In the grand theater of finance, where fortunes rise and fall with the whims of the market, Bitcoin has once again taken center stage, delivering a performance both tragic and absurd. This week, the digital darling slid with the grace of a drunken actor, landing just above $82,000 in early US trading. The result? A chain reaction of liquidations, a $1.7 billion farce, and the collective wailing of 270,000 traders who had bet on a never-ending ascent. Ah, the sweet irony of hubris.

The Great Liquidation Carnival

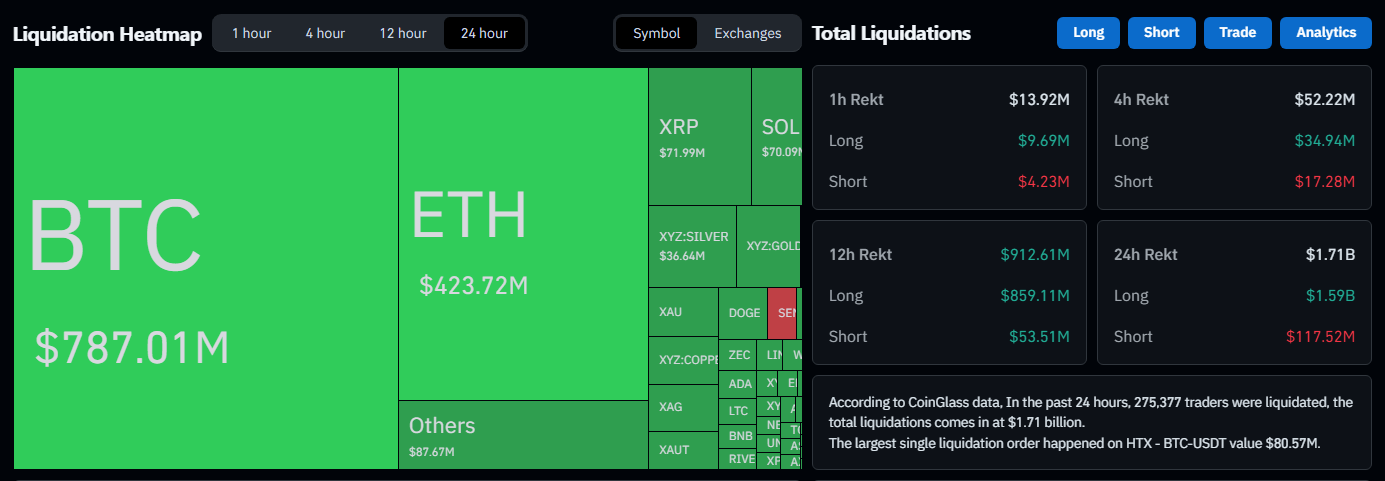

The speed of the collapse was breathtaking, like a poorly constructed set piece crashing mid-performance. Long positions, the optimists of the market, were the hardest hit-over 90% of the liquidated contracts, mostly in Bitcoin and Ether. Stop orders were triggered, margin calls enforced, and volatility spiked, leaving the market as unstable as a Chekhovian family dinner.

Price gaps appeared on platforms, a reminder that even in the digital realm, reality has a way of asserting itself. And as traders scrambled to make sense of the chaos, one could almost hear the faint echo of a distant voice: “I told you so.”

Geopolitics: The Uninvited Guest

As if the market needed more drama, geopolitical tensions in the Middle East decided to join the party. A US warship deployment and the ever-reliable theatrics of President Trump sent risk assets into a tailspin. Meanwhile, an executive action on tariffs added another layer of uncertainty, leaving global traders to ponder the impact on energy flows and trade. Ah, the joys of interconnectedness.

And let us not forget Microsoft’s earnings miss, a minor character in this saga but one who delivered a crucial plot twist. Rising costs and slower cloud growth sent tech stocks tumbling, prompting investors to question the AI-driven growth narrative. Confidence, once so robust, wobbled like a Chekhovian protagonist facing existential dread.

Bitcoin, ever the barometer of risk appetite, found itself caught in the crossfire. Headlines blared, traders adjusted positions, and the market atmosphere turned as cautious as a man tiptoeing around a sleeping bear. Buying dried up in minutes, leaving behind a landscape of uncertainty and regret.

Bitcoin now trades near a higher-timeframe support area, a familiar stage where it has performed before. Weekly closes have been confined between $94,000 and $84,000 for weeks, and this structure faces yet another test. Will buyers step in, or will the curtain fall on a deeper weakness? The wider crypto market, having lost $200 billion in value, watches with bated breath.

As always, the analysts have taken to the stage, each with their own interpretation of the drama. Some call the reaction overblown, noting that prices had been falling since October. Others warn of a longer correction if macro pressures persist. Benjamin Cowen, ever the pragmatist, suggests Bitcoin may continue to underperform stocks, dashing hopes of a rapid flip from gold or silver into crypto.

Speaking of gold and silver, they have climbed to record levels, with gold reaching $5,608 per ounce and silver rising to $121.60. A reminder, perhaps, that in the theater of finance, the old actors still have their moments.

And so, the curtain falls on another act in the great Bitcoin drama. The traders, the analysts, the market-all players in a comedy of errors, where the only certainty is uncertainty. Until the next performance, dear reader, let us savor the absurdity of it all.

Read More

- OP PREDICTION. OP cryptocurrency

- EUR TRY PREDICTION

- AXS Token’s Dramatic Rise: Is It a Mirage or the Next Big Thing?

- USD IDR PREDICTION

- SUI PREDICTION. SUI cryptocurrency

- ALGO PREDICTION. ALGO cryptocurrency

- Ah! Bitchat’s Popularity in Uganda: A Farce of Freedom and Frenzy 🎭📱

- Bitcoin’s Plunge: $60K or Bust? The Bear’s Tale Unfolds

- 4 Signs That Bitcoin Might Just Be Taking a Scenic Route to $85K

- GBP USD PREDICTION

2026-01-30 13:18