BCH Soars 61,561%: Bears Weep, Bulls Celebrate!

CoinGlass data reveals that traders betting short on BCH have seen $169,260 wiped out, a sum that could buy a small island… if the island accepted Bitcoin Cash. 🏝️

CoinGlass data reveals that traders betting short on BCH have seen $169,260 wiped out, a sum that could buy a small island… if the island accepted Bitcoin Cash. 🏝️

No longer shall digital assets cower in the realm of “miscellaneous income”-that mystical tax purgatory where lost receipts and speculative fortunes go to be devoured alive. Nay! The imperial decree now heralds crypto as a “financial product for asset formation,” a phrase so noble it belongs on a scroll sealed by the Emperor himself, or printed on a pachinko parlor brochure, depending on your cynicism level. 🧧

The disparity between the fundamentals and the price is like a farmer looking at his barren field while dreaming of a bountiful harvest. Yet, analysts and industry sages peer into the depths and see a slow but steady tide of improvement swelling beneath the surface, like the earth preparing for spring rains.

Despite the price’s deathly embrace, U.S. spot XRP ETFs are rolling in the dough-crossing a billion dollars in assets under management. English translation: Institutional investors are still playing hard to get, but they’re clearly interested. With a history as long as a Dickens novel and regulatory clarity that rivals a well-behaved puppy, XRP remains appealing enough for the traditional finance crowd to peek through their monocles. And, in the shadows, on-chain activity reveals a political coup-roughly 750 million XRP slipped off exchanges recently, leaving only about 1.5 billion to taunt us. If this trend keeps up, 2026 could see the market’s grandest supply squeeze-like a squeezed lemon, only with more zeros and less zest-especially if the big money keeps pouring in like a never-ending champagne fountain. 🍋🥂

The two startups, who were riding the Latin American digital payment wave – think: doing just fine until JPMorgan decided to throw a wrench – apparently saw a rise in chargebacks and weak identity checks that no amount of digital fortresses could fix. JPM’s official stance? “It’s just our compliance thing,” they say casually, “not a total crypto excommunication.” Because nothing says warm, fuzzy fintech hugs like freezing accounts in the middle of a booming market. 🤷♀️

Analysts, those ever-watchful sentinels of financial propriety, have observed an unusual alignment-like a well-matched set of gloves-between options positioning and shrinking volatility, hinting that technical exhaustion might be less a sign of surrender than of a poised, dramatic crescendo. One could almost imagine the curtains rising on a grand scene. 🎭

Macro-wise, with the recent BOJ rate hike and treasury yields soaring like a kite in a storm, not to mention the JPY taking a nosedive of 6% this quarter, it seems the Land of the Rising Sun has become a beacon of enlightenment-or perhaps just a captivating riddle-for U.S. investors. Who knew economics could be so thrilling? 🧐

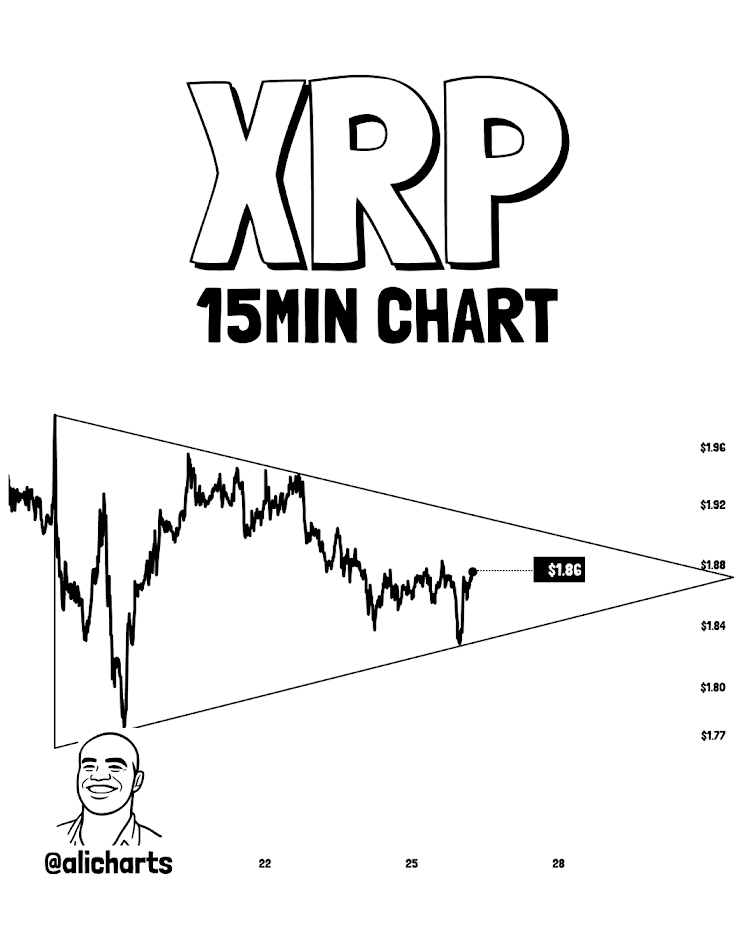

XRP, my dear, is showing more vulnerability than a Coward protagonist in the third act. Its price action is struggling to muster sustained bullish momentum near the $1.80 support level. Despite its valiant recovery attempts, the broader technical structure remains as bearish as a Coward wit at a society ball. Buying pressure? Fading faster than a Coward tune in a noisy cabaret. 🎭

Key takeaways

While mass capital dehydration occurred-$23.6 billion in Bitcoin and $3.8 billion in Ethereum-order reigned supreme, passing without the slightest fuss. Bitcoin kept to its modest dance around $88,000 to $89,000, and Ethereum preferred to lounge near $2,950 to $2,980, as if saying, “What’s the rush?” They ended the day around $88,500 and $2,960 respectively, both up a dainty 1.5% in the last 24 hours. Just enough to keep traders mildly interested-perhaps until post-holiday hangovers kick in. 🥂