Well, well, well. Bitcoin is doing its best impression of a circus acrobat, juggling around the $90,000 mark like it’s the world’s most expensive set of flaming torches. 🪨🔥 After failing to stick the landing above $95,000, it’s now in consolidation mode-crypto-speak for “let’s take a breather before we decide whether to crash or soar.” The broader market, ever the drama queen, is following suit, dragging its feet like a teenager told to clean their room. 🧹✨

And what’s the cherry on this volatile sundae? Oh, just a little thing called the U.S. Supreme Court ruling due Friday. 🏛️⚖️ Apparently, nearly 1,000 companies are throwing a tantrum over tariffs imposed by former President Donald Trump, warning of economic chaos. If the ruling goes against Trump, the dollar might flex its muscles, sparking a global risk-off party-and Bitcoin could be the first guest shown the door. 🥳💔 In that case, $89,000 might not just be a support level; it could be a goodbye wave. 👋

BTC Price: The 200-Day MA Tightrope

Bitcoin kicked off 2026 with the energy of a caffeine-fueled squirrel, surging to nearly $95,000. But, as is often the case with squirrels (and crypto), the momentum fizzled faster than a flat soda. 🥤💨 The price has since dropped over 5%, with declining volume suggesting investors are more interested in selling than holding. Unless BTC can reclaim $90,500-$91,000 faster than you can say “HODL,” the downside pressure might stick around longer than an uninvited houseguest. 🛋️🙄

Holding above $89,000 is now the crypto equivalent of passing a kidney stone-painful but necessary. If it fails, we could be looking at a bearish continuation that makes a winter cold snap feel cozy. ❄️😬

As the chart above so eloquently demonstrates, BTC has been rejected more times than a bad pickup line at a wedding. 💔 For the third time since December, it’s flashing bearish signals like a neon sign in Vegas. The MACD is dropping faster than a mic at the end of a rap battle, and the possibility of an extended pullback is looming like a storm cloud on a picnic day. ☁️🧺 However, the 200-day MA could be its safety net-but only if buyers decide to show up. 🎪🙏

Momentum Takes a Nap, But the Bull Isn’t Dead Yet 🐂💤

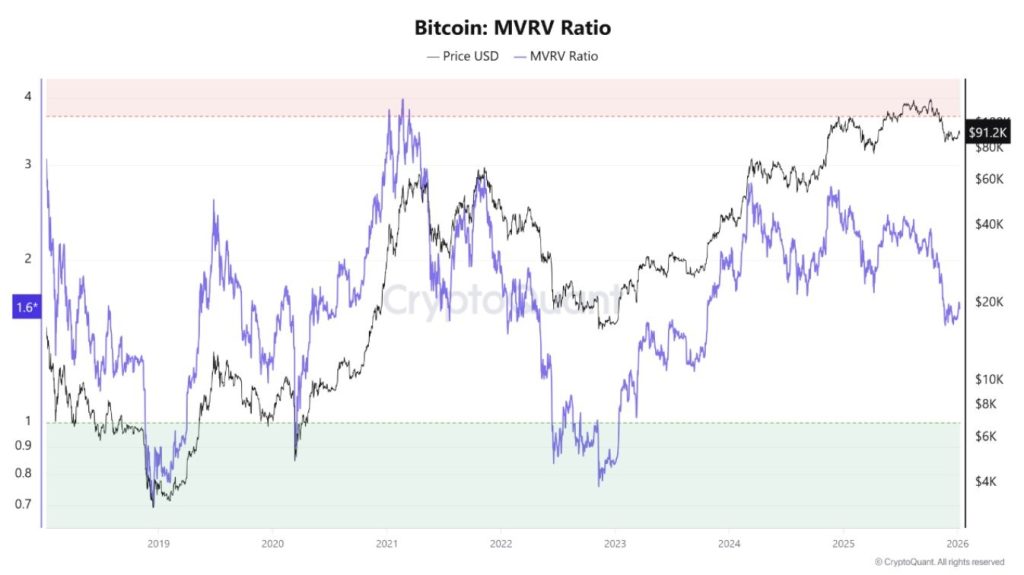

Bitcoin’s MVRV ratio is currently chilling around 1.6, which is crypto’s way of saying, “We’re not overheating, but we’re not exactly undervalued either.” 🌡️ Historically, major cycle tops form when MVRV hits the 3.5-4.0 zone-the crypto equivalent of a fever dream. Right now, Bitcoin is well below that, so don’t panic-sell your kidneys just yet. 🏥💰

In past bull cycles, Bitcoin has taken pullbacks like a spa day, consolidating between 1.3 and 2.0 before resuming its upward march. The current reading fits this pattern like a glove, suggesting this dip is more of a “catch your breath” moment than a “sell everything and move to a cabin” scenario. 🏔️🚀 Downside risk would only get serious if MVRV dips toward 1.0-a scenario about as likely as finding a unicorn in your backyard. 🦄🌈

The Bottom Line: Bitcoin’s Not Dead, It’s Just Resting

This pullback feels less like a trend reversal and more like a momentum reset-crypto’s version of a power nap. 💤 With on-chain metrics still looking healthy and MVRV nowhere near peak levels, the market isn’t screaming “distribution” just yet. In the near term, expect volatility to be the name of the game, with key support zones tested like a final exam. 📉📈 Whether the bulls hold the line or the bears take over depends on buyers’ resolve. A successful hold keeps the bullish party going, while a failure might delay the fireworks-but it won’t cancel them. 🎆🎉

Read More

- OP PREDICTION. OP cryptocurrency

- USD IDR PREDICTION

- ALGO PREDICTION. ALGO cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- GBP USD PREDICTION

- USD INR PREDICTION

- USD ILS PREDICTION

- EUR TRY PREDICTION

- USD ISK PREDICTION

2026-01-08 18:43