Markets

What to know:

- In a dramatic twist worthy of a Russian novel, more than $2.5 billion in crypto positions met their untimely demise in just 24 hours, including an astonishingly unfortunate $222.65 million ether trade on the infamous Hyperliquid exchange.

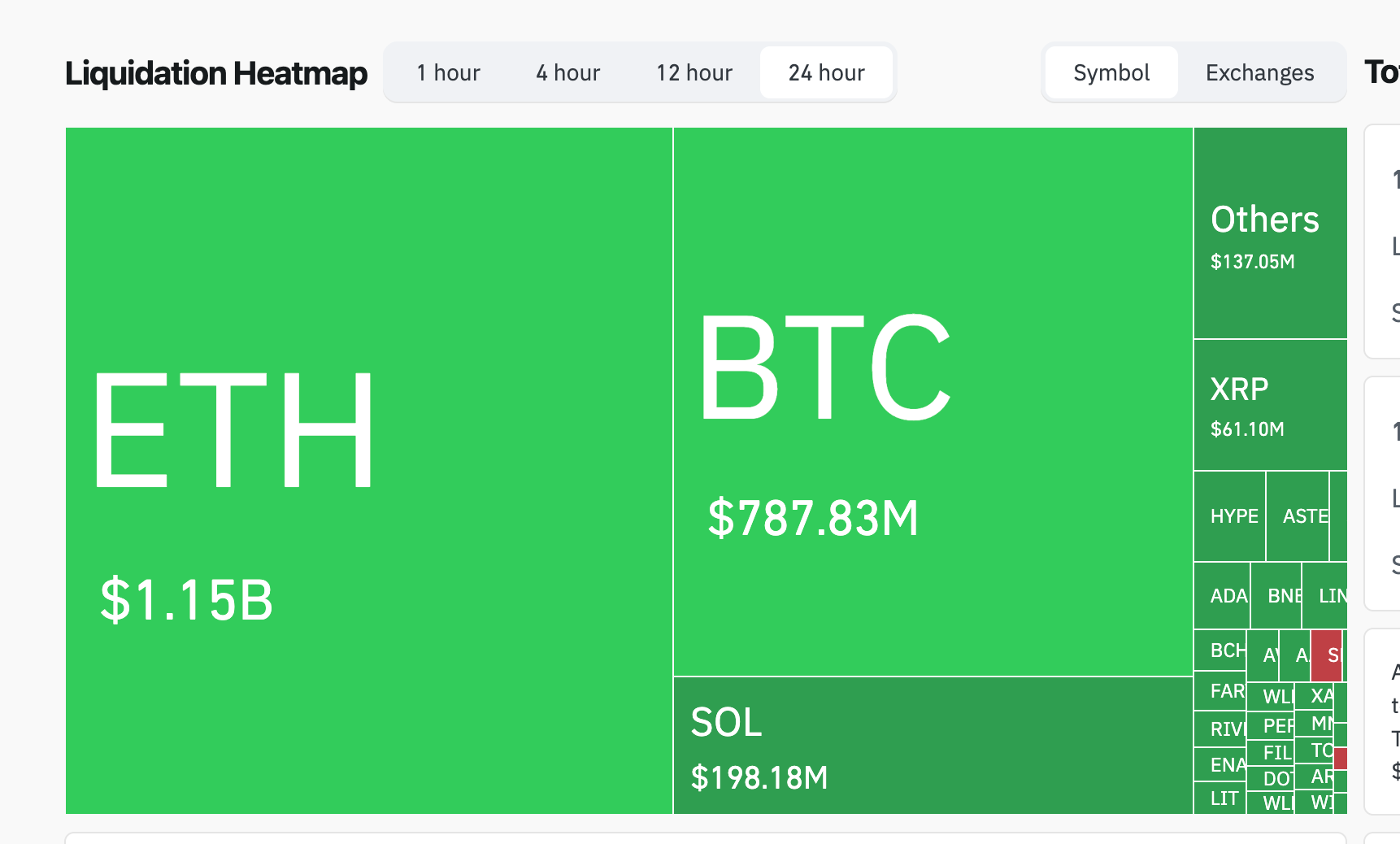

- The noble ether gallantly led the retreat, with over $1.15 billion in positions vanishing into thin air as it plummeted by a staggering 17 percent. Following closely behind was bitcoin-a poor cousin-losing about $788 million, and Solana, well, it just wanted some attention, losing nearly $200 million.

- This cacophony of liquidations, primarily targeting long positions, serves as a jarring reminder of how leveraged trading can unleash a raucous chain reaction, transforming the market into a chaotic carnival ride.

In a tale that seems plucked from the annals of tragicomedy, one unfortunate trader lost more than $220 million on an ether position as a fresh wave of forced liquidations swept through the crypto markets, dragging total losses over the past day to a dizzying $2.6 billion. Quite the day for a stroll through financial ruin!

The most monumental liquidation took place on the decentralized derivatives exchange Hyperliquid, where an ETH-USD position worth $222.65 million was obliterated, according to the scholars at CoinGlass. Truly, a case of “oops!” if ever there was one.

This calamity unfolded as ether slipped down a treacherous slope, sliding as much as 17% in the past 24 hours, dragging bitcoin and other major tokens along for the ride during a spell of suspiciously thin liquidity. Ah, the joys of trading!

A staggering 434,945 traders were liquidated in this melodrama, with long positions bearing the brunt of the losses. Roughly $2.42 billion of the $2.58 billion total stemmed from overly optimistic bets, while shorts, the responsible adults in the room, accounted for a mere $163 million. How quaint!

Hyperliquid took the crown for the most catastrophic damage, recording $1.09 billion in liquidations-virtually all from long positions-making up over 40% of total losses across exchanges. Bybit followed, grumbling with $574.8 million, while Binance chimed in with about $258 million. A veritable symphony of financial despair!

Ether, the diva of the day, bore the heaviest load of the sell-off, with more than $1.15 billion in ETH positions sent to the great digital beyond in just 24 hours. Bitcoin followed, like a dutiful sidekick, shedding roughly $788 million, while Solana, perhaps feeling a bit left out, saw close to $200 million disappear, according to the mysterious liquidation heatmap data.

Liquidations occur when leveraged positions are forcibly shuttered due to price movements that exceed a trader’s margin threshold. This typically results in substantial losses, and can trigger cascading effects during moments of volatility that could make even the steadiest heart tremble.

Traders, those brave souls, use liquidation data to gauge the fickle winds of market sentiment and positioning. Large long liquidations often signal panic bottoms, while short liquidations may herald a squeeze, leaving traders to ponder whether they’ve traded their way into a farce.

Spikes in liquidations also help identify overcrowded trades and potential market reversals. When paired with open interest and funding rate data, these metrics can provide strategic entry or exit points, especially in overleveraged markets that seem to delight in sudden flushes or unexpected rallies. One must always be prepared for the unexpected in this wild world of finance!

Indeed, liquidation-driven moves have become increasingly common during periods of low liquidity, where relatively minor price declines can cascade through the fragile edifice of derivatives markets-turning dreams of wealth into nightmares of loss. What a time to be alive!

Read More

- GBP CAD PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- EUR ARS PREDICTION

- AVAX PREDICTION. AVAX cryptocurrency

- EUR CLP PREDICTION

- GBP RUB PREDICTION

- TON PREDICTION. TON cryptocurrency

- STX PREDICTION. STX cryptocurrency

- USD JPY PREDICTION

- USD ARS PREDICTION

2026-02-01 10:34