Behold! As the U.S. marshals dragged the illustrious Nicolas Maduro into a cage of legal parchment, Bitcoin soared to $93,000, as if the market itself were laughing at the absurdity. But lo! Beneath this farce lies a tale of $60 billion in Bitcoin, hoarded like a digital El Dorado by Venezuela’s socialist court jesters.

Whispers from the crypto crypt suggest Venezuela’s treasury now brims with Bitcoin, a shadow reserve so vast it could make even Satoshi Nakamoto blush. If true, this treasure trove might yet send shockwaves through the global crypto market by 2026-or perhaps just a few well-timed gasps from investors.

Venezuela’s “Shadow Reserve”: A Hoard Hidden Beneath the Rubble of Socialist Grandeur

According to the sagacious Bradley Hope and Clara Preve (or as we call them, the crypto world’s modern-day Rasputins), Venezuela’s government may have amassed a Bitcoin and stablecoin stash worth $56-67 billion. One can only imagine the fervent debates in Caracas: “Shall we mint coins from gold or from code?”

The saga began circa 2018, when Venezuela, in its infinite wisdom, sold Orinoco gold and converted it into Bitcoin. Picture the scene: bureaucrats in ill-fitting suits, sweating over blockchain wallets, muttering, “This time, it’s different!”

Estimates claim $2 billion in gold was transmuted into Bitcoin at $5,000/BTC, yielding 400,000 BTC. By 2026, this digital alchemy would be worth $36 billion-enough to buy Maduro a new hat… or perhaps a new country.

Sanctions, Oil, and the Great USDT Heist of 2023-2025

As U.S. sanctions tightened like a corset on Venezuela’s economy, oil buyers were forced to pay in USDT, the stablecoin of the desperate. Over time, some of this USDT was “converted” into Bitcoin-a financial sleight-of-hand worthy of a Gogolian protagonist.

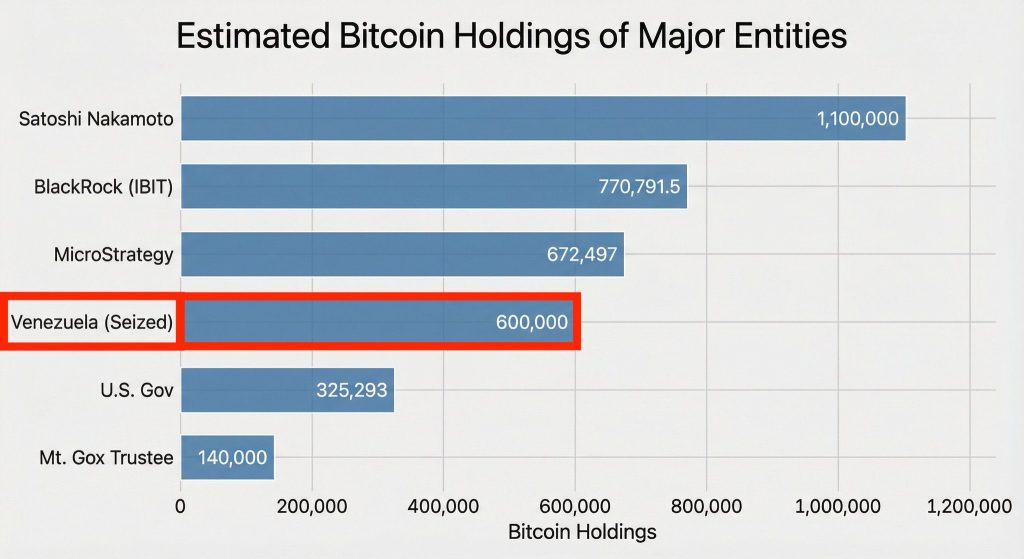

Additional riches flowed from seized mining operations and crude-for-crypto deals, as if Venezuela had discovered a black-market alchemist. By 2025, they held 600,000 BTC, rivaling even BlackRock’s crypto ambitions. One must wonder: Is this the birth of a new economic empire, or merely a fever dream of socialist technocrats?

Why This Matters for Bitcoin’s Ballroom of Supply and Price Chaos

To grasp the magnitude, recall Germany’s 2024 sale of 50,000 BTC, which sent prices tumbling 15-20%. Now imagine Venezuela’s stash-12 times larger-as a 12-course banquet for the market’s appetite for chaos.

Analysts, with all the certainty of a man counting stars in a hurricane, foresee three possible endings to this operetta:

Frozen assets: The U.S. Treasury seizes the Bitcoin, locking it away like a dragon hoarding fire. It cannot move, cannot sell-just brood.

Strategic reserve: The U.S. keeps the Bitcoin as a “strategic reserve,” a financial Noah’s Ark. Prices may rise, as if blessed by capitalist providence.

Fire sale: The DOJ dumps it all on Coinbase Prime, sending shockwaves through the market. A crypto crash so sudden it makes 2022’s “LUNA incident” look like a polite yawn.

The 2026 Crypto Market: A Dance of Bulls and Bears

If these assets are frozen or squirreled away, the result would be a supply lock-up so dramatic it could make Bitcoin’s price chart resemble a rollercoaster built by a drunkard. Q1 2026 might see prices soar, despite short-term volatility that would make a chinchilla faint.

Uncertainty, that old crypto companion, will likely cause sharp price swings. Yet analysts, ever the optimists, declare this “structurally bullish”-a term as mysterious as Maduro’s economic policies.

In the end, markets may realize Venezuela’s true power lies not in oil, but in Bitcoin. After all, what is a petro, if not a punchline? 🤡

Read More

- OP PREDICTION. OP cryptocurrency

- USD IDR PREDICTION

- GBP USD PREDICTION

- ALGO PREDICTION. ALGO cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- EUR ILS PREDICTION

- GBP AED PREDICTION

- LTC PREDICTION. LTC cryptocurrency

- BONK PREDICTION. BONK cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

2026-01-05 09:18