In the quiet month of January 2026, the demand for Tether’s USDT, once a steady river, now trickles like a dry creek bed. A curious sight, indeed.

Market experts, with their solemn faces and furrowed brows, speculate that this slowdown might be the harbinger of a Bitcoin rally’s pause, much like a weary traveler pausing for a sip of tea before continuing the journey. BTC: $89,472. A figure so high it makes one question the sanity of the market, or perhaps the sanity of the investor. 24h volatility: 0.4%. Market cap: $1.79 T. Vol. 24h: $52.99 B. A dance of numbers, as inscrutable as ever.

Tether USDT’s Circulating Supply Drops Sharply, Which Could Impact the Crypto Market

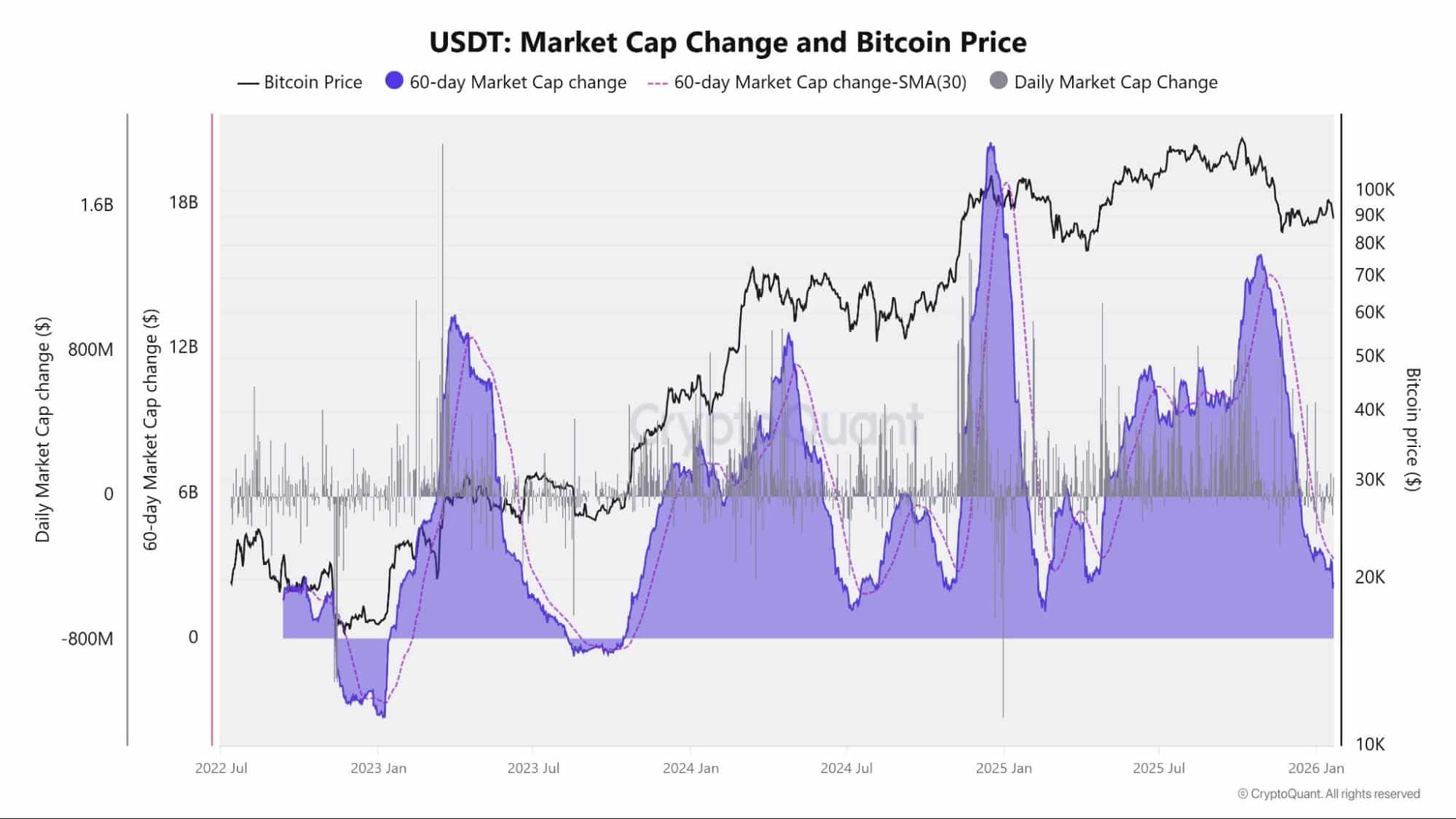

CryptoQuant data reveals that Tether’s circulating supply is experiencing a sharp slowdown, as if the very essence of liquidity is taking a siesta. Historically, these pauses in USDT issuance have been akin to a pendulum’s swing, affecting the crypto market’s momentum with a quiet but persistent hand.

The 60-day average of USDT market cap changes indicates a decline so steep it could make a mountain weep. Growth dropped from $15 billion to $3.3 billion. A drop that would make even the most stoic investor sigh. Yet, experts remain optimistic, envisioning a future where stablecoin payments reach $56 trillion by 2030-perhaps they’ve been reading too many sci-fi novels.

Comparing this to Bitcoin’s price action is like watching a familiar play, where the same actors reprise their roles with the same predictable flair. When USDT’s market cap surged, it was as if the market itself had donned a new coat of paint, ready for a Bitcoin rally. But when that liquidity growth slowed, Bitcoin would retreat into a consolidation phase, much like a timid creature hiding from the storm.

So far, the 60-day market cap change metric has not yet turned negative. However, CryptoQuant noted that the 60-day market cap change metric has not yet turned negative. A statement so redundant it could be a mantra for the confused.

Market Cap Change and Bitcoin Price. | Source: CryptoQuant

One notable development is the decline in USDT market capitalization on Ethereum, as if the platform itself is questioning its own relevance. ETH: $2,969. A figure that, while modest, still manages to baffle. 24h volatility: 0.6%. Market cap: $358.31 B. Vol. 24h: $33.56 B. A symphony of numbers, as enigmatic as ever.

During the same period, USDT has traded consistently below $1. CryptoQuant assures us it’s not a depegging event, just a temporary flirtation with the floor. This suggests that stablecoin holders are opting for the safety of the shore rather than venturing into uncharted waters.

CryptoQuant also highlighted Tether Treasury’s recent burn of 3 billion USDT, the first since May last year. A feat that would make even the most seasoned accountant raise an eyebrow. Some see the burn as a cautious signal, a whisper in the wind of macro uncertainty and geopolitical storms.

USDT Burn Signals Caution as Stablecoin Outflows Rise

USDT is removed from circulation when investors redeem the stablecoin for US dollars, prompting Tether to perform a ritual of burning, as if to erase the evidence of their transactions. If outflows accelerate, the stablecoin market’s two-month plateau near $308 billion in total capitalization could crumble, leading to a corrective phase that would make even the most seasoned trader break out in a cold sweat.

Such a shift could increase the risk of a broader downturn in crypto, a possibility that makes even the most optimistic investor clutch their pearls. Yet, Tether has an unusual buyer: Iran’s central bank, purchasing $507 million in USDT to circumvent US sanctions-a move as cunning as it is necessary.

Read More

- OP PREDICTION. OP cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- USD IDR PREDICTION

- ALGO PREDICTION. ALGO cryptocurrency

- SUI PREDICTION. SUI cryptocurrency

- GBP USD PREDICTION

- EUR CHF PREDICTION

- USD ARS PREDICTION

- EUR HKD PREDICTION

- USD VES PREDICTION

2026-01-22 18:18