Darling, Blackrock has gone positively mad for bitcoin, hoarding a staggering 771K of the digital trinkets while their CEO, the ever-charming Larry Fink, spins a delightful fantasy of it hitting $700K. How utterly thrilling.

Blackrock’s Bitcoin Binge: Larry Fink Plays Financial Soothsayer

Blackrock, that titan of tedium in the asset management world, has decided that bitcoin is the new black. Their spot ETF, the Ishares Bitcoin Trust (IBIT, because acronyms are so chic), has amassed roughly 771K bitcoins by the end of 2025. How quaint.

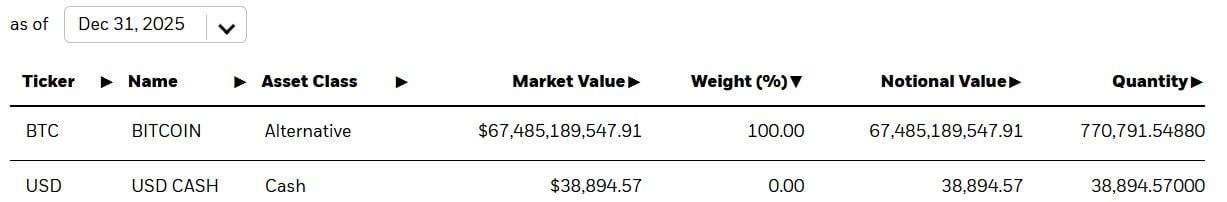

IBIT’s disclosures reveal-oh, do try to contain your excitement-that the ETF ended the year with $67.49 billion in bitcoin and a paltry $38,894.57 in cash. Because, darling, who needs liquidity when you can have volatility? The fund’s total holdings? A mere 770,791.55 bitcoins. One does wonder if they’ve misplaced a few.

Remarkably, this all happened despite bitcoin’s price behaving like a melodramatic diva in 2025. But fear not-adoption is driven by “structure” and “institutional demand,” not something as vulgar as profit. Market observers (bless their hearts) have declared IBIT the “most successful ETF launch in history.” One does hope they’ve sent flowers.

Ah, Larry Fink-once a bitcoin skeptic, now its most ardent cheerleader. In 2017, he called it an “index for money laundering.” Now? He’s evolved, darling. How progressive. He describes bitcoin as an “asset of fear,” which sounds positively Shakespearean, doesn’t it? Though one suspects he’s more concerned with debasement than dagger-wielding villains.

Earlier this year, Fink graciously suggested that if sovereign wealth funds allocated just 2% to 5% to bitcoin, it could soar to $700K. Because, of course, sovereign wealth funds are just itching

“If everybody adopted that conversation, it would be $500,000, $600,000, $700,000 for bitcoin.”

And let’s not forget tokenization-Blackrock’s latest obsession. Fink insists we’re at the “beginning of the tokenization of all assets.” Stocks, bonds, real estate-soon even your grandmother’s china will be on the blockchain. How revolutionary.

FAQ 🔥 (Because Everyone Loves a Good Drama)

- Why should institutions care about Blackrock’s bitcoin hoard?

Because nothing says “serious investment” like a fund holding $67.5 billion in digital Monopoly money. - How does IBIT fatten Blackrock’s wallet?

It’s their most profitable ETF. Who knew gambling-sorry, investing-could be so lucrative? - What does IBIT’s success say about bitcoin demand?

That institutions love a good rollercoaster-just as long as they’re the ones holding the reins. - How does IBIT fit into Fink’s grand tokenization fantasy?

It’s proof that even the stodgiest financiers can have a midlife crisis.

Read More

- OP PREDICTION. OP cryptocurrency

- GBP USD PREDICTION

- ALGO PREDICTION. ALGO cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- USD IDR PREDICTION

- USD TRY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- USD ILS PREDICTION

- GBP CNY PREDICTION

2026-01-04 05:58