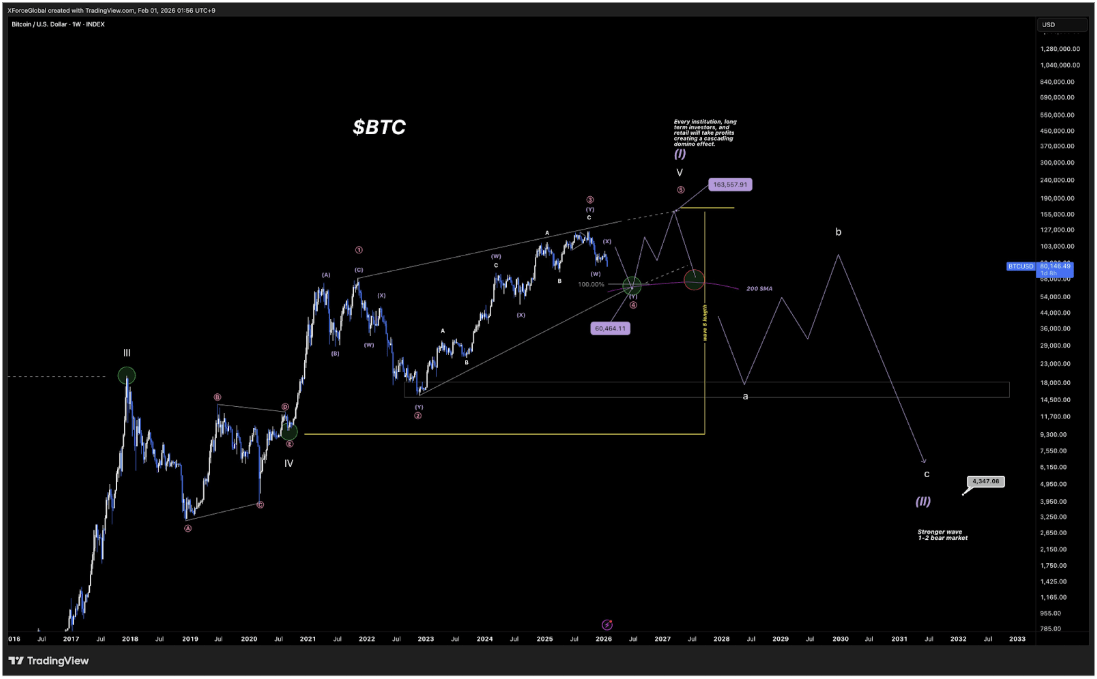

Well, butter my bitcoin, it seems the digital gold has taken a tumble down the cryptographic rabbit hole. After a dramatic plunge below its trusty support level, Bitcoin now finds itself in what the wizards of finance call “bearish territory.” At the time of scribbling, it’s hovering around $78,560, having dipped its toes into the $77,082 pool in the past 24 hours. The soothsayer XForceGlobal, armed with his Elliott Wave crystal ball, declares this a “significant change in the technical structure.” Or, as the common folk might say, “Uh-oh.”

According to XForceGlobal’s runes-er, charts-shared on the mystical platform X, the bullish framework traders were clinging to like a life raft has been invalidated. Lower levels, he warns, are as likely as a troll under a bridge in a Discworld novel. So, buckle up, crypto enthusiasts, for the rollercoaster of doom… or just a mild dip, depending on your perspective.

When the Low Goes Lower, the Wave Count Gets Wavier

XForceGlobal explains that Bitcoin had been meandering through a “complex sideways structure,” a WXY combination that was supposed to resolve itself with a polite “excuse me” rather than a dramatic breakdown. Alas, the bulls could only muster three out of five required components of this triangle-like dance before the prior low of $82,000 (from November 2025, mind you) crumbled like a poorly baked pie. When the price slipped below $80,000, the primary wave count went the way of the dodo.

In Elliott Wave parlance, this lower low means the price action from the all-time high is now “separated and corrective,” not the healthy continuation the bulls were hoping for. This restructuring gives the decline more room to stretch its legs, Fibonacci-style, and forces a reevaluation of the minimum and maximum downside targets. Because, of course, nothing in life-or crypto-is ever straightforward.

Two Paths, One Destination: The $60,000 Abyss

XForceGlobal presents two scenarios for Bitcoin’s future, both of which seem to agree on one thing: the price is headed south, possibly to the tune of $60,000. The first scenario is a “flat correction,” where Bitcoin is currently unfolding a C wave. While XForceGlobal finds this option as appealing as a troll’s breath, it still spells trouble for the bulls, invalidating their structure and dragging the price down to the aforementioned $60,000.

The second scenario is a “macro ending diagonal,” structured as a WXY move to the downside. This one uses the October 2025 all-time high of $126,000 as a cut point to improve wave separation. Ironically, this path also points to the same $60,000 target. So, whether Bitcoin takes the scenic route or the express lane, it seems $60,000 is the destination. Pack your bags, folks.

With the larger structure now as compromised as a wizard’s promise, XForceGlobal advises adopting a shorter-timeframe bearish bias while reorganizing the next wave count. The outlook? Bitcoin will likely continue its decline to at least $60,000 before attempting a rebound to reclaim the $100,000 throne. Until then, keep your hodling hands steady and your sense of humor sharper than a dwarf’s axe.

Read More

- GBP CAD PREDICTION

- EUR ARS PREDICTION

- STX PREDICTION. STX cryptocurrency

- EUR CLP PREDICTION

- PEPE PREDICTION. PEPE cryptocurrency

- GBP RUB PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- AVAX PREDICTION. AVAX cryptocurrency

- TON PREDICTION. TON cryptocurrency

- USD PHP PREDICTION

2026-02-02 01:56