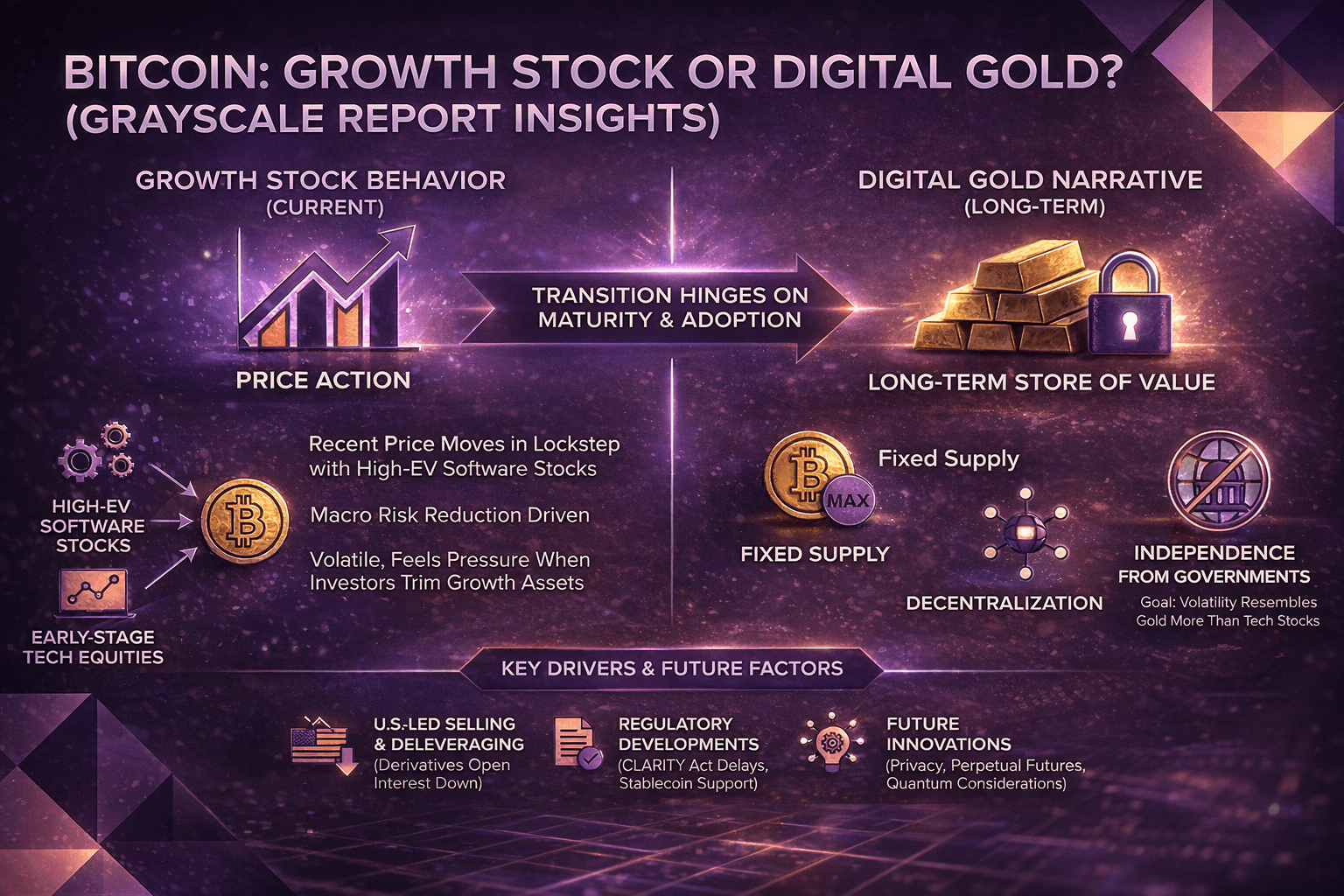

In a recent exposition, Grayscale has undertaken the whimsical task of pondering whether bitcoin-and let us not forget its grandiosity, for it is no mere coin but a digital marvel-truly embodies the noble virtues of a long-term store of value, or if it is merely masquerading as a growth stock, reveling in the fashion of a fleeting trend.

