So, it’s 2025, and the Bitcoin mining world has gone bonkers. 🤑 $IREN, $APLD, and $CIFR are the cool kids at the party, each flaunting over 200% returns. But wait, there’s more to this story than just numbers-the market has developed a taste for certain companies, and it’s not just about mining Bitcoin anymore. It’s like the universe suddenly decided, “Hey, let’s diversify!” 🌌

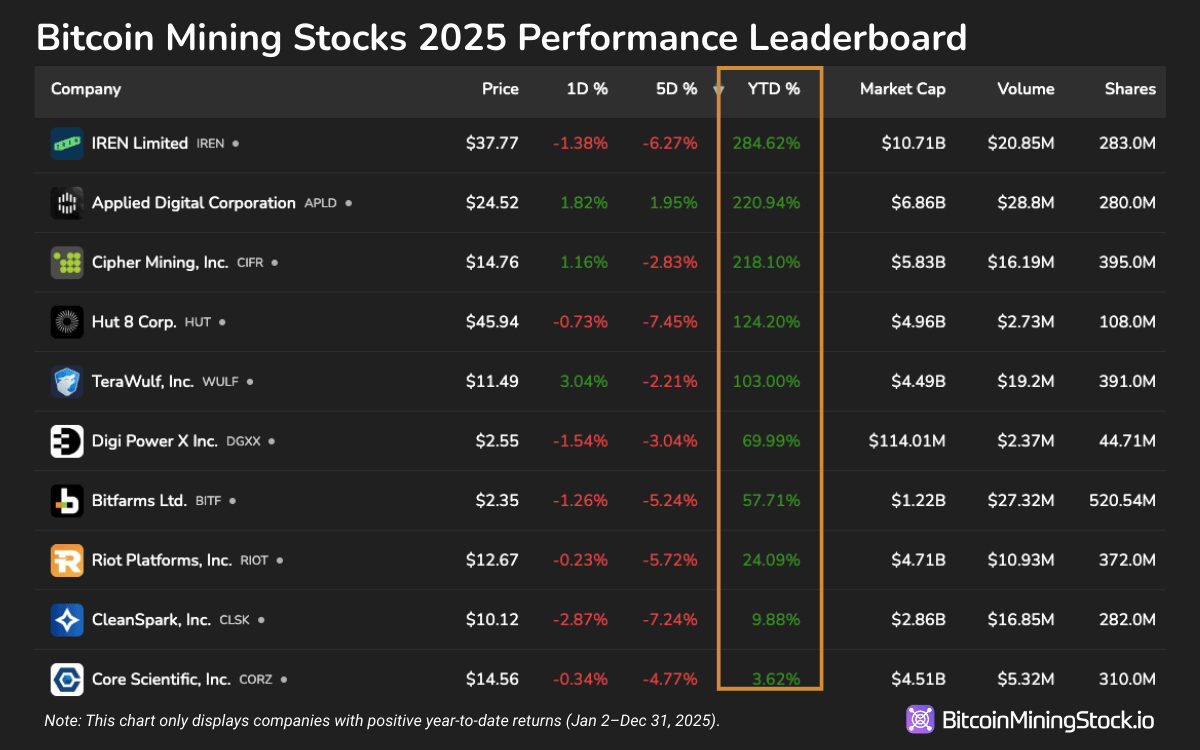

The performance of public Bitcoin mining equities in 2025 was like a galactic shift in investor preferences. Year-to-date (YTD) returns showed a gaping chasm between hybrid miners and the purists. It’s as if the purists were still trying to sell ice to Eskimos, while the hybrids were selling air-conditioning in hell. 🔥❄️

