Binance, the grand old juggernaut of the crypto carnival, has found itself at the center of a right proper rumpus, courtesy of rumors on the social grapevine that money is slithering out faster than a dockside eel.

“Get your funds off Binance,” cried a popular crypto analyst on X, in a voice that suggested he’d misplaced his top hat and was rushing to find it again. “-$17bn of withdrawals in the last seven days. There is a risk they will become insolvent, and you won’t be able to get your money out. Withdraw now or cry later.” The figures, like the weather, range from $10 billion to $17 billion, and the chorus keeps chorus-ing away with tireless gusto.

The exchange, never one to let a good flutter go to waste, fired back that data from third-party sources is a bit of a misbehaving chap and is to be restored in due course.

“Thank you everyone for your concern about Binance. The data cited by Coinglass comes from third-party sources, and DefiLlama previously showed discrepancies. It will take another 24 to 48 hours for their data to be restored.”

Moreover, Binance contends that regularly conducting withdrawal tests on all trading platforms is a positively healthy pastime. When performing these tests, please double-check the address carefully. Confirm, then withdraw – as one does after convincing oneself one has packed the umbrella for a sunlit stroll.

They even proposed an annual “withdrawal day” to be established for all platforms, a philanthropic national holiday wherein assets are thoroughly verified with all the pomp of a parish tea party and none of the peril of a surprise audit.

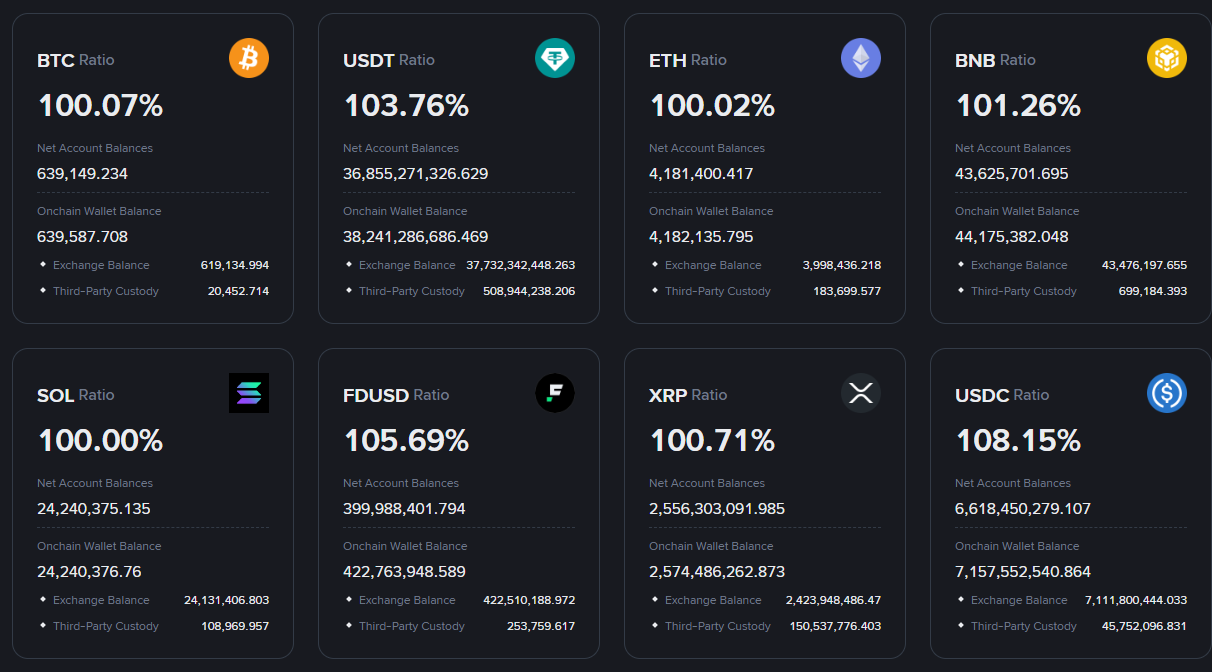

Meanwhile, the Proof-of-Reserves report on their official website reveals that all cryptocurrencies are, at the time of writing, overcollateralized – meaning there is more USD backing their reserves than crypto. A bit of health in the ledger, if you like your balance sheets with a dash of stoutness.

Read More

- EUR RUB PREDICTION

- 🐻 Mr. Cramer’s Bearish Blunder: Will Bitcoin Survive His Wrath? 🎭

- USD VND PREDICTION

- USD ISK PREDICTION

- ARB PREDICTION. ARB cryptocurrency

- STX PREDICTION. STX cryptocurrency

- ADA’s Holiday Meltdown: A Gogolian Tale of 66,530% Chaos! 🎄💸

- Crypto Market’s Holiday Slump: A Bulgakovian Nightmare 🐉💸

- Bitcoin & Yen: A Twisted Tale 😱

- Banking Drama: Can Stablecoins Save the Day or Sink the Ship? 💰🚢

2026-02-12 15:47