Gold’s dizzy sprint has begun to wobble, and the market mood has shifted from “shiny promise” to “how long before the glitter fades.” Ark Invest’s chief numbers-wrangler, Cathie Wood, insists gold has reached a late-cycle peak, and its tumble is less a dip and more a dramatic bow to the laws of gravity, probably written by a stern accountant with a sense of drama.

Gold Bubble Forming, Cathie Wood Says, as M2 Ratio Exceeds 1980 Peak

Ark Invest’s resident oracle of sensational charts, Cathie Wood, took to X on Jan. 29 to parade a series of posts about gold’s valuation. Her verdict: the old-school ratios, money-flow tricks, and currency shenanigans suggest exhaustion rather than a long-awaited ascent.

She wrote:

“Odds are high that the gold price is heading for a fall.”

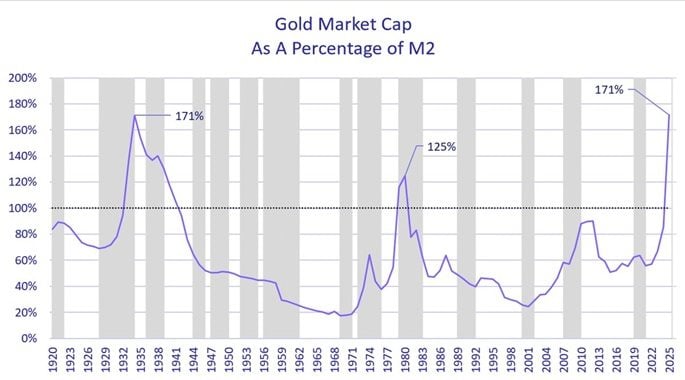

The Ark Invest captain anchored her forecast to a chart showing gold’s market capitalization as a percentage of the U.S. money supply, or M2-because apparently running a country’s liquidity is a spectator sport. “Intraday today, the market cap of gold as a percent of the US money supply (M2) hit an all-time high: higher than its peak in 1980 when inflation and interest rates soared to the mid-teens-and, even more shocking,” she noted. That ratio has reached comparable levels only during the early 1930s and around 1980, periods that ultimately preceded long adjustment phases rather than sustained bull markets.

As gold has already pulled back from its highs, Wood’s framework points to duration risk alongside downside risk. She continued by drawing a direct historical parallel: “The ratio of gold to M2 has hit the all-time high recorded during The Great Depression in 1934.” Wood expanded her reasoning by referencing the extraordinary policy responses of that era, adding: “In that crisis, the dollar devalued relative to gold by almost 70% on January 31, 1934, the government banned private ownership of gold, and M2 collapsed.”

Contrasting that backdrop with today’s environment, she explained: “The US economy today looks nothing like the double-digit inflation-prone 1970s or the deflationary bust of the 1930s. True, foreign central banks have been diversifying away from the dollar for years; yet, the 10-year Treasury bond yield peaked at 5% in late 2023 and is now 4.2%.” Framing gold’s recent decline through a market-cycle lens, Wood concluded: “While parabolic moves often take asset prices higher than most investors would think possible, the out-of-this-world spikes tend to occur at the end of a cycle.” The executive added:

“In our view, the bubble today is not in AI, but in gold. An upturn in the dollar could pop that bubble, a la 1980 to 2000 when the gold price dropped more than 60%.”

FAQ ⏰

- Why does Ark Invest CEO Cathie Wood see downside risk in gold?

She argues market cap relative to M2 has reached crisis-era extremes that historically preceded major declines. - How does the gold-to-M2 ratio factor into her view?

Wood notes the ratio matches levels seen in 1934 and 1980, periods tied to economic stress rather than normal growth. - What role does the U.S. dollar play in her gold outlook?

She suggests a strengthening dollar could reduce gold demand and pressure prices lower. - Why does Woodreject comparisons to the 1970s and 1930s?

She says today’s inflation, interest rates, and monetary policy dynamics differ sharply from those eras.

Read More

- STX PREDICTION. STX cryptocurrency

- LTC PREDICTION. LTC cryptocurrency

- EUR ARS PREDICTION

- TON PREDICTION. TON cryptocurrency

- EUR RUB PREDICTION

- GBP CAD PREDICTION

- GBP RUB PREDICTION

- SPX PREDICTION. SPX cryptocurrency

- 🐻 Mr. Cramer’s Bearish Blunder: Will Bitcoin Survive His Wrath? 🎭

- EUR HUF PREDICTION

2026-01-31 10:27