Ah, the great Bitcoin, that digital phoenix, has stumbled once more, and the soothsayers of Galaxy Digital, led by the venerable Alex Thorn, whisper of darker omens yet to come. The charts, those mystical scrolls of the modern age, foretell a descent into the abyss, where even the bravest of hodlers may weep.

Thorn Prophesies More Bitcoin Woes Before the Dawn

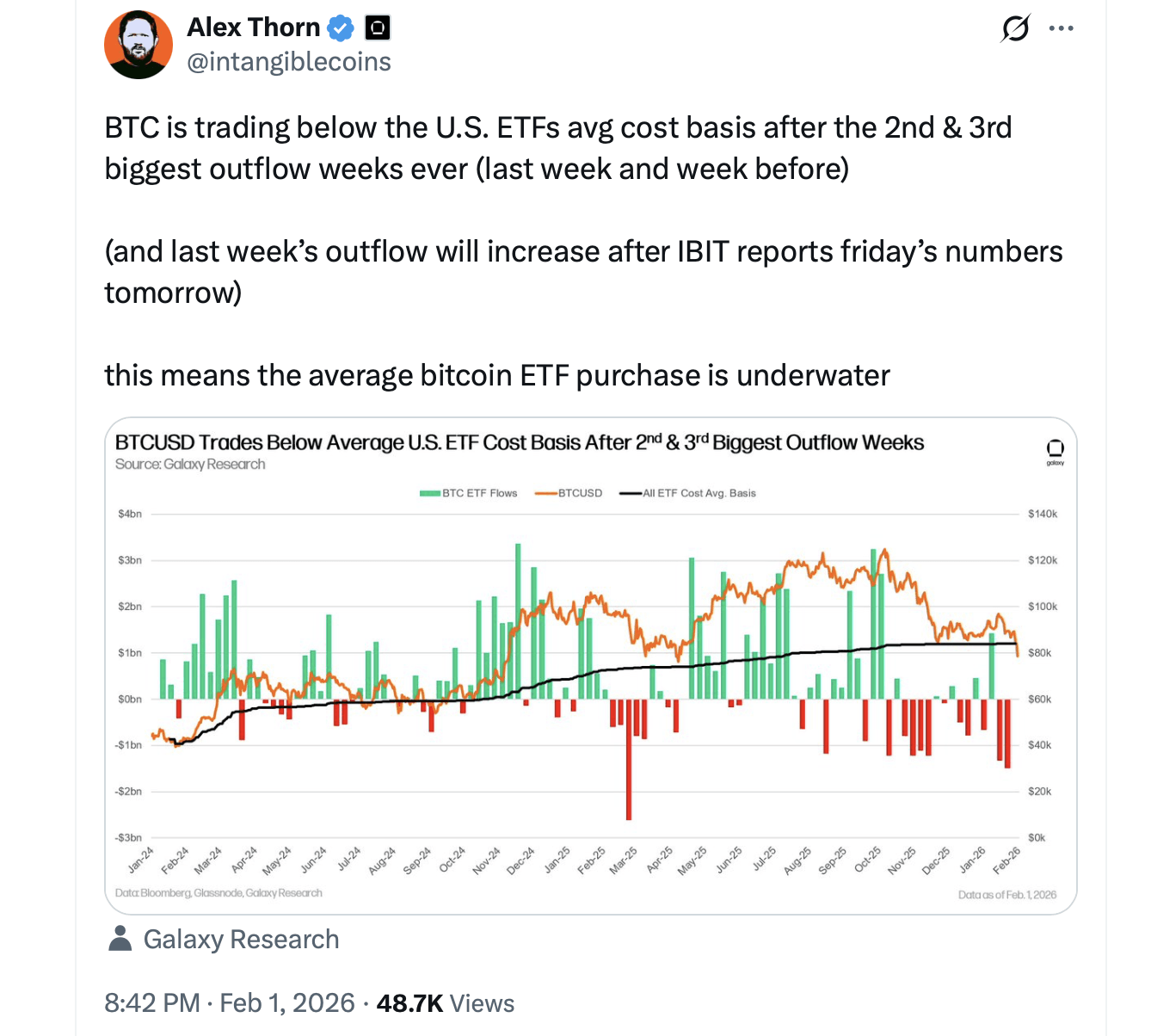

On the morrow of February 2, 2026, the Bitcoin traded at a mere $78,640 per coin, a shadow of its former glory, having plummeted 37.6% from its zenith of $126,000 in the halcyon days of October 2025. In a missive scribbled upon the digital tablets of X, Alex Thorn, the high priest of research at Galaxy Digital, declared that the stars align for further calamity.

