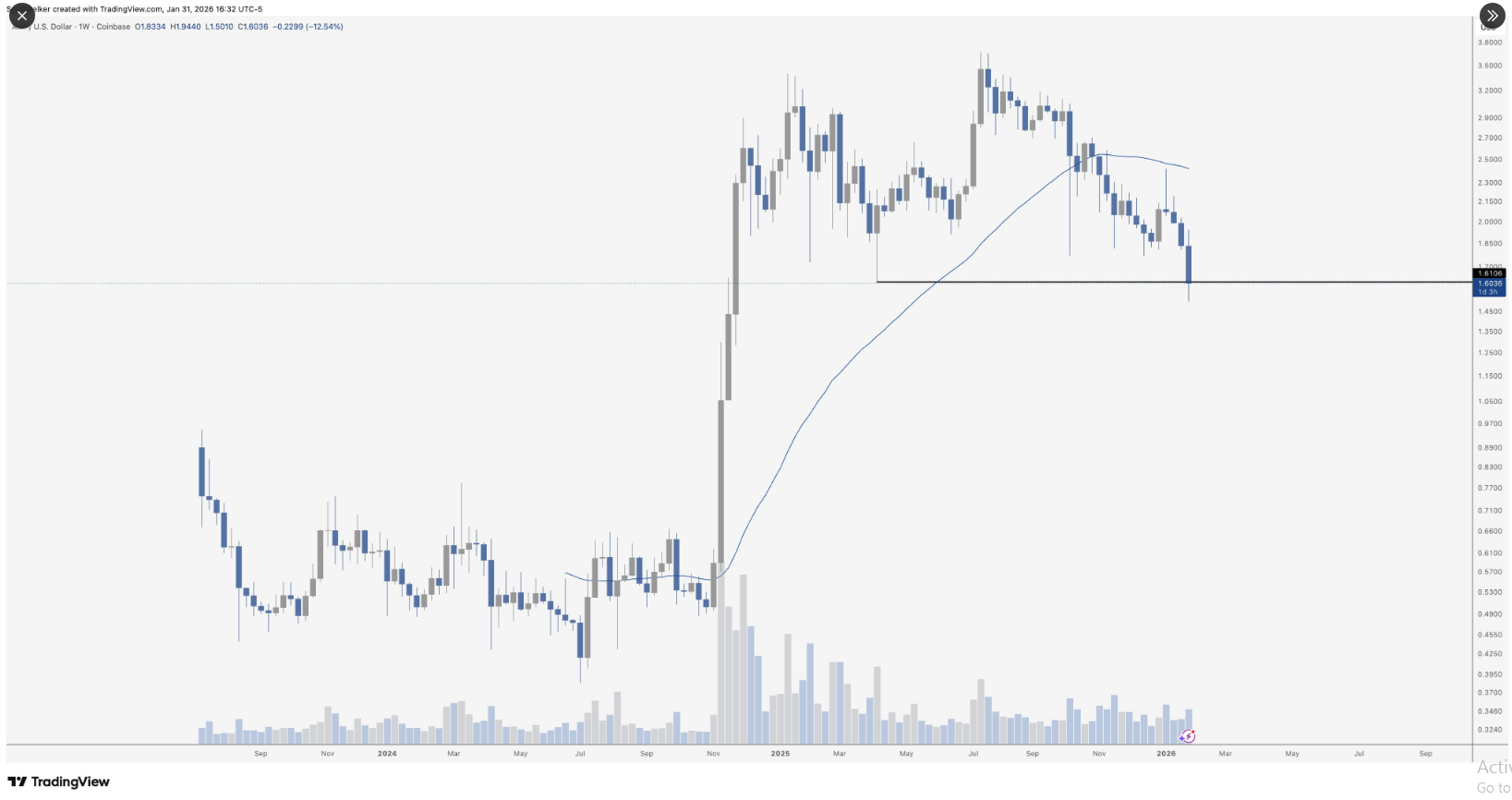

XRP found itself at a curious crossroads, where the path was lined with both gold and thorns. Trading around the $1.6 area after a steep run higher and a later pullback, the token now rested on a weekly support band that traders were watching with the intensity of a dragon eyeing a shiny trinket.

