Ah, the markets-a theater of the absurd, where numbers dance like shadows on the walls of Plato’s cave, and Bitcoin, that mischievous satyr, prances between $70,000 and $80,000 as if it were a tightrope walker in a circus of fools. Behold! 🌟

What to know, dear reader, as you sip your absinthe and ponder the folly of man:

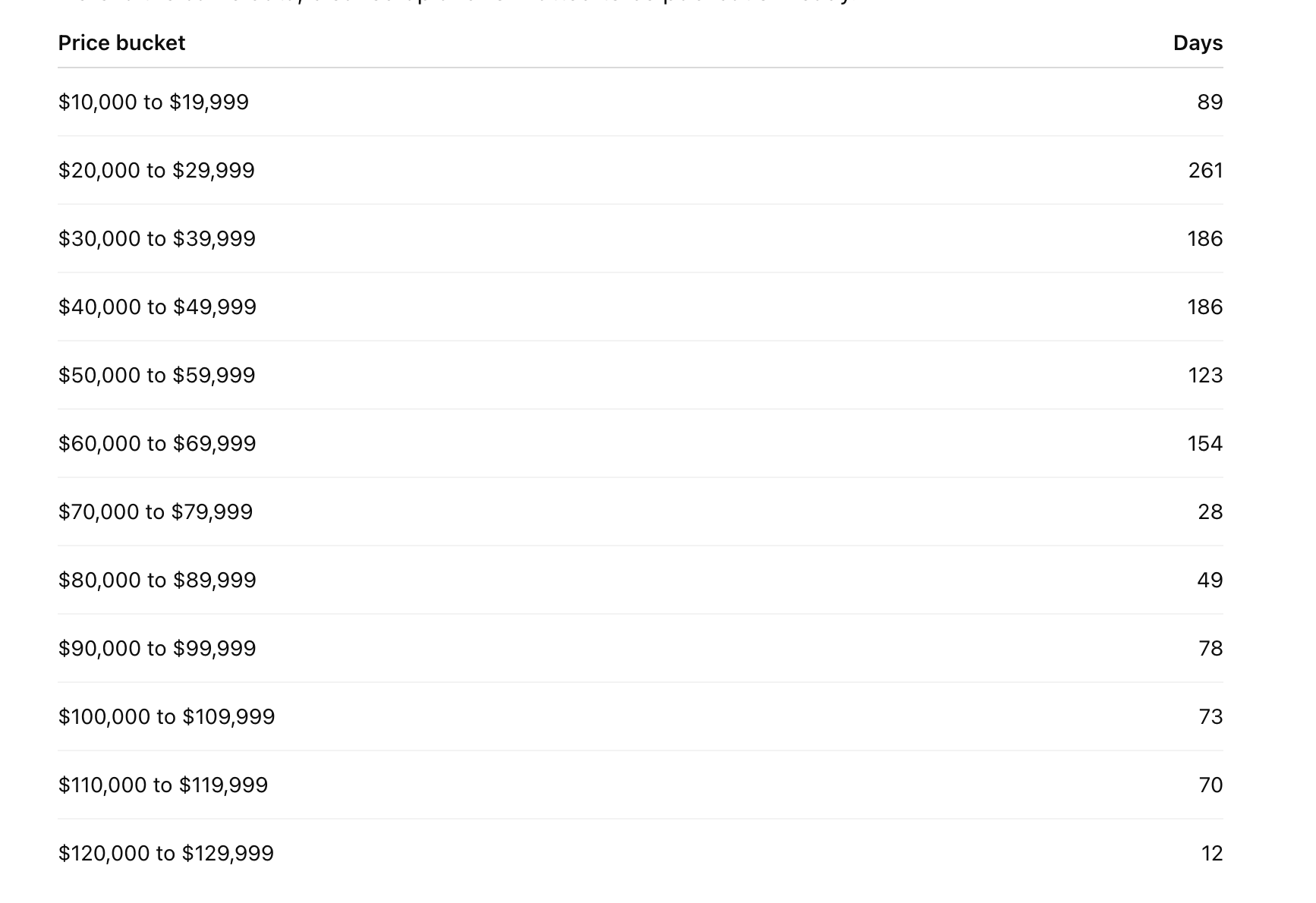

- Bitcoin, that capricious minx, has dallied a mere 28 trading days between $70,000 and $80,000-a fleeting romance, like a summer fling with a poet who forgets your name. 📆💔