Thorn, ever the sage, circulated his prophecy to the faithful Galaxy clientele on the Sabbath before unveiling it to the masses, lest they mistake it for mere gossip. His decree is simple: Bitcoin has forsaken its sacred technical levels, and the onchain oracles reveal a dearth of zeal among the dip-buyers.

The Bitcoin’s January rout was a spectacle to behold, with prices tumbling like a jester down a flight of stairs, culminating in a weekend massacre that liquidated $2 billion in long positions across the futures arenas. This folly briefly dragged Bitcoin below the hallowed cost bases, including the average entry price of the U.S. spot Bitcoin ETFs.

Thorn, with the air of a man who has seen too many cycles, noted that Bitcoin has now endured four consecutive months of crimson closes, a spectacle last witnessed in the annals of 2018. History, that fickle mistress, suggests such drawdowns often deepen before finding solace.

One curious anomaly in this saga is the “supply gap” between $70,000 and $80,000, a no-man’s-land where few coins have changed hands. Thorn posits that this barren terrain may allow prices to drift downward as the market seeks its equilibrium, much like a drunkard searching for his keys in the dark.

Galaxy’s auguries further reveal that nearly 46% of Bitcoin’s circulating supply is held at a loss, a figure that has historically approached parity at cycle bottoms. Though not yet complete, the trend marches onward, like a tortoise toward the finish line.

The macro winds add another layer of woe. Thorn laments that Bitcoin has lagged behind its traditional rivals, gold and silver, in recent months, dimming its luster during this era of geopolitical and economic tumult.

Yet, Thorn stops short of declaring Armageddon. He reminds us that levels near Bitcoin’s realized price and its 200-week moving average-both lurking in the high-$50,000 range-have historically lured long-term buyers from their lairs. Should prices descend to these depths, they may once again become accumulation zones, like honey traps for the prudent.

For now, Galaxy’s message is one of caution, not catastrophe: the trend is as heavy as a Russian novel, catalysts are as scarce as honesty in politics, and patience may be the only virtue left to the faithful.

FAQ ❓

- Why does Galaxy believe Bitcoin might fall further?

Galaxy’s divination points to shattered technical levels, feeble accumulation signals, and onchain supply gaps that may allow prices to drift lower, like a leaf in the wind. - What price levels are being watched as potential support?

The report highlights Bitcoin’s realized price and 200-week moving average in the high-$50,000 range as key long-term bastions. - How far is Bitcoin from its all-time high?

As of Feb. 2, 2026, Bitcoin languishes 37.6% below its October 2025 peak, a fall from grace worthy of a Greek tragedy. - What onchain trend suggests a potential bottom may be forming later?

The report reveals that long-term holder profit-taking has slowed, a pattern observed near the nadir of prior cycles, like the calm before the storm.

Read More

- Bitgo’s IPO: A Triumph of Capitalism or a Cryptic Joke?

- BitGo’s NYSE Gambit: A New Era or Just a Mirage?

- Bitcoin’s One-Night Stand at $97K: Proofreads Advised

- 🚨 Binance’s New Darlings: Four Tokens in the Spotlight! 🚨

- 2026 Crypto Breakthrough? Let’s Not Panic (Yet!)

- Bitcoin’s $90K Tango: Will It Break a Leg or Steal the Show? 🎭💰

- Bitcoin’s Christmas Miracle: A Festive Market Plunge & Recovery 🎄📉

- Bitcoin Stumbles While Altcoins Dance: A Comedy of Digital Assets!

- Bitcoin’s Wild Ride: Why Experts Say It’s Stronger Than Ever 😱

- Bitcoin’s Plunge: $60K or Bust? The Bear’s Tale Unfolds

2026-02-03 02:57