What to know:

By Omkar Godbole (All times ET unless indicated)

They preached a double gospel: first, that bitcoin is a gold-like digit with a cuff of 21 million, and second, a decentralized engine that shuffles money openly, without masters or mediators. The factory whistle blew, but the bells were hollow.

Today the faith wavers. It pretends to be both a store of value and a payments loom, yet it falters in both. Bitcoin’s lag behind gold, silver, and other precious metals is as plain as an empty stomach after shift end.

Equally bitter is the slow march of on-chain life, treading water at levels seen in the half-forgotten year 2025. The 30-day average of daily confirmed payments on the Bitcoin blockchain has sunk to 748,368-the lowest since mid-July, Blockchain.com records. It once roared at over 884,000 in September. A payment, mind you, means the recipient receives funds on-chain, as if the coin were a promise kept by a stubborn worker.

The monthly chorus of confirmed transactions declines as well. The mempool, that memory of unconfirmed deeds waiting for miners, dries up to a few thousand per day-a fatigue that has lingered since late 2025.

“On-chain signals point to a market in consolidation rather than accumulation. Network activity has softened. The reduced institutional and retail conviction can be seen in lower active addresses and subdued transaction volumes,” writes Vikram Subburaj, CEO of Giottus, in an email-an iron note in a brass season.

A token’s price is tethered to the living hands that use its network. The recent retreat in activity helps explain BTC’s dull price song in recent months, a tune no one asked for at the factory gate.

Bitcoin, the leading coin by market value, has fallen back to $87,500 after peaking above $90,000 in the days before Wednesday’s Fed meeting. The central bank kept rates unchanged, as expected. The policy sheet and Chairman Powell’s remarks hint at caution on rate cuts in the coming months-no fireworks, only a few sparks in a damp room.

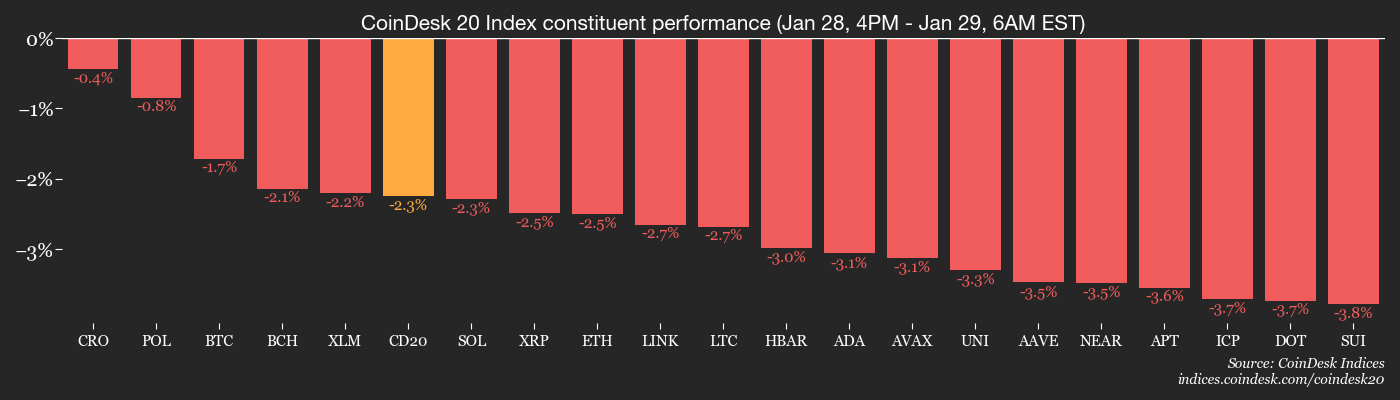

With BTC leaning lower, the bright sectors from early this week slump into the red. The CoinDesk Memecoin Index (CDMEME) drops more than 9% in 24 hours. The Metaverse Select (MTVS) and Culture and Entertainment indexes fall over 5% each.

Meanwhile, gold tokens PAXG and XAUT rise, drawing strength from the persistent rally in spot gold. Worldcoin’s WLD climbs 5%.

In traditional markets, oil climbs to four-month highs on both sides of the Atlantic, a temper for inflation that could complicate the Fed’s next moves. An energy-led inflationary push could make rate cuts harder to come by. Stay vigilant, citizen.

What to Watch

For a fuller map of events this week, see CoinDesk’s “Crypto Week Ahead”.

