Pepe’nin Vahşi Yolculuğu: Kurbağa’dan Fortune’a! 🐸💰

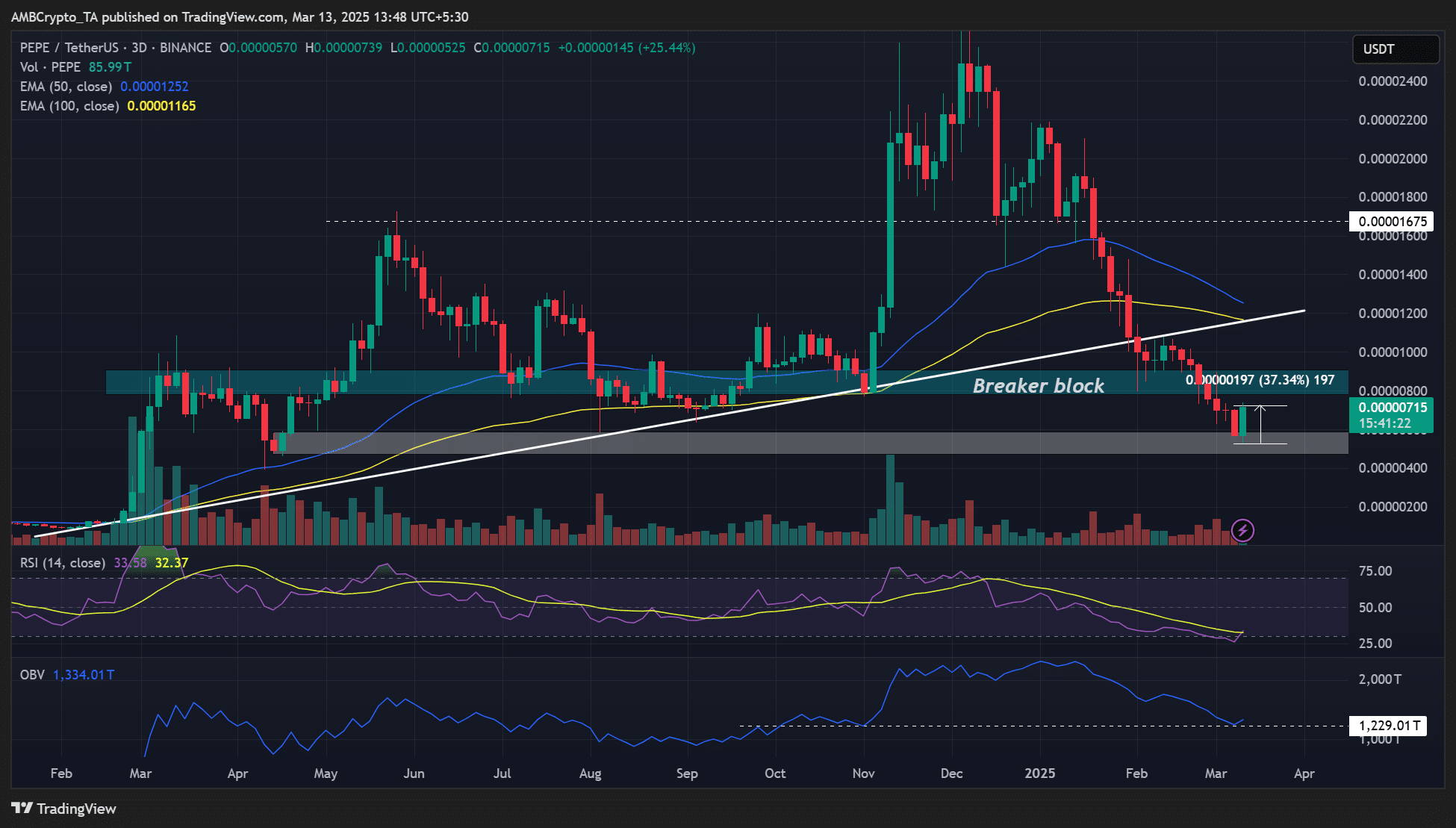

Son zamanlarda 0.00000525 $ ‘dan% 37’lik şaşırtıcı bir geri dönen kurbağa temalı memecoin Pepe [Pepe]’ ye girin. Fakat piyasa bir fırtınada bir sirk çadırına benzeyen bir şey merak etmelisiniz: Bu iyileşme sadece bir serap mı? 🤔