In the wake of the most recent tremors in the ever-volatile sea of Bitcoin, the price has begun a most curious recovery, one that inspires neither confidence nor trust among the weary traders who ride these waves. With each ascent, there are those who eagerly wait to sell, and the dips, alas, remain woefully unfilled, as if the buyers have taken an unexpected holiday. History teaches us that such behavior typically leads to a languid drift until the elusive buyer finally emerges from the shadows, prepared to engage. Presently, a handful of on-chain indicators from the discerning minds at Cryptoquant hint at an ominous bearish momentum gathering like storm clouds, and we shall examine the four most telling signs.

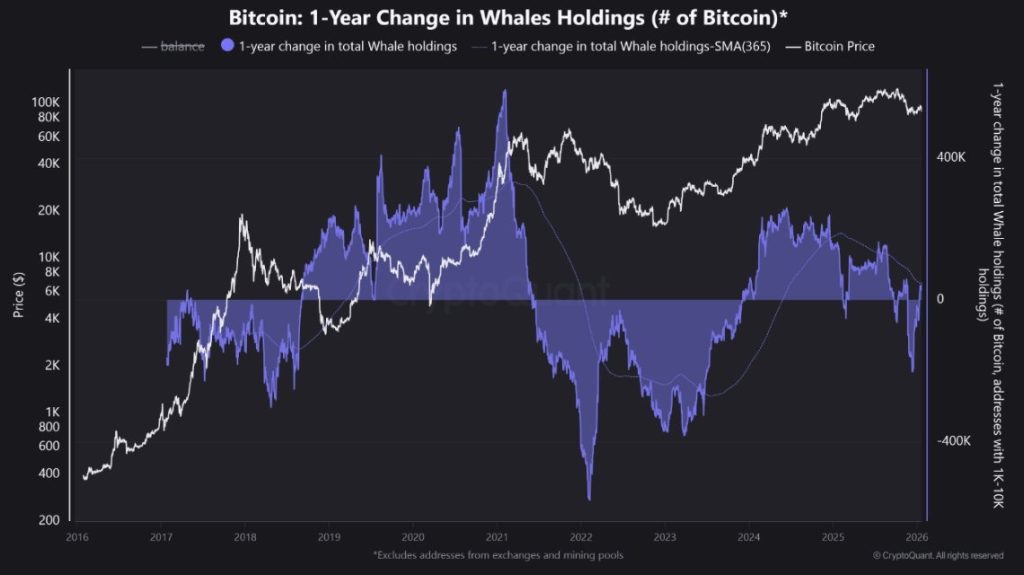

The Whales Have Decided to Share

The metric concerning the “1-year change in whale holdings” reveals that these grand creatures of the sea, those addresses holding between 1,000 and 10,000 BTC, are shifting into a phase of distribution, as though they were sharing their bounty with the world. Historically, a declining line here suggests that these mighty holders are retreating rather than accumulating-much like a timid hero at the first sign of battle. While this does not guarantee an immediate catastrophe, it tends to temper rallies and increases the likelihood of Bitcoin finding itself in the lower depths of liquidity, as fewer formidable buyers venture forth.

