As the dawn of 2026 broke, the delicate dance of cryptocurrency commenced with the usual fanfare typified by melancholic liquidations across all strata of digital tokens, much like a gallery teeming with peculiar art-grand masterpieces adorning the walls, flanked by eccentric vignettes nestled beside Bitcoin and Ethereum adventures.

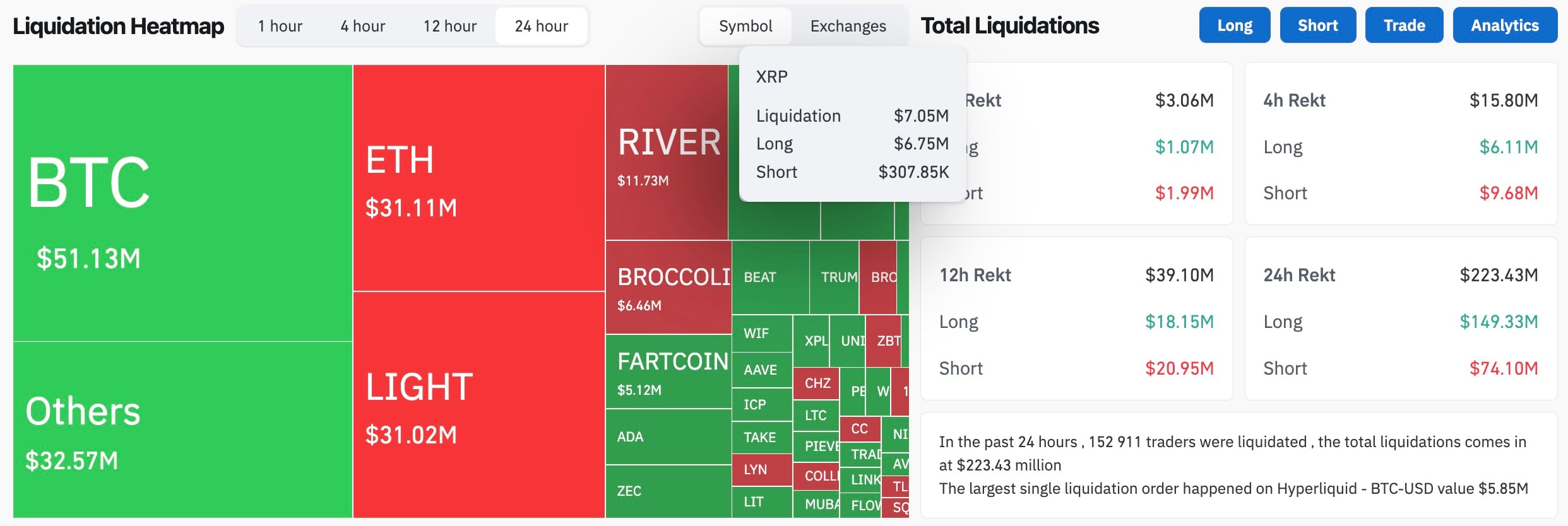

In the past 24 hours, the canvas of the market witnessed a liquidation total of $230.78 million. Long liquidations tangoed to the tune of $151.90 million, whilst their short counterparts danced to a more modest rhythm of $78.88 million. A fitting spectacle unfolded on Hyperliquid, where a BTC/USD position totting a modest $5.85 million suffered the indignity of the largest singular liquidation.

TL;DR

- XRP‘s illustrious start in 2026 enthralled observers as it displayed a 2,198% liquidation imbalance, almost entirely penned by long positions, to the tune of $7.05 million.

- Tether unveiled a staggering $780 million acquisition of Bitcoin, highlighted by 8,888.888888 BTC, thus swelling its coffers to a total of 96,370 BTC.

