So, Binance Coin (BNB) decided to take a nosedive on Friday, huh? Classic. The crypto market’s in a “risk-off” phase, whatever that means-sounds like a bad Tinder date. BNB dropped over 6% intraday because, apparently, $900 is just too much to ask for. Who knew? Meanwhile, Bitcoin and the altcoin gang are having their own meltdown, with liquidations and macro conditions tighter than my wallet after a trip to the farmer’s market. Derivatives data says it’s not just spot selling-it’s a full-blown liquidation party, and everyone’s invited. Except the bulls. They’re crying in the corner.

BNB’s $900 Rejection: When Even Crypto Can’t Handle Commitment

The BNB chart? It’s a disaster. $900 was the line in the sand, and BNB tripped over it like I trip over my own feet at Whole Foods. Once $880 support turned into a slip ‘n slide, the selling pressure went full-on firehose. Lower highs, lower lows-it’s like a bad relationship. Now $880’s the new resistance, because why not? Just rub it in, market.

If this keeps up, $800-$830 is the next pit stop. Psychological level? More like a psychological punch in the gut. Unless BNB magically finds its way back to $900 with “strong volume”-which, let’s be honest, is about as likely as me winning a marathon.

Liquidations: The Crypto Version of a Garage Sale

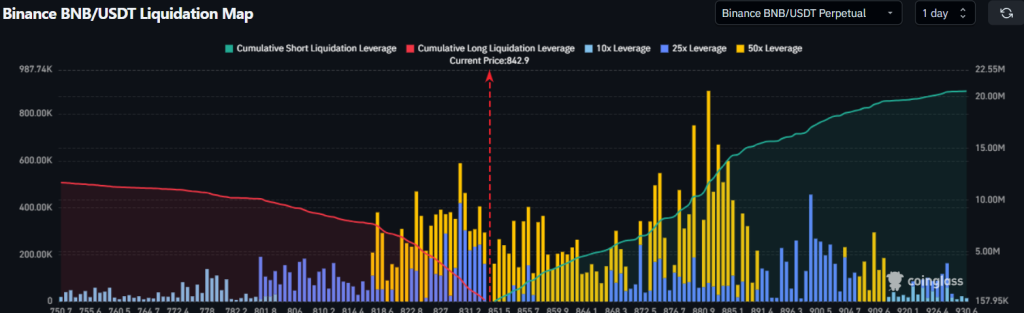

Oh, the liquidations. $100 million in BNB-related wipeouts? That’s not a selloff, that’s a fire sale. Long positions got hit harder than a piñata at a five-year-old’s birthday party. Overcrowded near resistance? Classic rookie move. Market’s like, “Surprise! You’re all wrong.”

Funding rates went negative faster than my mood after a bad coffee. Traders are paying to stay short-because who doesn’t love losing money? Open interest dropped 8-10%, which is just the market’s way of saying, “Leverage? More like leaveerage.”

Negative funding, falling open interest, clustered liquidations-it’s a leverage reset, not a panic move. Unless you’re a BNB long holder. Then it’s both.

Final Thoughts: BNB’s Bearish Binge

So, BNB’s $900 rejection turned it into a bearish dumpster fire. Liquidations exposed the market’s fragility like a bad haircut. Until leverage resets and price stabilizes-which, let’s face it, could take forever-downside’s the name of the game. Traders are watching support levels like they’re waiting for a bus. Will demand show up? Or will deleveraging keep this party going? Stay tuned, folks. It’s a circus out there.

Read More

- OP PREDICTION. OP cryptocurrency

- EUR TRY PREDICTION

- GBP USD PREDICTION

- Bitcoin’s Plunge: $60K or Bust? The Bear’s Tale Unfolds

- Bitgo’s IPO: A Triumph of Capitalism or a Cryptic Joke?

- Binance’s $40M WLFI Airdrop: A Carnival for USD1 Holders

- 4 Signs That Bitcoin Might Just Be Taking a Scenic Route to $85K

- USD IDR PREDICTION

- SUI PREDICTION. SUI cryptocurrency

- ALGO PREDICTION. ALGO cryptocurrency

2026-01-30 15:51