According to crypto analyst Scott Melker, this was one of the cleaner risk/reward setups in crypto right now – a small stop could limit losses while a bounce could offer gains so generous, they’d make a pirate blush.

Support Zone Holds The Key

Based on reports, the zone around $1.55 to $1.60 was important. It lined up with the midpoint of the breakout that began in November 2024 and had acted as resistance before flipping to support. A mysterious band, indeed, that whispered promises of safety to the brave.

When price briefly dipped toward $1.50 and then closed January above the $1.60 mark, some traders read that as a liquidity sweep that cleared short orders. That kind of action could presage either a bounce or a deeper move, depending on whether fresh buying showed up. Or, as one sly analyst might say, “It’s a game of chance, but with better odds than a raffle ticket.”

What History Shows

XRP had been a most unremarkable creature in 2023 and 2024, until it suddenly sprang into action, breaking free from its $0.50 to $0.60 cage and soaring to dizzying heights. A fast advance followed, carrying price toward the $2.00 area and then higher into the $3.66 peak in July 2025. A tale as old as time, really.

$XRP

Crazy chart.

Trading exactly at the last meaningful support on the chart before a huge air pocket.

For traders, this is about the best risk/reward you get on an asset. Easy to cut loose with a small loss if support fails.

– The Wolf Of All Streets (@scottmelker) January 31, 2026

Those gains set a higher structure, but they also left large pockets of profit taking above current levels. Reports say that repeated failed attempts above $3.50 marked weakening demand, which helped trigger the current drop back to the $1.6 region. A classic case of “too much of a good thing.”

Tight Downside, Open Upside

According to Scott Melker, a.k.a. “Wolf of All Streets”, traders could manage risk with a stop between $1.45 and $1.50. That made the downside measured, like a well-timed punchline. On the flip side, a recovery would likely test $2.00 first, then run into supply around $2.50-$2.60, before facing heavier resistance near $3.00 and the old highs. A journey with more twists than a rollercoaster in a haunted house.

That path was straightforward on paper, but market context changes outcomes. Volume confirmation was absent from many of the bullish takes; a support hold without visible buying on the tape was as fragile as a soap bubble in a hurricane.

Broader liquidity in US markets and risk appetite for crypto would also play a major role in whether the bounce could sustain itself. A tale of two markets, perhaps?

For Melker, setups like XRP’s current level were rare as a unicorn in a zoo – a defined support, a tight stop, and clear upside targets created a scenario where the potential reward outweighed the risk. He emphasized that traders didn’t need to predict every twist in the market; instead, focusing on trades with controlled losses and meaningful gains could be the difference between surviving and thriving in volatile conditions. A lesson for the ages, really.

In XRP’s case, the near-term risk was small relative to the possible rebound, making it a setup many were watching closely, with bated breath and a pinch of hope. Or, as the Wolf might say, “It’s a gamble, but one worth taking if you’ve got a lucky coin in your pocket.”

Read More

- Bitgo’s IPO: A Triumph of Capitalism or a Cryptic Joke?

- Bitcoin’s Wild Ride: Why Experts Say It’s Stronger Than Ever 😱

- Bitcoin’s Plunge: $60K or Bust? The Bear’s Tale Unfolds

- 4 Signs That Bitcoin Might Just Be Taking a Scenic Route to $85K

- BitGo’s NYSE Gambit: A New Era or Just a Mirage?

- Bitcoin’s One-Night Stand at $97K: Proofreads Advised

- 🚨 Binance’s New Darlings: Four Tokens in the Spotlight! 🚨

- 2026 Crypto Breakthrough? Let’s Not Panic (Yet!)

- Bitcoin’s $90K Tango: Will It Break a Leg or Steal the Show? 🎭💰

- Bitcoin’s Christmas Miracle: A Festive Market Plunge & Recovery 🎄📉

2026-02-03 09:41