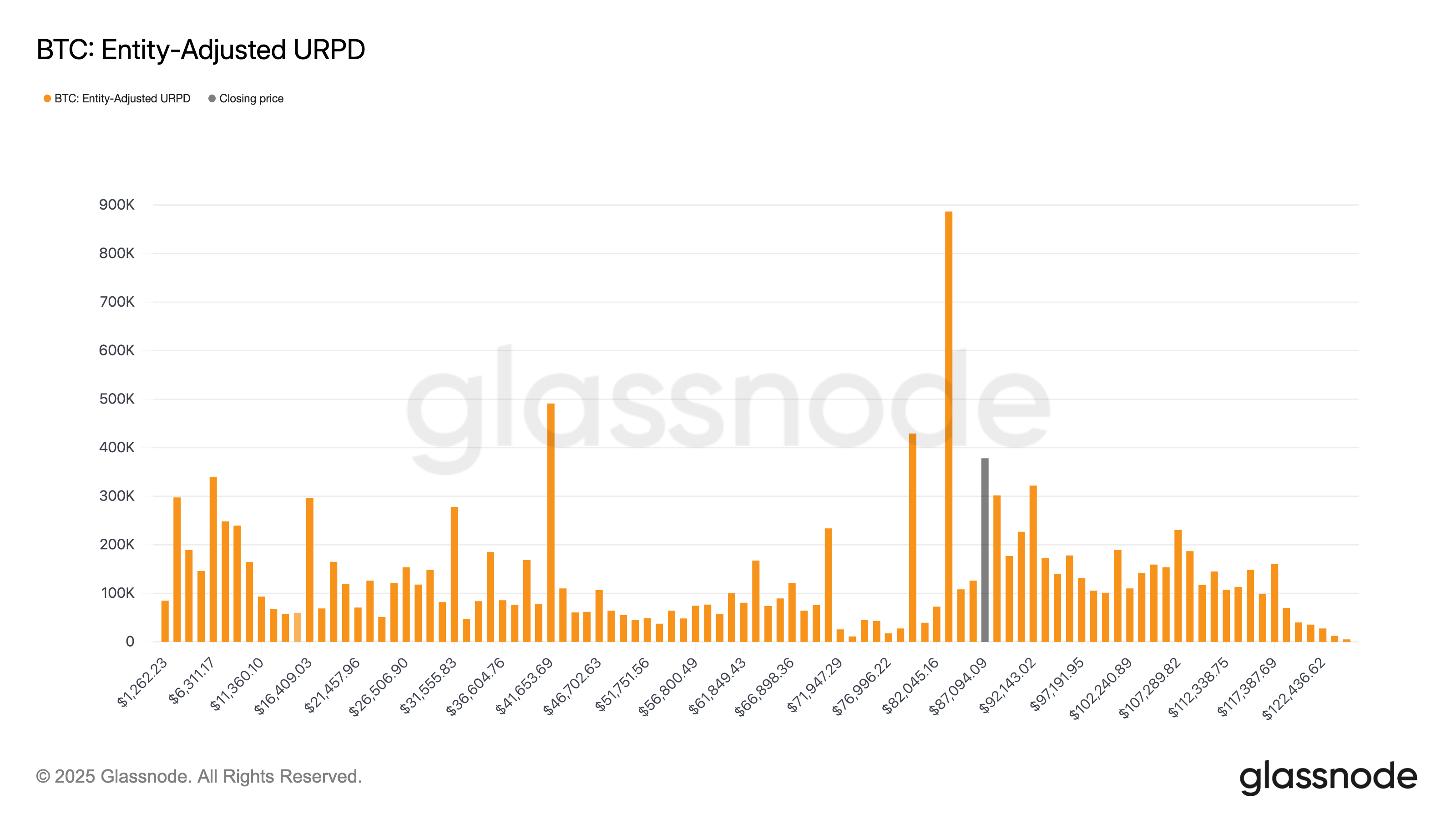

- Glassnode’s UTXO Realized Price Distribution, that oracle of the cryptosphere, reveals a barren wasteland of supply in this zone. Should another pullback occur, Bitcoin may find itself stranded in this desert, thirsting for consolidation like a camel in search of an oasis. 🏜️🐪

In the annals of the past five years, where Bitcoin’s CME futures have weaved their tangled web, one observes a curious pattern. Like a novelist crafting a plot, the crypto has lingered in certain price ranges, fortifying its support like a castle’s walls. Yet, the $70,000 to $80,000 zone remains a neglected stepchild, barely acknowledged in this grand saga. 📈📉

Consider, if you will, the number of trading days Bitcoin has spent in these price bands-a metric as revealing as a character’s soliloquy. The longer the stay, the stronger the support, like a well-rehearsed actor commanding the stage. Alas, the $70,000 to $79,999 band has seen but 28 days of glory, while the $80,000 to $89,999 range has been graced with a mere 49. In contrast, the lower zones-$30,000 to $49,999-have hosted nearly two hundred days of drama, a veritable Shakespearean epic. 🎭📊

For most of December, Bitcoin has frolicked in the $80,000-$90,000 range, a brief interlude after its October high. This correction, like a plot twist in a Bulgakov novel, has led it back to a zone where the market’s memory is faint, its support as flimsy as a bureaucrat’s promise. And yet, in 2024, it spent countless days between $50,000 and $70,000, a period of consolidation so robust it could rival the Soviet five-year plan. This uneven distribution suggests that the $80,000s, and the $70,000s, are but fragile constructs, waiting for the winds of change to topple them. 🌪️💨

Glassnode’s URPD, that meticulous archivist of Bitcoin’s journey, confirms this tale. It shows where the supply last moved, like footprints in the snow, each step assigned to its average acquisition price. And yet, in the $70,000-$80,000 zone, the footprints are scarce, as if the crypto had tiptoed through, reluctant to leave a trace. 🕵️♂️👣

So, dear reader, as you navigate this crypto circus, remember: the $70,000-$80,000 zone is but a mirage in the desert of support. Will Bitcoin consolidate, or will it vanish like a character in a Bulgakov novel? Only time-and the whims of the market-will tell. 🕰️🎪

Read More

- OP PREDICTION. OP cryptocurrency

- ALGO PREDICTION. ALGO cryptocurrency

- GBP USD PREDICTION

- CNY RUB PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- USD VES PREDICTION

- SUI PREDICTION. SUI cryptocurrency

- JUP PREDICTION. JUP cryptocurrency

2025-12-25 17:24