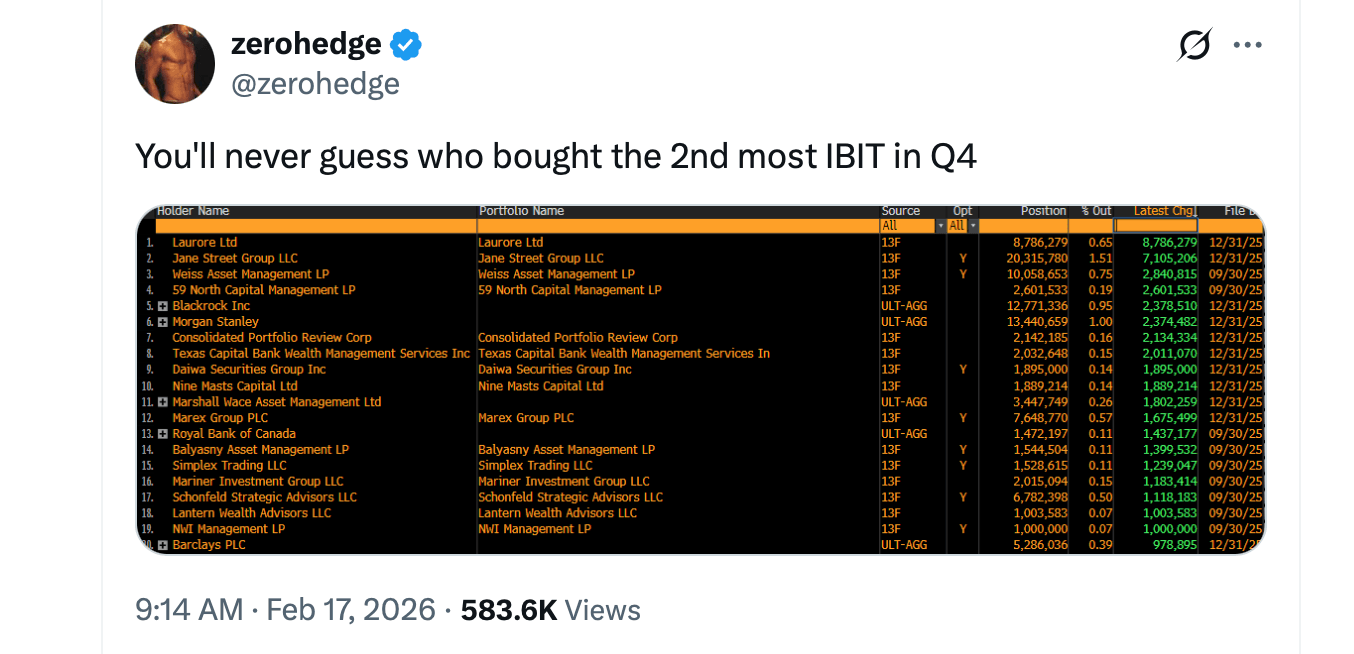

Jane Street Group, that grand maestro of numbers and spreadsheets, threw caution to the wind in Q4 2025, hoarding 7,105,206 shares of Blackrock’s IBIT like a Scrooge McDuck in a Bitcoin goldmine. The result? A $1 billion portfolio – a 54% quarterly leap that makes one wonder if they’ve finally mastered the art of turning volatility into alchemy.

