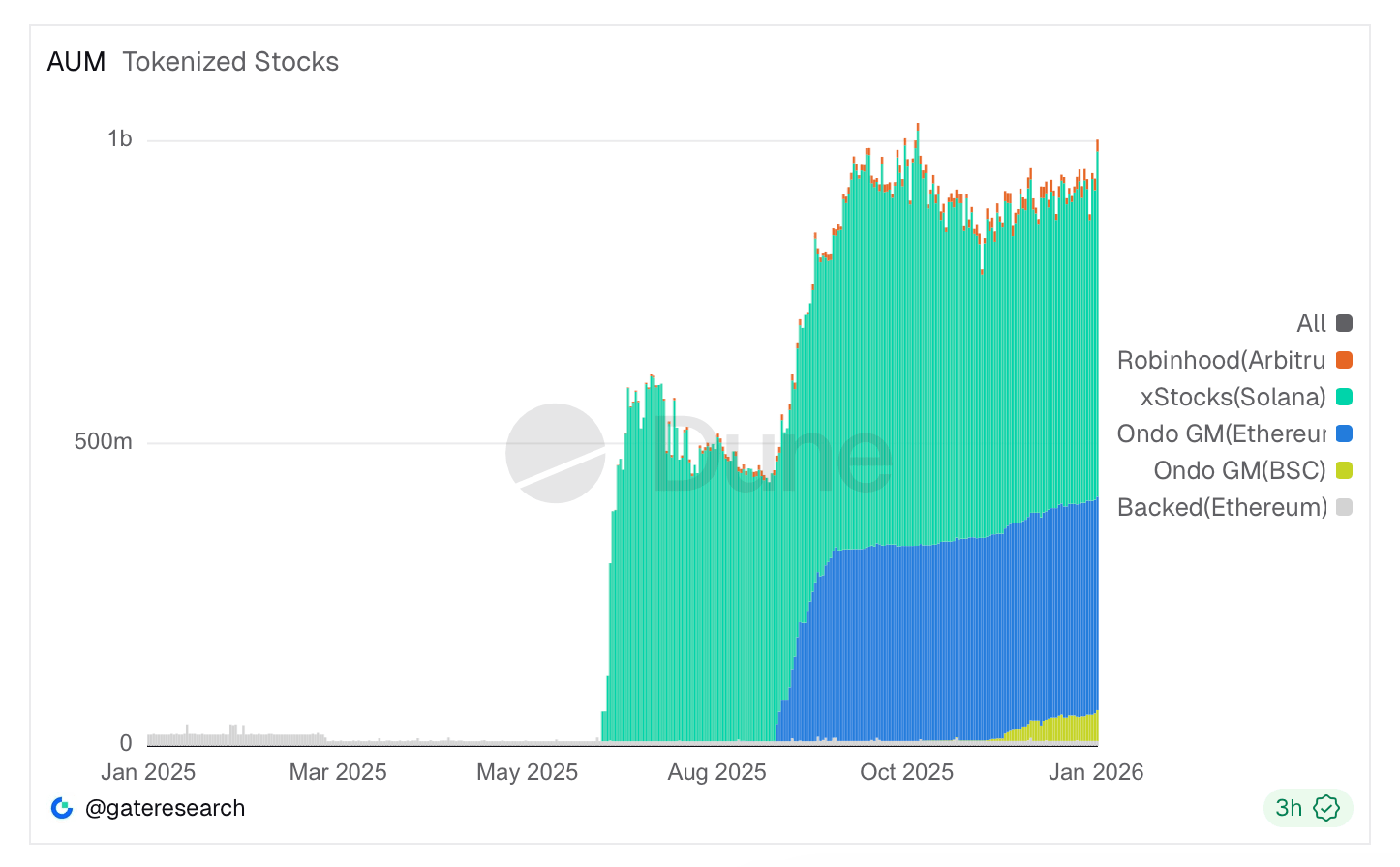

Solana’s Tokenized Stocks Hit $1B-What’s Going On? 😱

According to blockchain analytics platform Dune, the total assets under management (AUM) of all tokenized stocks is currently sitting just over the $1 billion mark, with Solana’s xStocks accounting for over 57% of it. 🎯