Crypto Drama: Senate’s Hot Mess of Bills, Gridlock, and Trump’s Urgent FOMO

Key Takeaways (Because Who Has Time for Nuance?)

Key Takeaways (Because Who Has Time for Nuance?)

With the gravitas of a second-rate magician, iShares Digital Assets AG announced on January 22 the issuance of 180,000 new securities for its iShares Bitcoin ETP. These are to commence trading on the London Stock Exchange the following day, a response, we are told, to the insatiable appetite of investors for regulated exposure to the cryptoasset circus.

Ah, the day dawned brightly for BitGo on that fateful Thursday, its shares pirouetting upward like a dandy at a ball, approximately 26% after the crypto custody firm commenced its dance on the New York Stock Exchange under the illustrious ticker BTGO. This opening spectacle sent BitGo’s worth into the stratosphere, marking one of the finest performances in the crypto IPO theatre of 2026 thus far.

Yet, amid this ballet of despair, Ripple’s machinery grinds on-a silent, clockwork promise of stability, like a forgotten sonata humming beneath the cacophony of selling.

Nomura’s digital arm, known as Laser Digital-like some futuristic knight of the financial realm-has unveiled the Bitcoin Diversified Yield Fund (BDYF) for those brave enough to call themselves professional investors. This fund, a curious concoction of long-term Bitcoin exposure mixed with income-focused strategies, seeks to offer a taste of predictability in an otherwise chaotic carnival.

Nasdaq, that purveyor of tickers and takers, has penned a letter to the SEC (short for “Somebody Else’s Cash”) begging to yank those special options limits off Bitcoin and Ethereum ETFs. The memo, dated January 21, reads like a plea from a man who’s had enough of counting beans. The gist? Let traders hold as many options contracts as they please on these crypto-linked ETFs-no more capping them at 25,000 like they’re circus tickets.

The real driver behind this momentum? The RWA sector. By making tokenized assets tradable on-chain, it turned what was once a niche experiment into a practical bridge between DeFi and institutional finance. In other words, the RWA sector became a direct link between on-chain activity and big-money adoption. Given that, it’s not surprising RWAs were 2025’s top performers, posting an impressive 250% YoY growth-because who doesn’t want their money to grow faster than a weed in a rainstorm?

Bitgo’s shares began trading Jan. 22 on the New York Stock Exchange (NYSE) under the ticker BTGO, following pricing late the previous day. The offering was originally marketed in a range of $15 to $17 per share, but demand allowed the company to price above that level, according to the IPO filing.

The Dutch parliament, in a moment of fiscal madness, has resolved to adopt a new tax system by 2028. Under this inspired proposal, cryptocurrency investors will now be taxed on both realized and unrealized capital gains-because why let imagination go untaxed?

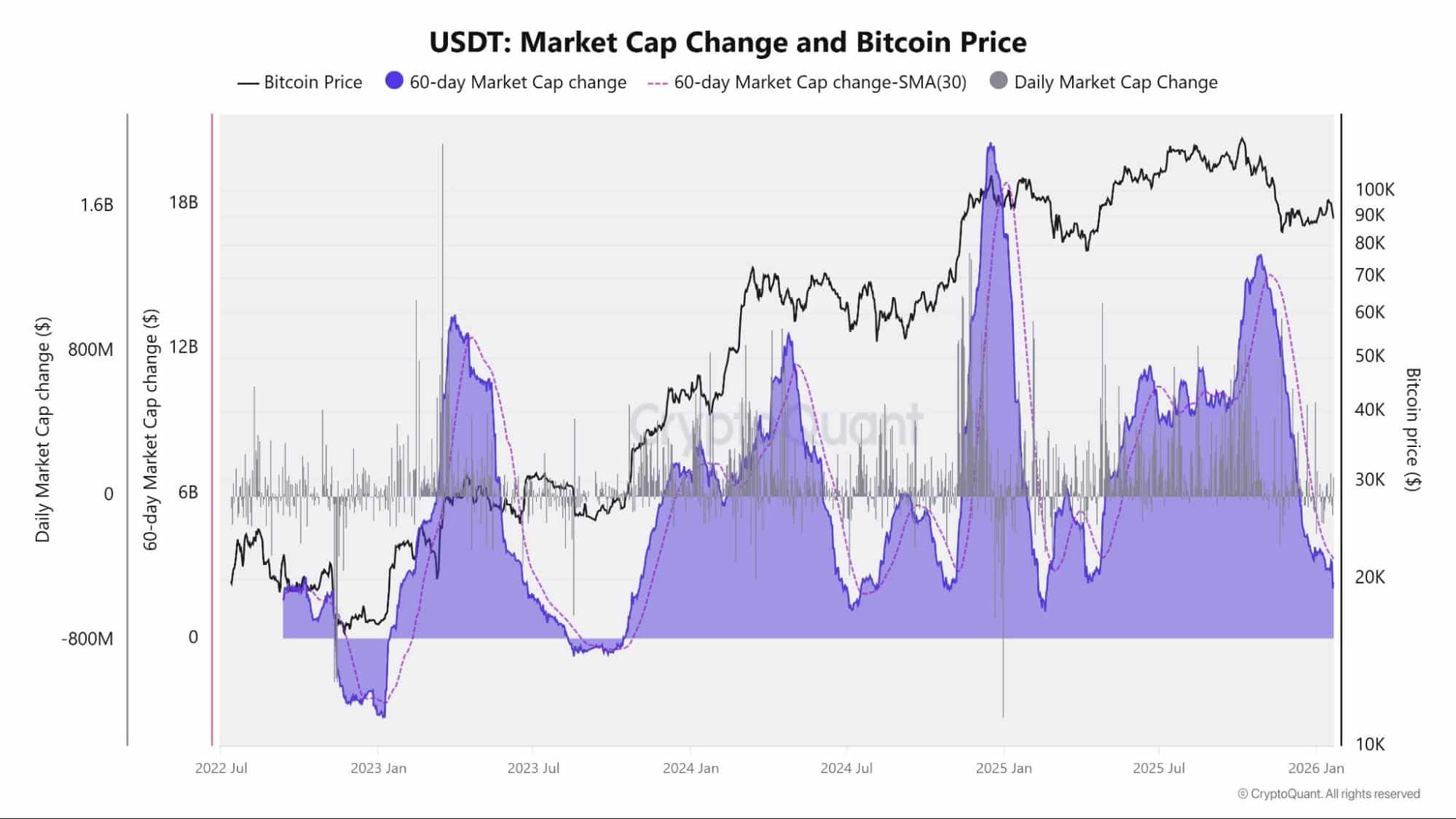

Market experts, with their solemn faces and furrowed brows, speculate that this slowdown might be the harbinger of a Bitcoin rally’s pause, much like a weary traveler pausing for a sip of tea before continuing the journey. BTC: $89,472. A figure so high it makes one question the sanity of the market, or perhaps the sanity of the investor. 24h volatility: 0.4%. Market cap: $1.79 T. Vol. 24h: $52.99 B. A dance of numbers, as inscrutable as ever.