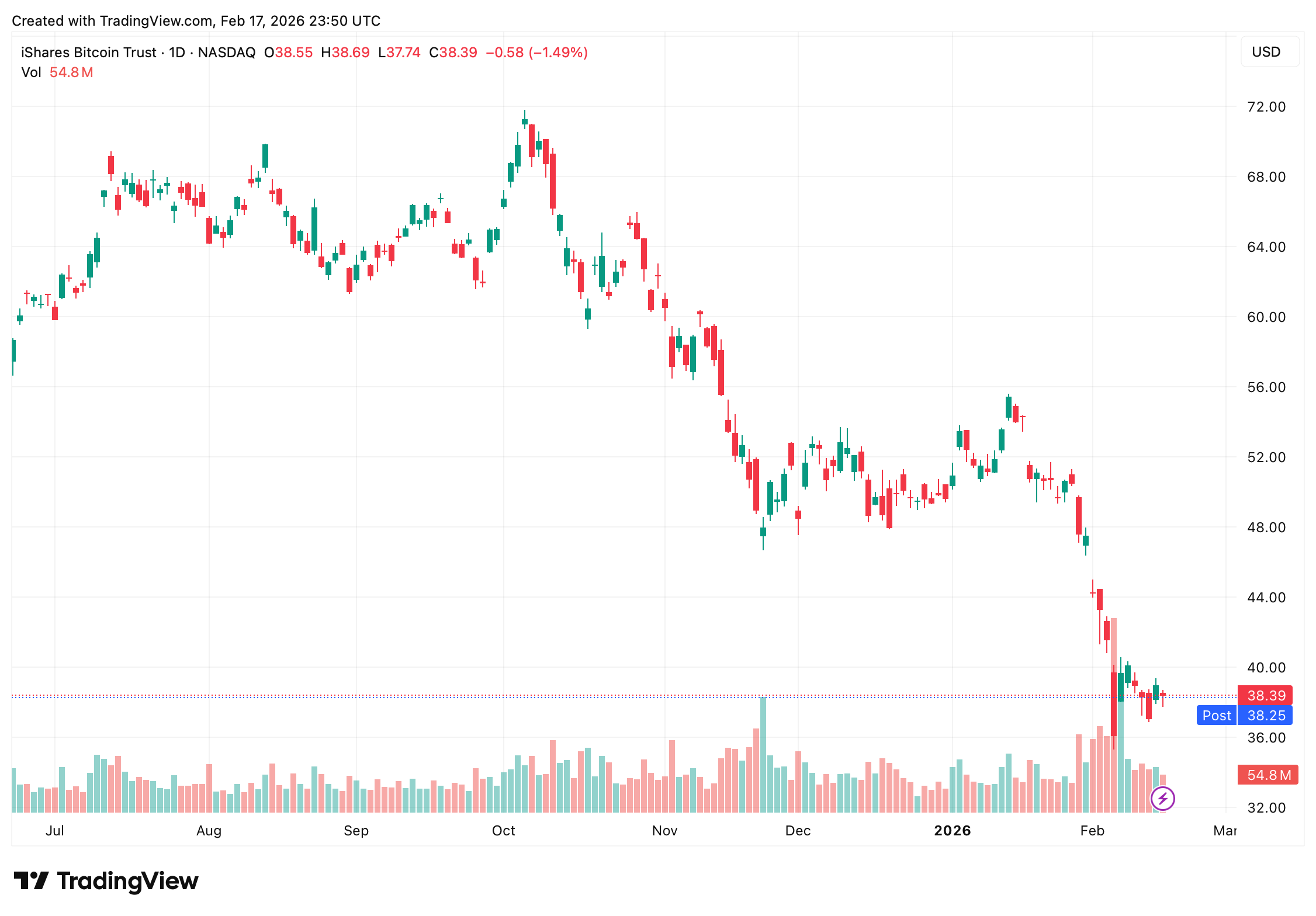

The SEC filing reads like a love letter to chaos: as bitcoin danced between euphoria and despair, Jane Street’s stake ballooned to $1.01 billion by year-end. But by February 2026, the market’s whims had trimmed their fortune to $790 million – a reminder that even Wall Street’s sharpest minds can’t outwit a falling knife.

Founded in 2000, Jane Street is the kind of firm that turns markets into a chessboard, where liquidity is a pawn and ETFs are the queens. With 45 countries as their kingdom, they trade with the precision of a surgeon and the flair of a magician – though one might argue they’ve just mastered the art of juggling flaming crypto.

Quants, those modern-day oracles, treat volume spikes like poetry and correlations like scripture. Jane Street, with its army of engineers and traders, is less a firm and more a cathedral of algorithms, where every decimal point is a stained-glass window.

IBIT, Blackrock’s bitcoin ETF, is the golden goose of 2024, letting investors sip the Kool-Aid without holding the bottle. As an authorized participant, Jane Street isn’t just trading – they’re playing god, minting and melting ETF shares like a digital alchemist. One wonders if they’ve ever accidentally created a Bitcoin Frankenstein.

Bitcoin’s Q4 2025 journey was a rollercoaster that would make a rollercoaster blush. From $87,000 to $109,000 and back again, it’s enough to make a seasoned trader question their life choices. Meanwhile, IBIT’s $40 billion AUM is a testament to the madness – or genius – of institutional investors who now treat Bitcoin like a trust fund baby with a penchant for risk.

Harvard’s U-turn on IBIT is just another chapter in this Shakespearean tragedy. Some cut their losses; others doubled down. The market, ever the crowd-pleaser, keeps us guessing.

Speculation swirls that Jane Street’s trading patterns are the puppeteer behind morning sell-offs. Critics whisper of market manipulation, while defenders insist it’s all hedged with futures and options – a game of musical chairs where the music is always playing.

13F filings, those cryptic scrolls of long positions, leave us seeing only half the picture. Like reading a novel with every other page torn out, we’re left to guess whether Jane Street is a hero or a villain in this crypto saga.

Jane Street’s IBIT bet is less a gamble and more a declaration of war against the old guard. They’ve bridged the gap between liquidity and crypto, proving that even the most stodgy Wall Street firms can moonlight as tech bros.

Yet the drop in IBIT’s share price since year-end is a sobering reminder: volatility isn’t just a number – it’s the market’s way of saying, “You thought you owned this, didn’t you?”

Whether Jane Street is a visionary or a madman remains to be seen. But one thing’s certain: in the theater of finance, they’ve just taken the lead role in the most expensive play ever written.

FAQ ⏱️

- What did Jane Street acquire in Q4 2025? They scooped up 7.1 million IBIT shares, turning their portfolio into a Bitcoin-shaped snowball.

- How much was Jane Street’s IBIT position worth at year-end 2025? A cool $1.01 billion – until the market decided to play 20 questions with their wallet.

- What does IBIT invest in directly? Bitcoin, because nothing says “safe investment” like a digital asset that’s basically a screensaver with a price tag.

- What does Jane Street do as an authorized participant? They create and redeem ETF shares like a crypto Santa, ensuring prices stay cozy with net asset value – or at least pretend to.

Read More

- XDC PREDICTION. XDC cryptocurrency

- USD CAD PREDICTION

- GBP CHF PREDICTION

- ICP PREDICTION. ICP cryptocurrency

- Crypto Scammers Caught! SEC Goes After $14M Fraud Scheme 😱💸

- BCH Soars 61,561%: Bears Weep, Bulls Celebrate!

- BTC Barriers, XRP’s 2026 Moment, SHIB’s Chill Fest!

- 🔥 Surprise! Michael Saylor’s Plan Loses “Multibillion-Dollar” Magic! 🔥

- Bankers in Monkey Suits Are Now Miming Crypto 😱

- BTC’s Midlife Crisis & XMR’s Chaotic Dance 🕺💰

2026-02-18 10:52