Token Events

For a fuller map of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a fuller map of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 2 of 4: WallStreetBets Live (Miami, Florida)

Market Movements

- BTC is down 1.67% from 4 p.m. ET Wednesday at $87,798.68 (24hrs: -2.39%)

- ETH is down 2.5% at $2,941.84 (24hrs: -3.59%)

- CoinDesk 20 is down 2.13% at 2,679.82 (24hrs: -2.9%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.81%

- BTC funding rate is at 0.0073% (7.9628% annualized) on Binance

- DXY is unchanged at 96.44

- Gold futures are up 3.1% at $5,505.70

- Silver futures are up 2.46% at $116.32

- Nikkei 225 closed unchanged at 53,375.60

- Hang Seng closed up 0.51% at 27,968.09

- FTSE is up 0.44% at 10,198.87

- Euro Stoxx 50 is up 0.39% at 5,956.17

- DJIA closed on Wednesday unchanged at 49,015.60

- S&P 500 closed unchanged at 6,978.03

- Nasdaq Composite closed up 0.17% at 23,857.45

- S&P/TSX Composite closed up 0.24% at 33,176.07

- S&P 40 Latin America closed up 1.17% at 3,751.00

- U.S. 10-Year Treasury rate is up 0.4 bps at 4.255%

- E-mini S&P 500 futures are unchanged at 7,011.50

- E-mini Nasdaq-100 futures are up 0.1% at 26,181.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 49,137.00

Bitcoin Stats

- BTC Dominance: 59.65% (0.1%)

- Ether-bitcoin ratio: 0.03335 (-1.07%)

- Hashrate (seven-day moving average): 872 EH/s

- Hashprice (spot): $39.24

- Total fees: 2.87 BTC / $256,633

- CME Futures Open Interest: 113,020 BTC

- BTC priced in gold: 15.9 oz.

- BTC vs gold market cap: 5.88%

Technical Analysis

- The chart shows bitcoin’s daily price swings since November.

- The price has turned lower after facing rejection at the resistance of the bullish trendline, a technical analysis term for an uphill path.

- That has shifted the focus to support first at $86,000 followed and then, if it falls through, at $84,445.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $209.43 (-0.66%), -0.9% at $207.54 in pre-market

- Circle Internet (CRCL): closed at $72.84 (+4.12%), -0.91% at $72.18

- Galaxy Digital (GLXY): closed at $31.90 (-3.86%), -0.85% at $31.63

- Bullish (BLSH): closed at $34.33 (-1.35%), -0.17% at $34.27

- MARA Holdings (MARA): closed at $10.37 (-1.43%), -1.16% at $10.25

- Riot Platforms (RIOT): closed at $17.55 (+0.00%), -0.4% at $17.48

- Core Scientific (CORZ): closed at $19.49 (-2.26%), +0.15% at $19.52

- CleanSpark (CLSK): closed at $13.45 (+1.36%), -1.49% at $13.25

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $51.37 (+0.92%)

- Exodus Movement (EXOD): closed at $14.33 (-7.43%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $158.45 (-1.94%), -0.71% at $157.33

- Strive (ASST): closed at $0.80 (-2.20%), -0.51% at $0.80

- SharpLink Gaming (SBET): closed at $9.97 (-0.2%)

- Upexi (UPXI): closed at $1.96 (-1.01%)

- Lite Strategy (LITS): closed at $1.31 (-0.76%), +0.76% at $1.32

ETF Flows

Spot BTC ETFs

- Daily net flows: -$19.6 million

- Cumulative net flows: $56.32 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: $28.1 million

- Cumulative net flows: $12.41 billion

- Total ETH holdings ~6.04 million

Read More

- OP PREDICTION. OP cryptocurrency

- EUR TRY PREDICTION

- 4 Signs That Bitcoin Might Just Be Taking a Scenic Route to $85K

- GBP USD PREDICTION

- 2025’s Best Antivirus: Save Your Data… or Die Trying 🐍

- Ah! Bitchat’s Popularity in Uganda: A Farce of Freedom and Frenzy 🎭📱

- 2026 Crypto Breakthrough? Let’s Not Panic (Yet!)

- Bitcoin’s Plunge: $60K or Bust? The Bear’s Tale Unfolds

- AXS Token’s Dramatic Rise: Is It a Mirage or the Next Big Thing?

- USD IDR PREDICTION

2026-01-29 15:48