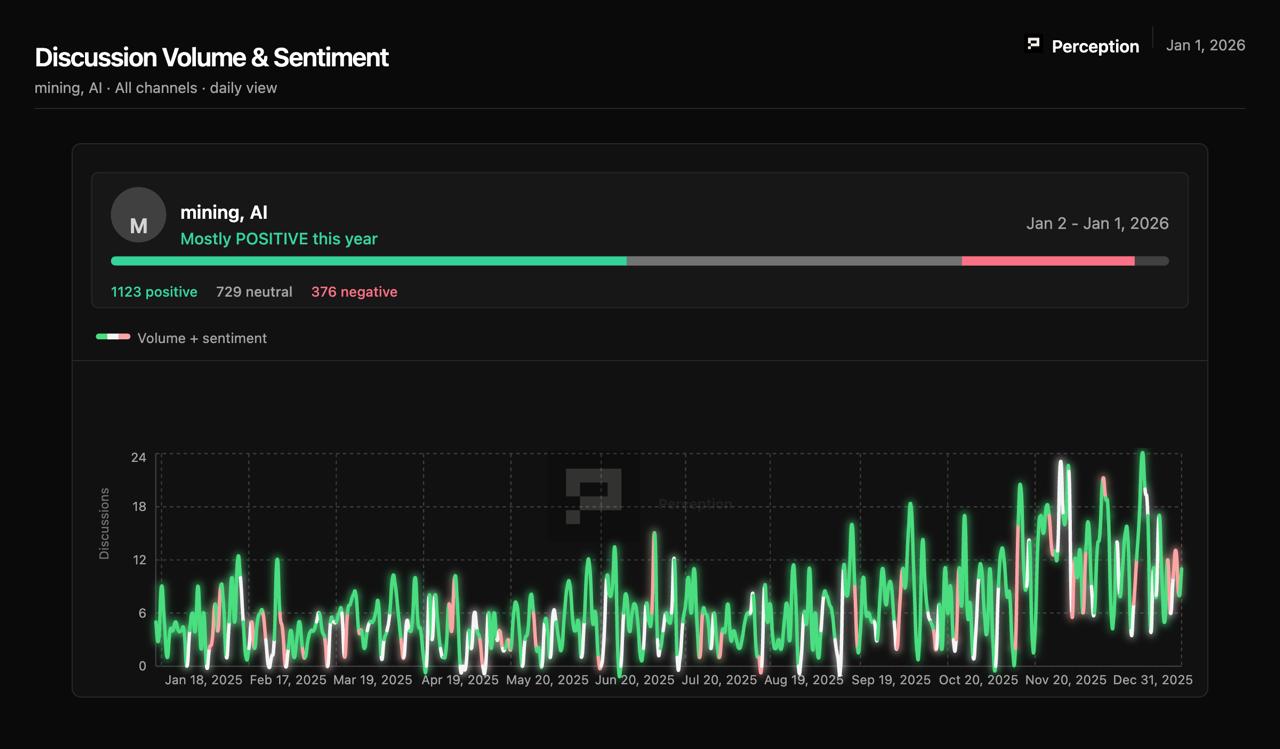

- AI, that inscrutable oracle of silicon and smoke, stole the spotlight, causing sentiment swings so wild they’d make a Cossack dancer weep.

Despite the media’s usual penchant for painting crypto as a modern-day Chernobyl, 2025 saw them grudgingly admit Bitcoin exists-not as a menace, but as a stubborn weed in the cracks of their narrative. Perception, that shadowy crypto intelligence agency, claims this balance was less “Eureka!” and more “We’ve run out of creative insults.”