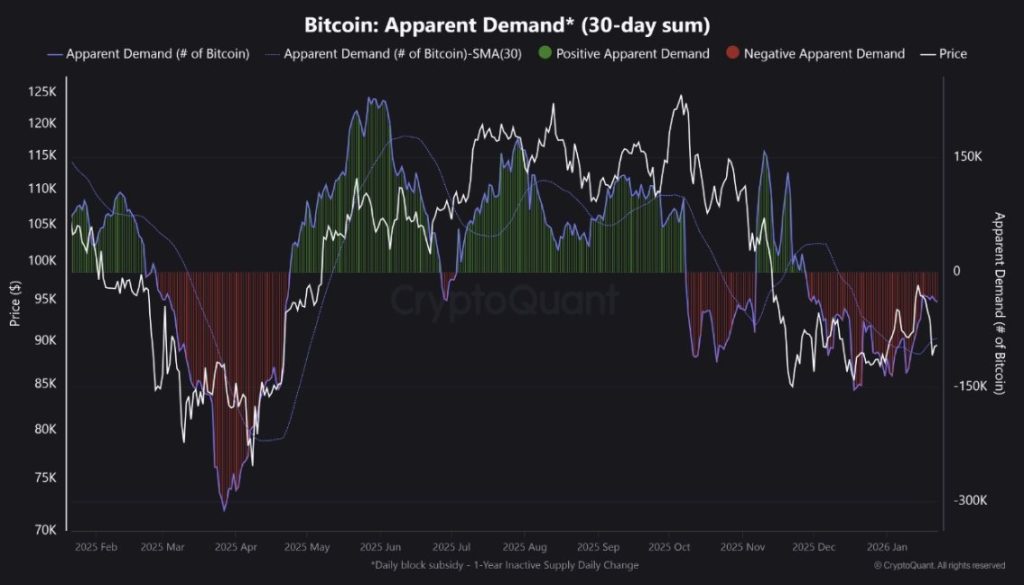

Demand Seems to Have Taken a Vacation

The chart representing the “Apparent Demand (30-day sum)” is flashing negative readings with all the urgency of a fire alarm-indicating that the net pressure from buyers appears feeble in comparison to the abundant supply. When the apparent demand remains negative, our dear Bitcoin often finds itself struggling to maintain recoveries, as each bounce encounters a wall of selling pressure that overwhelms the timid demand. This scenario frequently leads to a slow but steady bleed-a series of lower highs, pitiful rebounds, and repeated tests of support-until demand, like a prodigal son, finally returns to the fold.

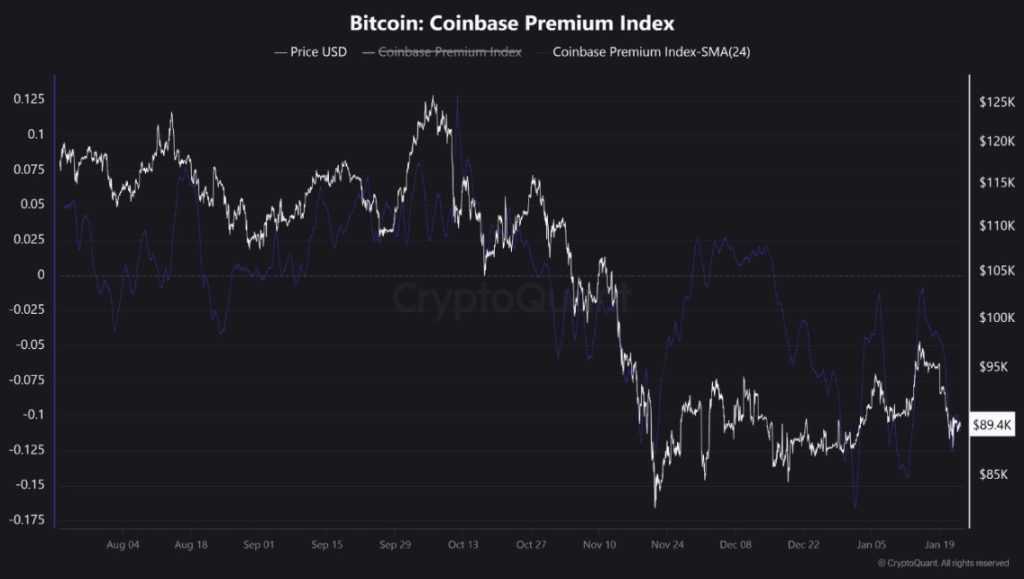

Coinbase Premium Suggests a Weaker US Spot Bid

The Coinbase Premium Index, primarily lingering below zero, indicates that Bitcoin is not enjoying a robust premium on Coinbase compared to its offshore counterparts. Such a development suggests that the US spot bid is feeling rather lackluster. In more exuberant phases, one would expect Coinbase’s premium to bask in the sunshine of positivity, as spot demand leads the charge. Yet when it languishes in the negative, it implies that any rallies may be driven more by derivatives or those whimsical short-term flows, movements that can fizzle out faster than a soda left open.

