In the tumultuous sea of the financial markets, where fortunes rise and fall with the capricious whims of the crowd, the tale of XRP ETFs unfolds as a drama both absurd and enlightening. Amidst the wreckage of a market crash, these instruments of modern speculation have, against all odds, soared to new heights, defying the very logic that governs the masses. It is as if, in the midst of a great storm, a single flower has bloomed, not out of resilience, but perhaps out of sheer obstinacy.

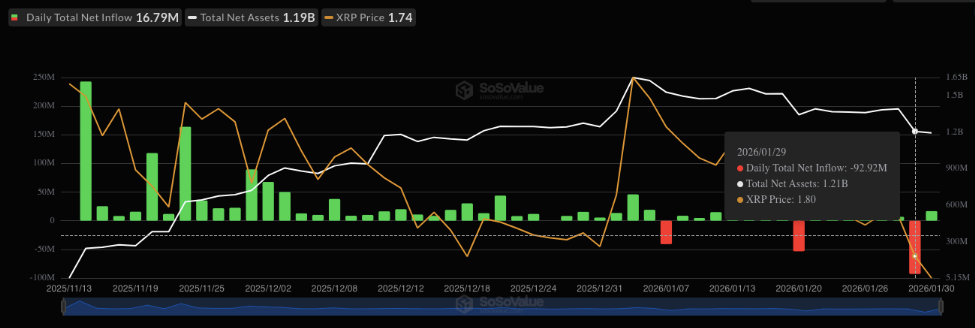

The numbers, cold and unfeeling as they are, tell a story of contradiction. On one hand, a record outflow of $92.9 million on January 29, 2026, marked a retreat so grand it seemed to herald the end. Yet, like a character in one of my novels, the XRP ETFs refused to succumb. Fresh inflows followed, and trading volumes reached unprecedented levels, as if the investors, in their collective madness, had decided to dance on the edge of the abyss.

Grayscale’s GXRP, that behemoth of financial engineering, saw a staggering $98.39 million flee its coffers, only to be partially offset by the inflows into Franklin Templeton’s XRPZ, Bitwise’s XRP ETF, and Canary’s XRPC. It is a comedy of errors, where the players move not with purpose, but with the chaotic energy of a flock of birds startled by a gunshot.

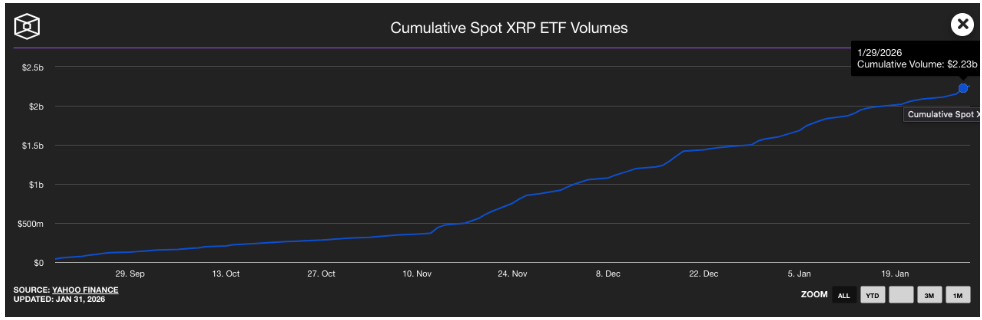

The total net assets of these ETFs, once standing at $1.39 billion, fell to $1.21 billion, only to rebound slightly to $1.19 billion. The price of XRP itself, that fickle creature, dropped from $1.92 to $1.80, and then further to $1.69, as if it were a leaf caught in the wind, unaware of its own direction. Yet, the trading volumes of the ETFs rose to $2.23 billion, a testament to the irrational exuberance that so often characterizes the human condition.

Bitwise’s XRP ETF led the charge in trading volume, followed by Grayscale’s GXRP, Franklin Templeton’s XRPZ, Canary’s XRPC, and 21Shares TOXR. It is a hierarchy of folly, where each participant believes themselves to be the hero of their own story, unaware of the larger farce in which they play a part.

Assets Under Management (AUM) declined from $1.48 billion to $1.32 billion, a reminder that even in the midst of this absurd theater, reality has a way of asserting itself. Meanwhile, the price of XRP continues its slide, down by more than 11% over the past week and 3% in the last 24 hours. The Fear and Greed Index, that barometer of collective emotion, has fallen into the “Fear” zone, a fitting reflection of the uncertainty that pervades the market.

And so, we are left to ponder the nature of this phenomenon. Are the XRP ETFs a phoenix, rising from the ashes of market despair, or are they a fool’s errand, a testament to the irrationality that so often drives human behavior? In the end, perhaps it matters not. For in the grand tapestry of life, it is the absurdity itself that gives us pause, that forces us to question, and that, in its own way, makes us human.

Read More

- GBP CAD PREDICTION

- STX PREDICTION. STX cryptocurrency

- EUR ARS PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- EUR CLP PREDICTION

- AVAX PREDICTION. AVAX cryptocurrency

- GBP RUB PREDICTION

- LTC PREDICTION. LTC cryptocurrency

- OP PREDICTION. OP cryptocurrency

- TON PREDICTION. TON cryptocurrency

2026-01-31 23:02