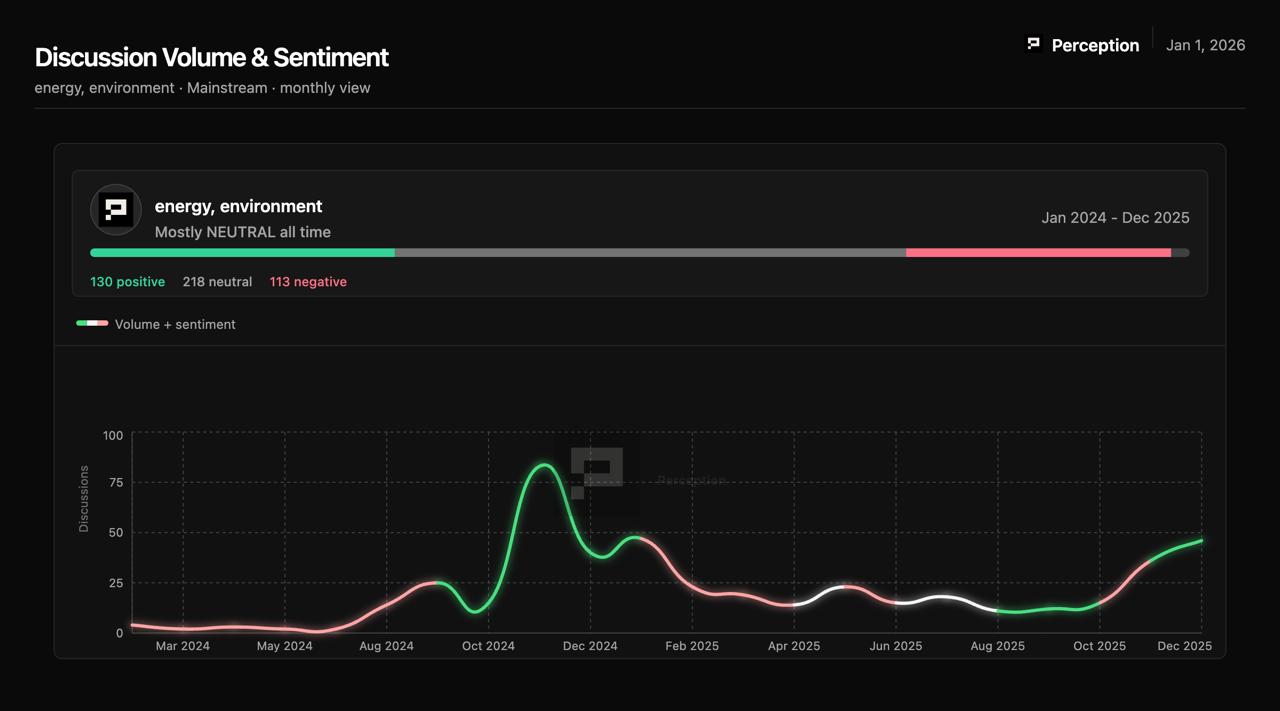

Perception’s data-350,000 mentions across 407 outlets, a bureaucratic labyrinth of words-reveals the media’s obsession with Bitcoin’s environmental sins faded, replaced by tales of crime, kidnappings, and illicit use. Imagine! A currency so successful it inspires its own noir subplot. 🕵️♂️

For the first time, Bitcoin’s media moments weren’t about “Is it dead?” but “Can it survive?” A question as thrilling as watching paint dry. 🐢

This metamorphosis, however, was not a phoenix rising from ashes, but a bureaucratic machine sputtering through phases. January: The SEC’s Gensler, that bureaucratic sorcerer, departed, leaving enforcement cases to wither like overripe tomatoes. March: An executive order birthed a Strategic Bitcoin Reserve, shifting coverage from “apocalypse now” to “budget spreadsheets.” October: Bitcoin hit new highs, proving it’s not a fragile experiment but a volatile, middle-aged man in a pinstripe suit.

By year’s end, even quantum computing couldn’t outdo Bitcoin’s existential dread. The press now debates whether the blockchain can withstand the future-or if it’s just a glorified ledger for our grandchildren. 🤯

