A new institutional report finds crypto markets entering 2026 with reduced leverage, stronger structure, and a shift toward defensive positioning, as bitcoin maintains leadership and institutions favor large-cap exposure.

Institutions Turn Defensive as Crypto Risk Gets Repriced

Digital asset markets began 2026 on steadier footing after last year’s broad deleveraging reset risk across the sector. According to the Charting Crypto Q1 2026 report, produced by Glassnode and Coinbase Institutional, leverage has fallen, derivatives positioning has become more conservative, and market participants are repricing risk. One might say the market has finally learned to fear the storm-though the storm, it seems, is merely a more polite version of the same chaos.

Bitcoin continues to anchor the market. BTC dominance has held near 59%, even as mid- and small-cap tokens struggled to sustain gains made earlier in the cycle. Institutional survey responses cited in the report show a clear preference for large-cap exposure, reflecting ongoing geopolitical uncertainty and a cautious approach to risk. How noble! Institutions, those paragons of wisdom, now favor large-cap exposure, as if the market’s future depends on a single, stoic leader.

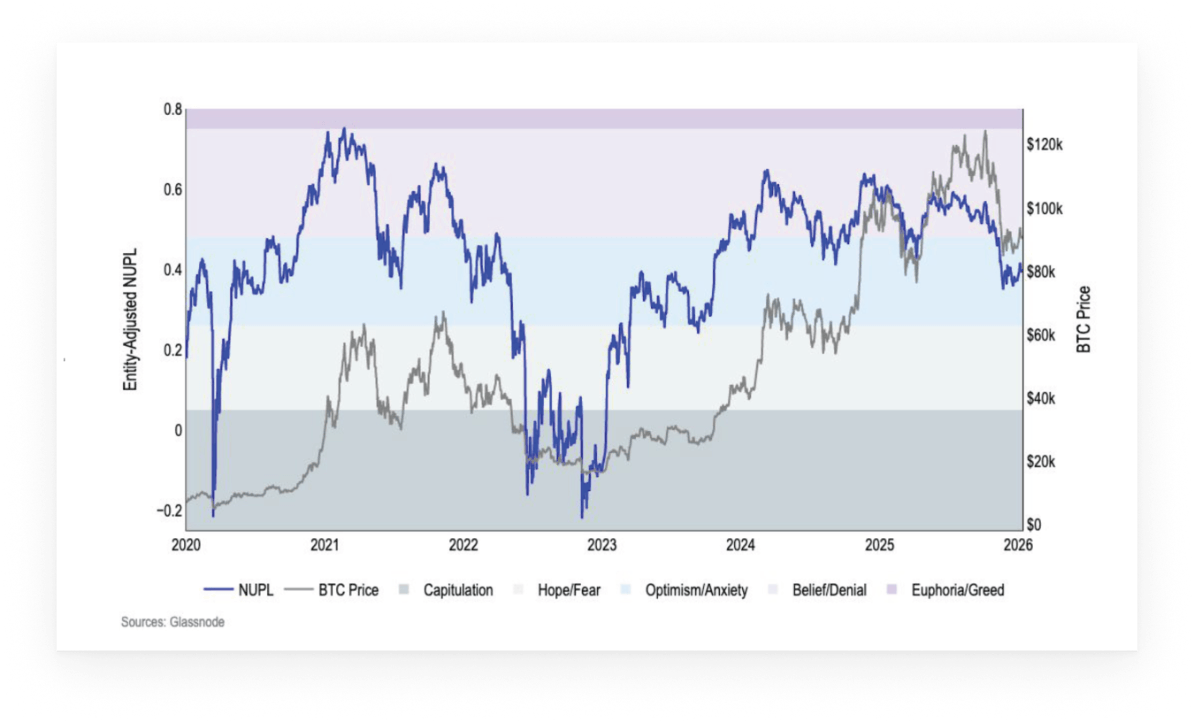

Sentiment around bitcoin remains restrained. The Net Unrealized Profit/Loss (NUPL) metric has stabilized at lower levels after October’s massive liquidation event. Structurally, this leaves room for sentiment to improve if volatility compresses or macro conditions remain supportive. A glimmer of hope, perhaps-though one wonders if it’s merely the faintest flicker before the next collapse.