Grayscale’s Insight: Bitcoin Dances with High-EV Software Stocks

Bitcoin, that elusive creature, saw its value tumble to a lowly $60,000 on February 5, a dramatic plunge that could make even the most stoic heart flutter-over a 50% decline! Yet, like a phoenix, it began to rise again. As noted by the astute Zach Pandl, this descent was not merely a crypto calamity, but rather a reflection of the broader malaise gripping high-growth software stocks, a case of macro risk reduction that left no digital stone unturned.

For at least a year now, our dear bitcoin has been strolling hand in hand with those high-flying U.S. software stocks, their valuations soaring as if on wings made of dreams. Alas, when the investors decide to tighten their purse strings, our digital hero feels the weight of their discontent.

This curious alignment complicates the age-old narrative of bitcoin as “digital gold.” Grayscale posits, with all the fervor of a true believer, that bitcoin’s finite supply, delightful decentralization, and charming independence from government whims do indeed support its lofty aspirations as a long-term store of value. However, in these tempestuous short-term waters, its correlation appears more akin to the spirited hustle of Silicon Valley than the steadfastness of Fort Knox.

Pandl articulates this dichotomy with a refreshing clarity: bitcoin wears two hats-one as a store of value and the other as a growth asset. Its appeal hinges upon adoption; should bitcoin evolve into the dominant digital monetary asset, its volatility may one day resemble that of gold rather than the erratic nature of tech stocks.

The recent sell-off, it seems, has been particularly concentrated among our friends in the United States. Indeed, the price of bitcoin on Coinbase fell beneath that of Binance, suggesting that our U.S.-based sellers were quite active, perhaps in a fit of panic. Since early February, U.S.-listed spot bitcoin exchange-traded products have witnessed an exodus of approximately $318 million.

Remarkably, the onchain indicators reveal a lack of significant liquidation among long-term holders, affectionately known as “OG whales.” Instead, the derivatives market has seen a pronounced deleveraging, with aggregate open interest on major perpetual futures exchanges plummeting by over half since October-a veritable crash diet! Funding rates have dipped into negative territory, and the options skew has reached dizzying heights, conditions that could signal a local bottom to those who dare to interpret such signs.

Ahead of us lies a landscape shaped by regulatory developments. Pandl pointed out that delays surrounding the CLARITY Act in the U.S. Senate might have dampened the spirits of investors, although broader regulatory shifts-marked by the bipartisan GENIUS Act and various agency-level changes-continue to encourage institutional interest in stablecoins and tokenized assets.

As we look further into the horizon, the report highlights intriguing innovations in privacy, perpetual futures, and prediction markets, while also raising an eyebrow at the looming specter of quantum computing, which may one day threaten the cryptographic foundations of our beloved bitcoin. Should bitcoin navigate these challenges and expand its adoption, Grayscale suggests its behavior might eventually align more closely with that of gold-though for now, it continues to flitter about like a sprightly growth bet.

FAQ ⏱️

- Why did bitcoin fall to $60,000 in February 2026?

The report attributes this decline to a general derisking in high-growth technology equities rather than any specific crypto disaster. - Does Grayscale still consider bitcoin a store of value?

Indeed, citing its fixed supply, decentralization, and remarkable resilience. - Who appeared to be selling during the downturn?

Price disparities on Coinbase and ETP outflows suggest a strong involvement of U.S.-based sellers. - What signals a possible local bottom?

A sharp deleveraging in derivatives, negative funding rates, and extreme options skew.

Read More

- EUR RUB PREDICTION

- USD VND PREDICTION

- CRV PREDICTION. CRV cryptocurrency

- RENDER PREDICTION. RENDER cryptocurrency

- 🐻 Mr. Cramer’s Bearish Blunder: Will Bitcoin Survive His Wrath? 🎭

- USD ZAR PREDICTION

- GBP CHF PREDICTION

- LTC PREDICTION. LTC cryptocurrency

- QNT PREDICTION. QNT cryptocurrency

- Bitcoin’s Chilly Christmas: 2025 Will Give Us Tears or Cheers 🎅🍻

2026-02-13 02:07