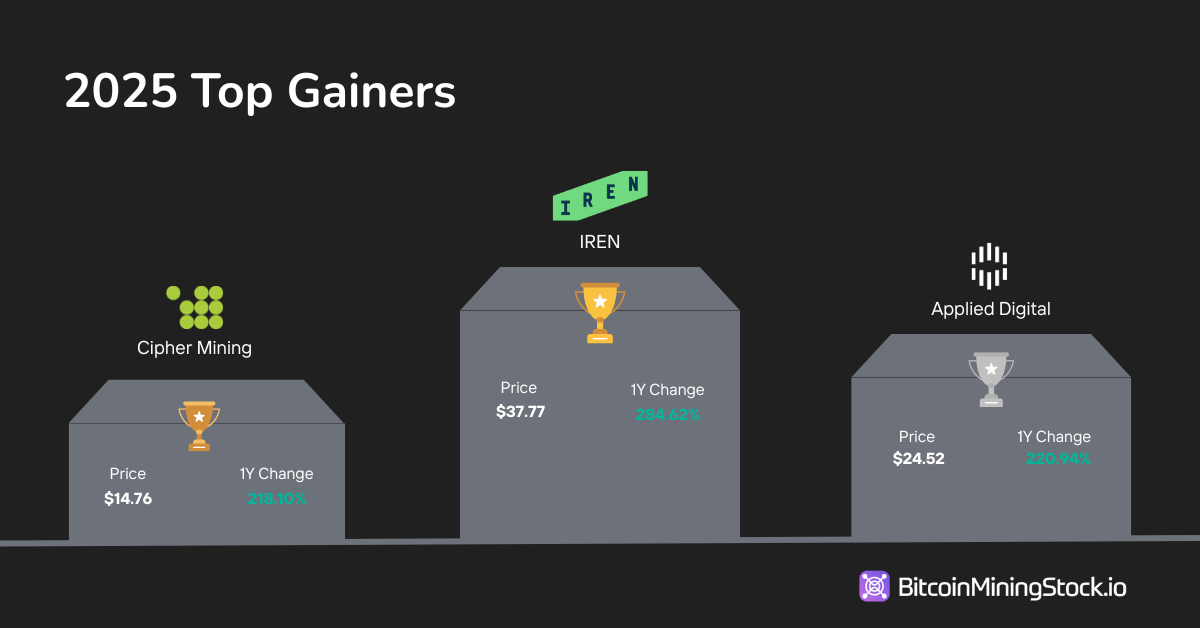

At the top of the leaderboard-because, yes, there’s always a leaderboard-were IREN, Applied Digital, and Cipher Mining. These guys didn’t just hit 200% returns; they smashed it. Their secret sauce? Multi-billion-dollar hyperscaler agreements. 🍱 Meanwhile, Hut 8 and TeraWulf were like the sidekicks who still managed to snag over 100% returns. The moral of the story? If you’re not monetizing your infrastructure beyond Bitcoin, you’re basically a one-trick pony in a circus of multi-talented animals. 🎪

Zooming out, every Bitcoin miner with positive YTD returns in 2025 had either dipped their toes into HPC revenue or made very visible moves toward AI-related services. On the flip side, pure Bitcoin miners were left eating dust, posting negative returns. It’s like they were still using dial-up internet while everyone else had moved to 5G. 📞➡️📡

But here’s the twist: not all AI or HPC ventures were greeted with open arms. Northern Data AG, Bitdeer, and MARA Holdings all ended up in the red despite their AI exposure. Northern Data’s financial numbers were as disappointing as a soggy towel after a shower, and their business combination deal didn’t exactly scream “success.” MARA, meanwhile, clung to its Bitcoin-centric strategy like a life raft, which, spoiler alert, didn’t float. And BTDR? Well, they lacked the scale and narrative clarity that investors were craving. Lesson learned: having an AI position isn’t enough-you’ve got to execute and communicate. 🎭

Another fun fact: hashrate size didn’t guarantee stock performance. Some of the biggest miners by Exahash capacity still ended up in the red. It’s like having the biggest muscles at the gym but still losing the arm-wrestling match. 💪😬 Meanwhile, smaller miners like Cipher Mining and TeraWulf, who were busy growing their HPC operations, saw outsized gains. The takeaway? Scale is great, but it’s nothing without a plan to diversify and boost those margins. 🧩

CleanSpark is a perfect case study in market sentiment. For half of 2025, they were all like, “We’re America’s Bitcoin miner!” and their stock price just shrugged. But then, in August, they got a new CEO, Matt Schultz, who was all, “Let’s do HPC and AI!” Suddenly, investors were like, “Oh, you’re speaking our language now!” 🗣️ And just like that, CleanSpark’s stock went from “meh” to “yay.” It’s amazing what a little diversification can do. 🌈

Micro-cap miners with no AI ambitions? They got hit harder than a piñata at a five-year-old’s birthday party. Some lost over 70% of their market value. Ouch. 😵 Meanwhile, a few names like Cathedra Bitcoin, Argo Blockchain, and Mawson Infrastructure posted gains, but those were mostly due to reverse stock splits or low float shenanigans. Adjusting for these, the real winners were still the hybrid miners. 🏆

So, what’s the moral of this 2025 Bitcoin mining saga? The HPC/AI pivot isn’t just a trend-it’s the new black. And if you’re not on board, you might as well be selling typewriters in the age of laptops. 📠➡️💻

For those who want to keep an eye on the Bitcoin mining stocks, head over to: BitcoinMiningStock.io/gainers-losers. Just don’t say we didn’t warn you about the AI gold rush. 🏃💨

Read More

- OP PREDICTION. OP cryptocurrency

- GBP USD PREDICTION

- ALGO PREDICTION. ALGO cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- USD IDR PREDICTION

- USD TRY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- USD ILS PREDICTION

- GBP CNY PREDICTION

2026-01-04 14:02