Bitcoin shuffles past the 61,000 mark like a schnook in a Broadway chorus line, then slips to an intraday low of 60,000 per coin on Binance as the day’s selling pressure refuses to take a bow. The slide is so dramatic you’d think the tape opened a slapstick routine, and the question on everyone’s lips is who will press the reset button-if anyone remembers where the reset button is.

Bitcoin Sinks 17% in a Day as Market Anxiety Peaks

As Wall Street and precious metals wrapped the session in the red like a curtain at curtain-call, crypto assets were still absorbing blows Thursday evening. The price of bitcoin ( BTC) dumped 17% in a single day, sliding to a low of $60,000, where-for the moment-it bounced back above $63,000 and appears to have found a temporary footing, as if it just remembered it left the oven on.

Over the past week, BTC has surrendered 28.7%, with the top crypto asset now down 35.6% from last month-a decline so dramatic it could audition for its own space-age musical. Jeff Park, partner and chief investment officer at Procap Financial, noted on X that bitcoin’s implied volatility has climbed to 75%-which, in case you forgot, is a lot of wiggly digits for a currency that wears a cape and calls itself digital.

“ Bitcoin implied vol is now at 75%,” Park said. “This is the highest level since the ETF launch in 2024. It is also finally higher than gold volatility. [I] know it’s a lot of pain right now, but this is all part of the process required for Bitcoin to make new highs. The melt up will be fast,” he added, as if the script demanded a cliffhanger and the audience got a free popcorn refill.

Despite the depressed pricing, Placeholder VC’s Chris Burniske is keeping his guard up-like a maître d’ at a comedy club who knows the punchline is coming but fakes politeness first. “Watching with interest, but not buying yet. Expect a bounce, but doubt the bloodletting is done,” Burniske wrote. Galaxy Digital’s head of research, Alex Thorn, told his X followers that bitcoin is more oversold today than at any point since 3AC collapsed in June 2022, based on the 30-day relative strength index ( RSI).

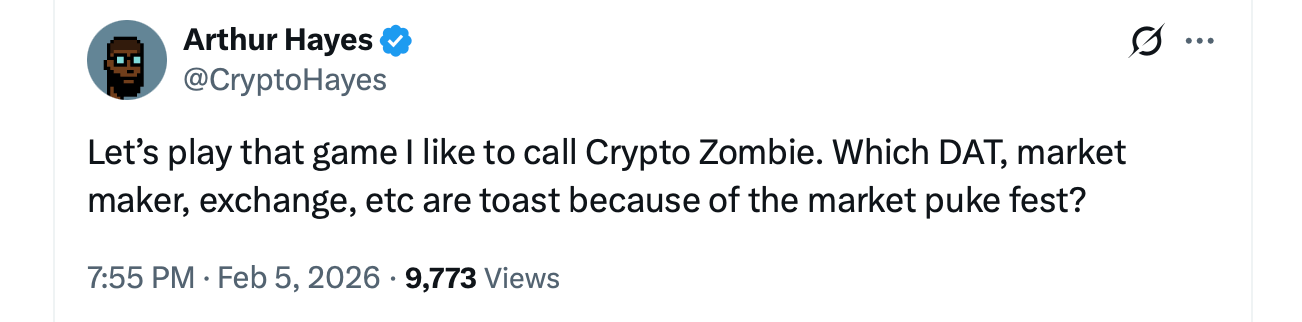

“From an RSI perspective, this is basically in the top 3 oversold events ever. Nov. 2018 dump from $6k to $3k. June 2022 3AC dump. Feb. 5, 2026,” Thorn added.

In a lopsided twist, bitcoin’s liquidation map now leans sharply against the shorts, setting the stage for outsized discomfort. Roughly $28 billion to $30 billion in potential losses stack up for bearish bets between the current zone and the upper band around $108,000 to $109,000, while long positions are nearly wiped clean.

Coinglass.com data shows $2.65 billion in crypto derivatives positions were erased on Thursday, with BTC longs making up $1.22 billion of the damage. Bitcoin’s bruising sell-off has pushed the market to a familiar crossroads, with stretched metrics, thinning leverage, and frayed nerves on full display.

Oversold signals and skewed liquidations point to sharp counter-moves, yet caution still hangs over the tape. The Crypto Fear and Greed Index (CFGI) sits at a bleak 9, firmly planted in “extreme fear.”

FAQ ❓

- Why did bitcoin fall to around $60,000 on Feb. 5, 2026?

Heavy selling pressure across global markets, combined with aggressive leverage unwinds in crypto derivatives, pushed bitcoin sharply lower. - How severe was the crypto market liquidation?

Roughly $2.65 billion in crypto derivatives positions were erased in one day, with BTC long positions accounting for about $1.22 billion. - What do oversold indicators signal right now?

The 30-day RSI shows bitcoin is among its most oversold levels since June 2022, pointing to elevated stress and potential volatility. - What does a Crypto Fear and Greed Index reading of 9 mean?

A score of 9 reflects “extreme fear,” indicating widespread caution and risk aversion among crypto investors.

Read More

- GBP CAD PREDICTION

- GBP RUB PREDICTION

- TON PREDICTION. TON cryptocurrency

- STX PREDICTION. STX cryptocurrency

- SPX PREDICTION. SPX cryptocurrency

- EUR ARS PREDICTION

- AVAX PREDICTION. AVAX cryptocurrency

- EUR CLP PREDICTION

- GBP EUR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2026-02-06 05:30