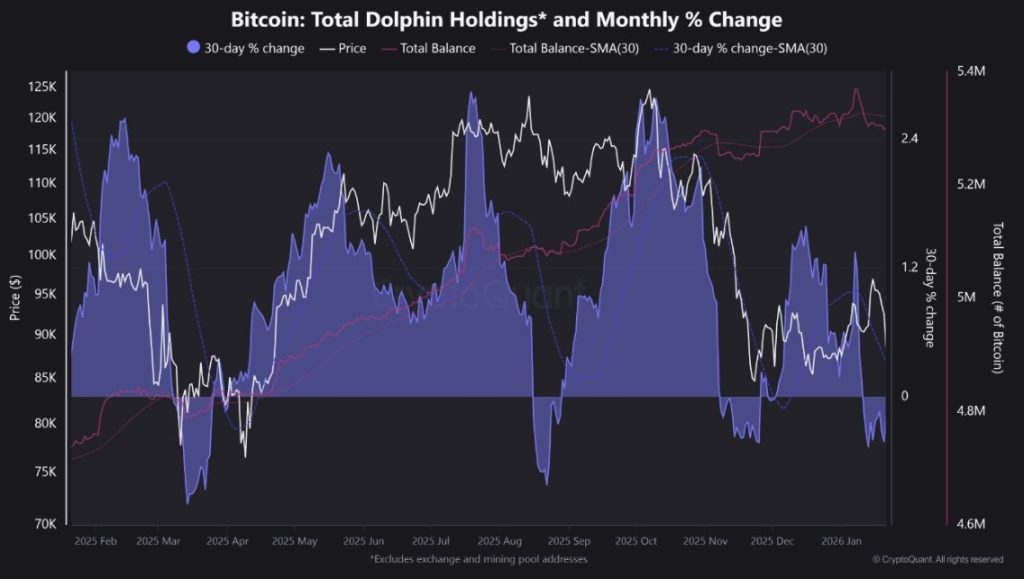

The Dolphins Are Also Parting Ways

Turning our attention to the “Dolphin holdings”-those mid-tier wallets lurking just below the whales-we observe a weakening monthly change, drifting toward or even beneath the dreaded zero line-another signal of distribution. When both whales and dolphins simultaneously reduce their exposure, it suggests a broadening wave of selling pressure, rather than an isolated incident. This matters greatly, for Bitcoin rallies are at their most vigorous when multiple cohorts join forces in accumulation. If both whales and dolphins choose to sell while demand remains negative, support levels may find themselves swept away like autumn leaves in a brisk wind.

What Lies Ahead for Bitcoin Price Action

Together, these four signals weave a narrative of impending risk: supply is rising, yet demand remains stubbornly absent. This typically portends that Bitcoin’s price will remain vulnerable, teetering on the brink of another descent or at least deeper probes into support zones.

The next chapter in this unfolding saga depends entirely upon whether demand decides to make a comeback:

- If Bitcoin experiences a rebound, brace yourself for a relief rally that shall inevitably encounter heavy selling, unless (1) Coinbase Premium miraculously flips positive and holds, and (2) apparent demand turns positive. Without these miraculous occurrences, any bounces may prove as fleeting as a summer breeze.

- If Bitcoin breaches support, the descent could accelerate rapidly as liquidity is swept away and dip buyers abandon ship. Bitcoin typically finds stability only after demand improves and distribution takes a breather.

In conclusion, while a Bitcoin (BTC) price rally is within the realm of possibility, it requires the confirmation of spot demand. Absent this, the path of least resistance remains downward or sideways, until buyers demonstrate their return as if from a long and treacherous journey.

Read More

- OP PREDICTION. OP cryptocurrency

- USD IDR PREDICTION

- SUI PREDICTION. SUI cryptocurrency

- XRP Alert: Brad’s Swiss Secrets Could Blow Your Crypto Mind!

- GBP USD PREDICTION

- ALGO PREDICTION. ALGO cryptocurrency

- USD INR PREDICTION

- USD HUF PREDICTION

- EUR PHP PREDICTION

- EUR AED PREDICTION

2026-01-23 21:01