Well, bless my stars and garters, if it ain’t another week in the wild, wild west of finance! Investors, those skittish critters, done skedaddled faster than a cat in a room full of rocking chairs. Seems the crypto crowd got cold feet, and quicker than you can say “Huckleberry Finn,” they yanked a cool $1.80 billion out of them spot crypto ETFs. Markets moved faster than a liar in a truth contest, with short-term jitters trumping long-term visions like a riverboat gambler on a losing streak.

Spot Crypto ETF Flows: A Tale of Fleeting Fancy

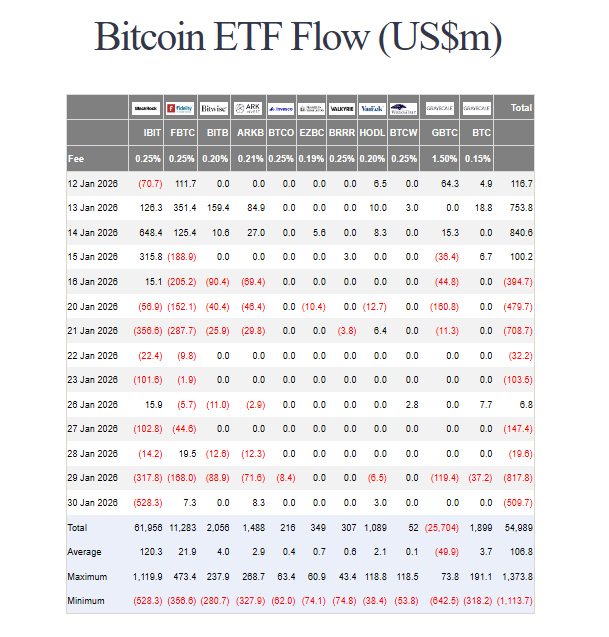

According to the wise folks at Farside, them US-based Bitcoin ETFs saw a $1.50 billion exodus over five trading days, while Ether ETFs got the short end of the stick with $327 million in outflows. That’s right, nearly two billion dollars vanished quicker than a politician’s promise. And let’s not forget January 14th, when $840 million flowed in like a flood-only to be followed by a stampede for the exits. Some saw it as a buying opportunity, others as a profit-taking fiesta. The result? A financial tug-of-war that’d make Tom Sawyer proud.

Metals’ Shiny Rally: A Flash in the Pan

Now, gold and silver had their moment in the sun, climbing to heights that’d make Icarus blush. Investors piled in like ants at a picnic, but the party didn’t last. Faster than you can say “fool’s gold,” prices plummeted. Gold took a nosedive, and silver? Well, it fell harder than a banjo player off a barstool. Those reversals left some folks scratching their heads and others selling off risk assets like they were yesterday’s news-crypto included.

Bitcoin Price Action: A Rollercoaster Ride

Bitcoin’s been swingin’ wilder than a saloon door in a hurricane. Down 6.50% in a week, while Ether dropped 8.90%. Last seen trading at $82,500 and $2,685, respectively, according to CoinMarketCap. The market got a brief jolt from the US CLARITY Act chatter, but cooler heads prevailed-or maybe just cooler wallets. These moves? Tied to positioning, margin calls, and traders reacting to headlines like a dog to a dinner bell.

Sometimes, ETF inflows push prices up like a hot-air balloon. Other times, outflows coincide with volatile days, and traders bail faster than a coward in a gunfight.

Now, some market watchers reckon this pullback’s just a hiccup. ETF guru Eric Balchunas calls the Bitcoin doom-sayers short-sighted, pointing to its past glory days. Meanwhile, Bitwise’s Matt Hougan figures steady ETF demand could send Bitcoin skyward-eventually. It’s all about perspective: some focus on the here and now, others on the long, winding road ahead.

So there you have it, folks. Another week in the financial circus, where money moves faster than a Twain quip and the only sure thing is uncertainty. Stay tuned, or don’t-either way, the show goes on.

Read More

- GBP CAD PREDICTION

- STX PREDICTION. STX cryptocurrency

- EUR ARS PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- EUR CLP PREDICTION

- AVAX PREDICTION. AVAX cryptocurrency

- GBP RUB PREDICTION

- LTC PREDICTION. LTC cryptocurrency

- OP PREDICTION. OP cryptocurrency

- TON PREDICTION. TON cryptocurrency

2026-01-31 20:46