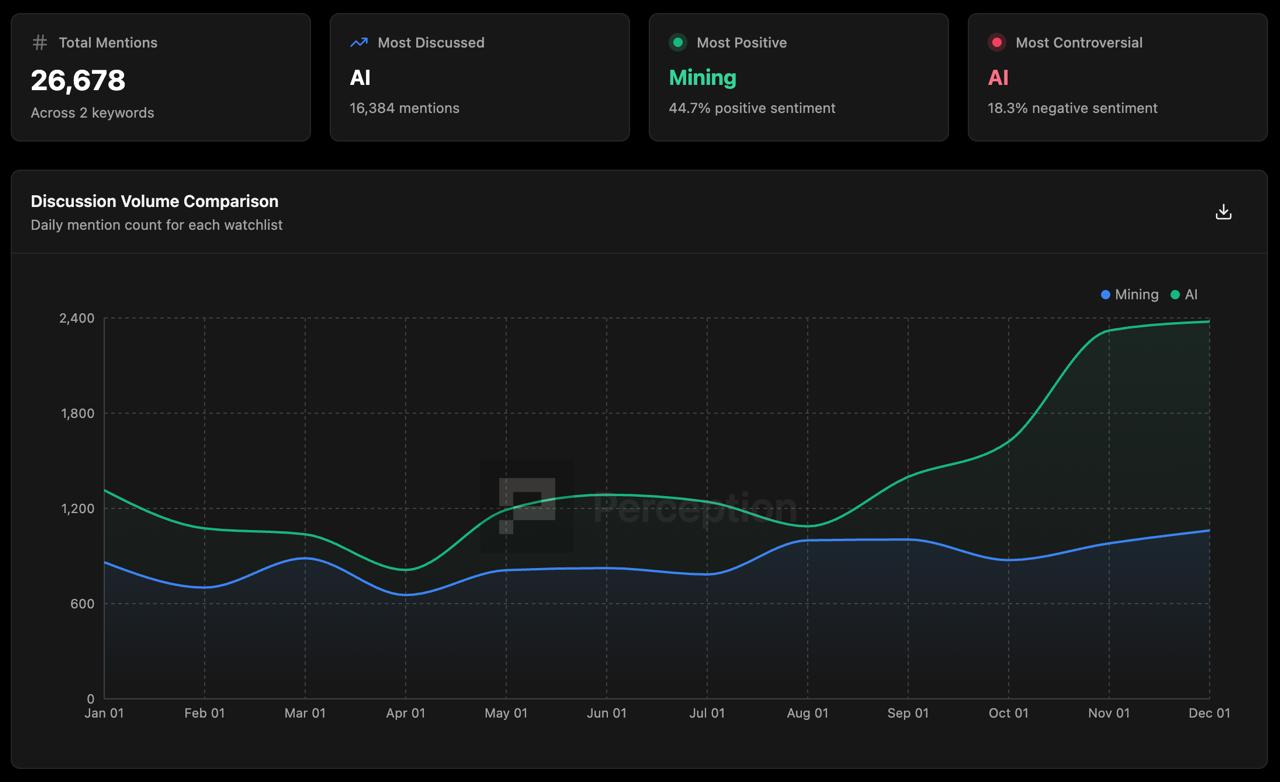

And what of AI, that digital goblin? It inherited Bitcoin’s media chaos, generating more drama than a Tolstoy novel. Mining coverage, once a toxic swamp, now glistens with positivity. Perception, that data oracle, admits even the most cynical reporter can’t resist a well-placed algorithmic metaphor. 🤖

Bitcoin, once the poster child of disruption, now plays the aging statesman-respected but ignored. AI, meanwhile, dances in the spotlight, a puppet of hype and fear. As for crypto prices? They linger like a forgotten guest at a party. Only time will stir the media’s interest again. Until then, AI reigns supreme. 👑

Market Movement

BTC: Bitcoin clings to $92,000 like a drunkard to a lamppost. ETF inflows whisper of institutional support, but let’s not confuse stability with excitement. 🏦

ETH: Ethereum inches toward $3,160, its gains as subtle as a bureaucrat’s smile. Accumulation? Yes. Speculation? Not quite. 🤷♂️

Gold: Gold trades at $4,392.93, a safe haven for those who forgot how to panic. Venezuela’s geopolitical chaos and U.S. jobs data keep it afloat, but even gold needs a vacation. 🏝️

Nikkei 225: The Nikkei 225 leapt 2.26% in 2026, outpacing its peers like a Cossack horse. Maduro’s capture and oil’s jittery dance set the stage. A geopolitical ballet, if you will. 🎭

Read More

- OP PREDICTION. OP cryptocurrency

- USD IDR PREDICTION

- GBP USD PREDICTION

- ALGO PREDICTION. ALGO cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- EUR ILS PREDICTION

- GBP AED PREDICTION

- LTC PREDICTION. LTC cryptocurrency

- BONK PREDICTION. BONK cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

2026-01-05 04:45