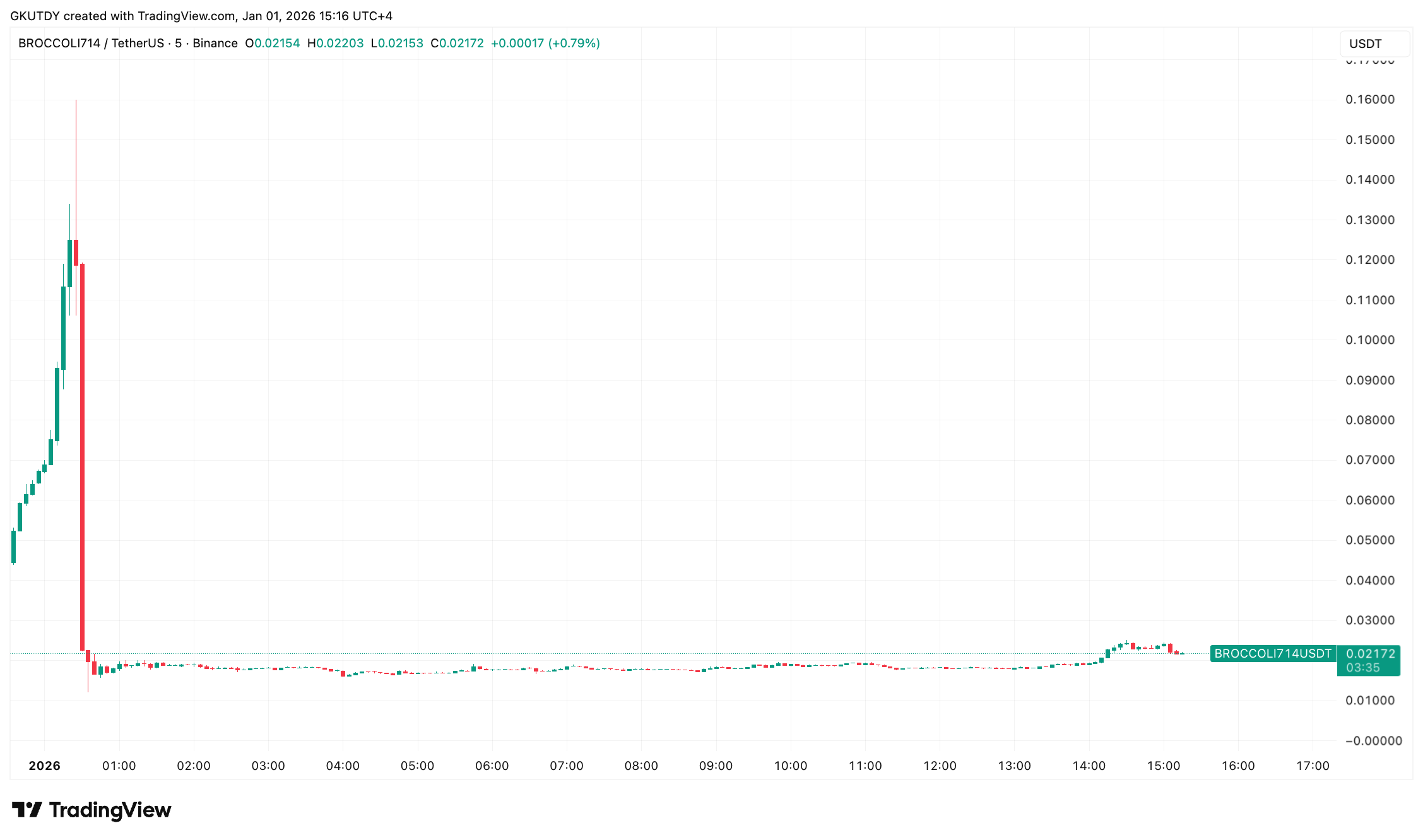

- BROCCOLI714, a hapless meme coin on Binance, took an 88% nosedive after a tale of hackers conspiring against a market-maker account.