One of the most notable changes has occurred in derivatives markets. October’s deleveraging materially reduced systemic leverage, with the leverage ratio in perpetual futures falling to around 3% of total crypto market capitalization, excluding stablecoins. Rather than exiting entirely, traders migrated toward options. How quaint! The market, once a wild beast, now seeks the safety of a cage-though the bars are made of hope and uncertainty.

One of the most notable changes has occurred in derivatives markets. October’s deleveraging materially reduced systemic leverage, with the leverage ratio in perpetual futures falling to around 3% of total crypto market capitalization, excluding stablecoins. Rather than exiting entirely, traders migrated toward options. How quaint! The market, once a wild beast, now seeks the safety of a cage-though the bars are made of hope and uncertainty.

Bitcoin options open interest now exceeds perpetual futures, with positioning increasingly focused on downside protection and defined-risk structures. This shift points to a more resilient market structure, even if near-term conviction remains muted. Resilient? Perhaps. But resilience, in this context, is merely the ability to endure the next disaster without collapsing entirely.

The report also highlights signs of distribution in bitcoin. Supply that has been active within the past three months rose to 37% in the fourth quarter of 2025, while long-dormant supply declined modestly, suggesting some reallocation by longer-term holders. A dance of shadows, perhaps. The long-term holders, those who once believed in the promise of decentralization, now move like ghosts, redistributing their assets with the caution of prisoners in a cellblock.

Ethereum, meanwhile, appears to be entering a late-stage phase of its current cycle, which began in mid-2022. However, the report argues that traditional cycle signals are losing predictive power as ethereum’s economics evolve. Fee compression on Layer 2 networks and shifting usage patterns mean future performance is likely to be driven more by liquidity conditions and positioning than by historical cycle timing alone. A fitting metaphor: the old rules no longer apply, and the game has become a labyrinth with no exit.

Overall, the report concludes that while sentiment remains cautious, crypto markets are structurally healthier than in past cycle transitions, with discipline replacing excess. Healthier? Perhaps. But what is health in a system where the very idea of value is a mirage, and the only certainty is the next crash?

FAQ🏦

- Why are institutions turning defensive in crypto?

Lower leverage and macro uncertainty are pushing institutions toward cautious, risk-managed positioning. Or perhaps they’ve finally realized that the game is rigged, and the only way to survive is to play it safe. - Which assets are institutions favoring most?

Bitcoin and other large-cap assets lead portfolios as mid- and small-caps lose favor. A curious choice, given that large-cap assets are the very embodiment of the system they claim to distrust. - What changed in crypto derivatives markets?

Traders reduced leverage and shifted from perpetuals to options for downside protection. A wise move, if one believes that protection is possible in a world where the only constant is chaos. - What does this mean for crypto in 2026?

Markets look structurally stronger, with disciplined risk-taking replacing speculative excess. Stronger? Perhaps. But strength in this context is a relative term, akin to a prisoner finding comfort in the weight of their chains.

Read More

- Bitgo’s IPO: A Triumph of Capitalism or a Cryptic Joke?

- EUR TRY PREDICTION

- USD IDR PREDICTION

- XDC PREDICTION. XDC cryptocurrency

- 4 Signs That Bitcoin Might Just Be Taking a Scenic Route to $85K

- Bitcoin’s Plunge: $60K or Bust? The Bear’s Tale Unfolds

- AXS Token’s Dramatic Rise: Is It a Mirage or the Next Big Thing?

- OP PREDICTION. OP cryptocurrency

- Bitcoin’s One-Night Stand at $97K: Proofreads Advised

- 2026 Crypto Breakthrough? Let’s Not Panic (Yet!)

2026-01-29 07:59