Well, well, well. Bitcoin decided to take a nosedive below $73,000 for the second day in a row. Because, you know, one day of drama wasn’t enough. In a week that’s been more volatile than my ex’s mood swings, it’s lost nearly 18% of its value and erased $500 billion from its market cap since mid-January. Someone get this crypto a therapist, stat.

Bitcoin Erases Gains Faster Than I Erase My Search History

For the second day in a row, bitcoin slid below $73,000, because apparently, it’s allergic to stability. This volatile week has seen the cryptocurrency lose nearly 18% of its value. It plunged from $76,300 to $72,000 by 12:40 p.m. EST-a 3% intraday drop. Meanwhile, the Nasdaq was like, “Hold my beer,” and dropped 2.36%. Solidarity, I guess?

This latest dip pushed bitcoin’s market cap down to $1.45 trillion. Since its January 15 high of $97,500, it’s lost $500 billion. That’s enough to buy a small country, or at least a really nice yacht. The February 4 crash triggered $125 million in liquidations in four hours, because nothing says “fun” like watching long positions get wiped out. Over 24 hours, $830 million in leveraged bets were liquidated, mostly from bullish “long” bets. Ouch.

Oh, and let’s not forget the $272 million in outflows from spot bitcoin ETFs. Even the U.S. Senate’s CLARITY Act-a bill to regulate crypto-couldn’t boost sentiment. And the government shutdown ending? Yeah, that didn’t help either. Investors were like, “Thanks, but no thanks.”

AI Stocks: The New Crybabies of the Market

According to reports, the market’s mood swing was thanks to the AI sector. Semiconductor and AI stocks had a meltdown, led by AMD, which dropped 16% after some conservative guidance. Nvidia, Broadcom, and Intel also took a hit. The Nasdaq was like, “I’m not crying, you’re crying!” while the S&P 500 and Dow were just mildly annoyed.

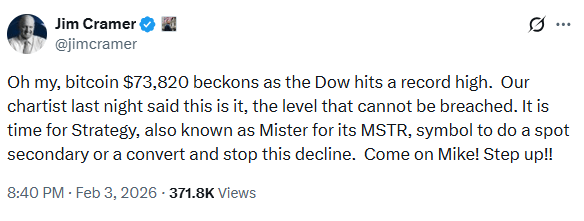

Bitcoin’s correlation with the Nasdaq has everyone questioning its “digital gold” status. It’s acting more like a tech stock than a safe haven. And Strategy’s weekly purchases? Not the spark they used to be. Jim Cramer even tweeted at Michael Saylor, basically saying, “Dude, do something!” Because nothing says “I care” like a public memo.

Critics are calling for a strategy shift, but analysts say Strategy’s cash reserves will keep it afloat. So, no need to start a GoFundMe…yet.

FAQ ❓

- Why did bitcoin drop below $73K again? It’s following the Nasdaq’s lead. Because misery loves company.

- How much has bitcoin lost in 2026? About $500 billion since January 15. That’s a lot of avocado toast.

- What caused the liquidations? $830 million in bets were wiped out in 24 hours. Oops.

- Is Strategy in trouble? Analysts say no. Their cash reserves are like a safety blanket.

Read More

- Bitgo’s IPO: A Triumph of Capitalism or a Cryptic Joke?

- Bitcoin’s $90K Tango: Will It Break a Leg or Steal the Show? 🎭💰

- Bitcoin Stumbles While Altcoins Dance: A Comedy of Digital Assets!

- Bitcoin’s Christmas Miracle: A Festive Market Plunge & Recovery 🎄📉

- Bitcoin’s Plunge: $60K or Bust? The Bear’s Tale Unfolds

- 4 Signs That Bitcoin Might Just Be Taking a Scenic Route to $85K

- Bitcoin’s Wild Ride: Why Experts Say It’s Stronger Than Ever 😱

- BitGo’s NYSE Gambit: A New Era or Just a Mirage?

- Bitcoin’s One-Night Stand at $97K: Proofreads Advised

- 🚨 Binance’s New Darlings: Four Tokens in the Spotlight! 🚨

2026-02-05 00:23