XRP Champions the Balan

In the overture that was XRP’s entrance, the imbalance was such that one could hardly ignore the overwhelming loss of long-suffering investors. CoinGlass provided a telling narrative: $7.05 million in liquidations-of which a towering $6.75 million stemmed from longs. Such pronounced ratio merits a saga, as it signifies a directional misfortune visiting one side of the market balance.

The XRP/USDT chart reads like a pastoral landscape, wherein lies a dip to $1.82 and a subsequent rally to $1.85-a picturesque cycle reminding us of the day’s market forces at play, shearing off the longs before allowing prices their reprieve with the clearing of leverage.

In terms of practicality, the recent furrows and hillocks stand with $1.82 as the ground truth and $1.85 as the current ledge of decision, while the $1.88 to $1.90 range remains marked by earlier sell-offs.

Such imbalances hold significance not as harbingers of fate on their own, but rather as tales of market pressures relieved, subtly altering the thresholds of price movement henceforth.

Tether’s Notable Bitcoin Acquisition

The subplot in this monetary opera involves a reserve saga, numbers that captivate both speculator and utopian dreamers alike-a narrative seldom seen in such grand reserves by the giants of stablecoins, such as Tether. Today, the enterprise dutifully withdrew 8,889 BTC from Bitfinex, hoarding a new high of 96,370 BTC worth $8.5 billion.

Through the quill of CEO Paolo Ardoino, we learned that in the season of Q4, 2025, Tether embraced 8,888.888888 BTC, correlating to the resounding $780 million headline. A division of these numbers by their BTC count reveals an agreeable price echoing the December markets, near $87,750 per BTC.

Tether acquired 8,888.8888888 BTC in Q4 2025.

– Paolo Ardoino (@paoloardoino) December 31, 2025

Crucial to this account is Tether’s unwavering portrayal of Bitcoin within its reserve strategy, showcased with figures audacious enough to command attention, rivaling even the chaotic symphony of extant liquidations.

Binance’s BROCCOLI714: A Meme Coin’s Fall from Grace

In an ironic twist, BROCCOLI714, bolstered by the whimsical genius of Binance founder Changpeng Zhao’s dog “Broccoli,” succumbed spectacularly to an 88% tumble after a narrative laced with cyber malefactors and compromised market-makers.

An assailant, much like a thief in an ancient folktale, seized the reins of market-maker accounts on Binance, weaving together a series of carefully choreographed trades through the low-liquidity token.

A simple sketch of their plans reveals a fraudster buying on the spot, placing futures trades on accomplice platforms, and finally transferring riches betwixt coordinated accounts. BROCCOLI714, a token with sparse liquidity, became their unlikely chariot for an audacious price surge and subsequent precipitous fall.

On the TradingView chart, BROCCOLI714 lies humbled, hovering near $0.019, post its explosion above $0.15-a narrative tale born from the sharp rise and more abrupt descent that characterizes the 88% plummet, especially within the realm of lesser-known markets.

The map of liquidations draws a picture of $6.46 million in BROCCOLI714, suggesting that such reversal did more than retreat spot buyers; it buoys the extinguished leveraged flair.

On the Horizon of Crypto Markets

As the spirits within crypto circles hold court hearty revelry, full of doctrine like “this is when you buy” and chants declaring “this year shall be verdant”-the fruit of the breakup with yesterday’s screen is catharsis from anticipating the disappointments of the day.

- XRP: Behold the range within $1.8493 to $1.8552 and safeguard $1.82 as the conservatory of your disdain should $1.85 fail as a bastion.

- Bitcoin (BTC): Watch for a rallying point above $87,750 as homage to Tether’s Q4 acquisition, or its wane below should it face rejection.

Read More

- OP PREDICTION. OP cryptocurrency

- USD TRY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- ALGO PREDICTION. ALGO cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

- GBP USD PREDICTION

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- USD IDR PREDICTION

- USD MYR PREDICTION

- EUR TRY PREDICTION

2026-01-01 16:20