Mon Dieu! What a mélange of madness! Behold, the eternal duel between the noble Bitcoin and the dusty relics of gold and silver! A year of chaos, where fortunes rise and fall like a drunken minuet. Bitcoin, that rascal, boasts gains so grand they make your eyes water. Gold and silver, those ancient gents, rally with such vigor they’d make a court jester weep. All the while, the crowd shouts, “Encore!” or “Out, damned spot!”

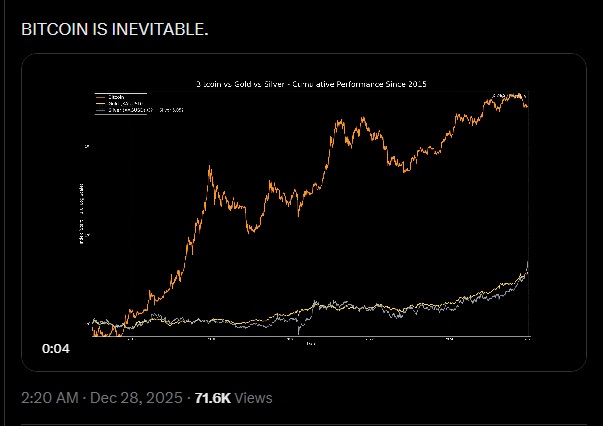

The Bitcoin Waltz Since 2015

From 2015 to now, Bitcoin has leapt a staggering 27,700%! Adam Livingston, our modern-day Alcibiades, declares this a triumph over the meager 400% for silver and 280% for gold. Ah, but some scoff! They argue, “Ignore the first six years, you scoundrel!” Even then, Bitcoin pirouettes ahead, leaving the metals in its wake. “A clear win!” cry the crypto enthusiasts. Others, with faces redder than a boiled lobster, remain unconvinced.

Silver: 405%

Gold: 283%

Bitcoin: 27,701%Even if you discard Bitcoin’s first six years (for those who whine about timeframes like a spoiled child), the APEX ASSET still shines brighter than the moon on a cloudy night. 🌕✨

– Adam Livingston (@AdamBLiv) Dec 27, 2025

The Critics’ Lament

Peter Schiff, that old curmudgeon, retorts, “Focus on the last four years, you fool! Bitcoin’s glory days are over!” Thus speaks the man who once declared paper money a fable. Meanwhile, Matt Golliher, with all the subtlety of a cannon, argues that gold and silver will eventually return to their “cost of production.” As if nature itself bows to human whims!

“Now do the last four years only. Times have changed. Bitcoin’s time has passed.”

– Peter Schiff (@PeterSchiff) Dec 27, 2025

Supply and macro forces? Pah! In 2025, gold hit $4,533 per ounce, and silver flirted with $80. The US dollar, that beleaguered beggar, fell 10%. Analysts whisper of Fed easing and geopolitical tensions-oh, what a merry dance of uncertainty!

“Surprisingly unpopular opinion: Gold and silver do not need to slow down for Bitcoin to do well.”

“Bitcoiners thinking that needs to happen are low T and don’t understand any of these assets.”

– _Checkmate (@_Checkmatey_) Dec 28, 2025

Glassnode’s James Check, that sage of the blockchain, declares: “These assets need not duel like dueling pistols in a French farce!” Lyn Alden, our macro oracle, nods: “They may both charm the same crowd!” Arthur Hayes, ever the optimist, adds, “Fed easing and a weak dollar will lift all stores of value-digital and physical alike!”

Read More

- OP PREDICTION. OP cryptocurrency

- ALGO PREDICTION. ALGO cryptocurrency

- GBP USD PREDICTION

- CNY RUB PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- USD KZT PREDICTION

- GBP CNY PREDICTION

2025-12-29 12:12